- Print the full document

- Save the page as a HTML document to your device

- Save the page as a PDF file

- Bookmark it - it will always be the latest version of this document

This box is not visible in the printed version.

National Strategic Assessment 2020

This report sets out our latest assessment of the issues we face and the risks that gambling poses to consumers and the public

Published: 6 November 2020

Last updated: 23 February 2021

This version was printed or saved on: 27 February 2026

Online version: https://www.gamblingcommission.gov.uk/strategy/national-strategic-assessment-2020

Chief Executive's foreword

The Gambling Commission was set up under the Gambling Act 2005. We license gambling operators and key personnel. We regulate gambling, by setting the rules of our licensees and ensuring they comply with them, as well as preventing illegal gambling. We advise the Secretary of State about gambling and we provide guidance to local authorities, as premises-based gambling is subject to dual licensing. We also regulate the National Lottery under the National Lottery etc. Act 1993.

Our work is always guided by a determination to make gambling safer and the licensing objectives are always at the forefront of our minds.

The objectives are to:

- protect children and other vulnerable persons from being harmed or exploited by gambling

- prevent gambling from being a source of crime or disorder, being associated with crime or disorder or being used to support crime

- ensure that gambling is conducted in a fair and open way.

I am pleased to introduce the Gambling Commission’s first National Strategic Assessment. It sets out our latest assessment of the issues we face and the risks that gambling poses to consumers and the public. Identifying issues and risks must be a dynamic process, as technology and consumer behaviour constantly change.

Our overall assessment is built on four pillars linked to:

- the Person gambling (Chapter one)

- the Place gambling is occurring (Chapter two)

- the Products available to customers (Chapter three)

- the Provider of facilities for gambling (Chapter four).

This assessment also takes account of the unprecedented impact of the coronavirus (COVID-19) pandemic, as it has implications for all four pillars.

For each of these four pillars, we have collated the data, statistics and evidence obtained from our compliance and enforcement work. We have also drawn from the advice of our Advisory Board for Safer Gambling (ABSG), our Digital Advisory Panel (DAP), and the Interim Experts by Experience Group, which consists of those with direct experience of gambling harm. We have engaged industry representatives and colleagues in the third sector and taken account of the findings of recent Parliamentary reports into gambling and its regulation.

Drawing on all these sources, we have developed this comprehensive National Strategic Assessment. This assessment is the foundation for prioritising action over the coming months and years. The assessment should be read alongside our actions and those of partners in progressing the National Strategy to Reduce Gambling Harms.

We look forward to working with the government on the forthcoming review of the Gambling Act, but we want to make it clear that we will not be waiting for the outcome of that review to address the issues that we have identified. We are responding quickly, using the full range of our powers, whenever we see an opportunity to make gambling fairer and safer.

Neil McArthur Chief Executive – Gambling Commission

Executive summary

This report outlines the Commission’s assessment of the key issues faced in making gambling fairer, safer and crime free. We have used our insight, research and casework to assess the risks and challenges in gambling through four different lenses – the Person, the Place, the Products and the Provider. We will continue to develop our assessment to help inform stakeholders.

This assessment also sets out our priority actions to enable us to address these issues. We have also included in this document an overview of progress that has been made since April 2019, the start of the last business year.

Evidence tells us that gambling participation is not increasing, but ways of gambling are changing. At an overall level, participation rates have remained stable in recent years. At the same time problem gambling rates are not increasing, the data indicates that the rate of problem gambling has been statistically stable since 2012. Nevertheless, it is important that we continue to develop a robust understanding of how different groups within society, particularly those who are more vulnerable, are experiencing gambling-related harm. The National Strategy to Reduce Gambling Harms (opens in new tab) sets out how a public health approach will help identify and reduce these harms.

Risks and issues set out across the four chapters of this assessment include ineffective ‘know your customer’ approaches including affordability checks by operators; the need for early identification and action to at-risk behaviours; the availability of online gambling; advertising; safer online and platform games and the characteristics of high risk products. Other issues highlighted include underage gambling; ownership and governance of gambling providers; and gaps in the evidence and understanding of gambling-related harms.

Good regulation is informed by good evidence. We continually seek to improve the evidence base; to have access to better data, to move away from just counting problem gamblers to understand more about specific gambling related harms. We also highlight further research outputs on why people chose to gamble and the benefits they derive from it.

We want industry to do more to understand their customers and end the distinction between regulatory and commercial considerations – that means engaging on big topics like developing credible affordability solutions, making products safer by design and building dynamic player-centric safeguards. We must see the industry doing more to proactively identify and address the risks within their businesses. An approach to raising standards for consumers which is heavily dependent on the Commission using its formal regulatory powers will continue to damage the industry’s reputation, restrict activities and result in escalating penalties.

As a regulator we will do more to demonstrate the impact of our regulation and where we are making progress in changing the behaviours of operators. As such, we will be preparing key metrics to address this.

This assessment has been prepared amid the unprecedented disruption caused by the coronavirus (COVID-19) pandemic. The impacts of the pandemic now and moving forward are still being assessed and will shape the gambling industry and its regulation in the years to come.

The person gambling

Key issues and risks

Key issues and risks

- Ineffective ‘know your customer’ approaches including affordability checks: Licensees do not know enough about their customers including how much a customer can afford to gamble. Customers can be reluctant to share personal information.

- Early identification and effective responses to at-risk behaviours: Adverse consumer outcomes can be avoided or mitigated with early identification of at-risk behaviours or vulnerability displayed by customers.

- More engaged gamblers who participate in multiple products across different providers: Efforts to identify and provide preventative controls for more engaged gamblers is consistent with a risk-based approach to harm minimisation.

- Underage gambling: Age restrictions on gambling products protect children and young people. Controls to enforce them must be robust and effective.

- Gaps in the evidence and understanding of gambling-related harms: Building and maintaining a first-rate evidence base is essential to inform effective regulation and legislation.

What do we know?

Gambling participation

Gambling is a popular activity in Great Britain. Our latest annual data shows that 24.7m adults in Great Britain participated in gambling in the last four weeks.

Gambling participation is not increasing. At an overall level, participation rates have remained stable in recent years. The latest annual data shows 47% of adults had gambled in the last four weeks, with rates consistently between 45-48% since 20151.

The most popular gambling activities by participation rates are:

| Activity | % Participation |

|---|---|

| National lottery draws | 30% |

| Other lotteries | 13% |

| Scratchcards | 10% |

When National Lottery products are excluded, our data show that 32% of adults (17.0 million) participated in other forms of gambling in the last four weeks. This rate has remained relatively stable over the last few years2.

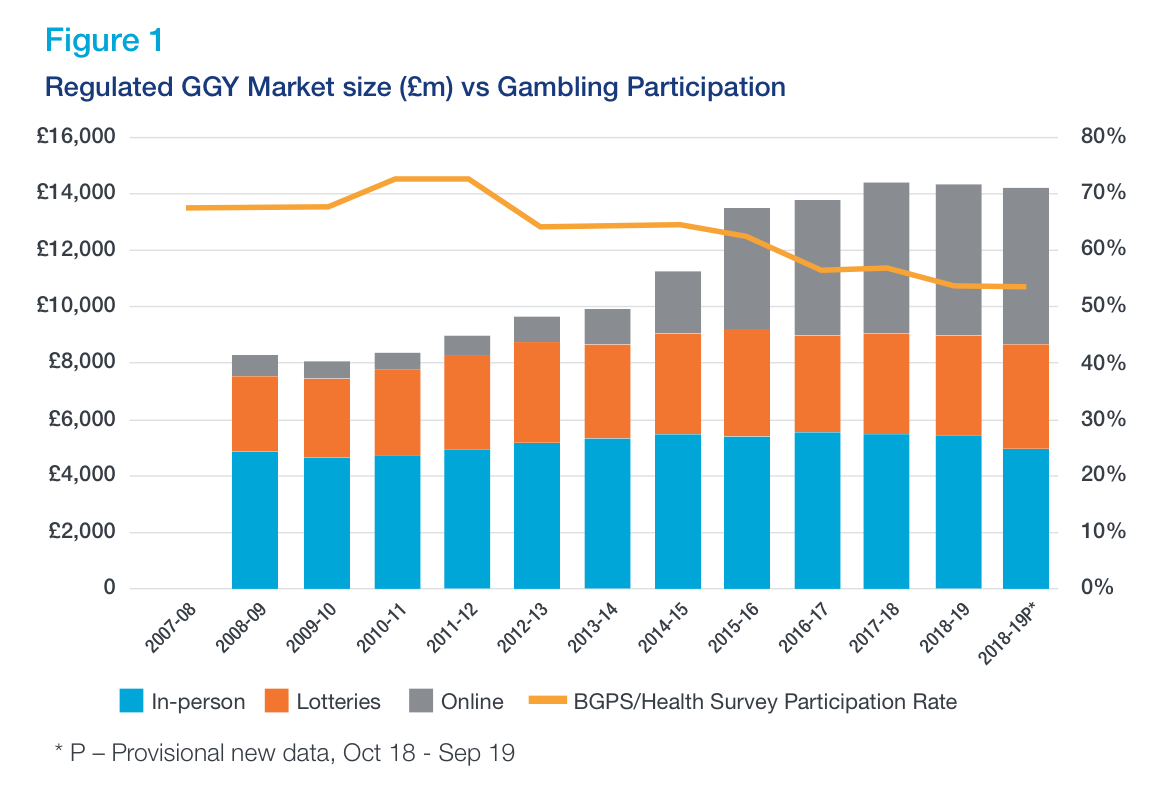

Figure 1 which shows a longer-term trend tracking participation in gambling in the last 12 months (rather than the last 4 weeks), shows a decrease in participation alongside the growth in industry gross gambling yield 3.

The Gambling Commission’s data shows that the increase in Gross Gambling Yield (GGY) has been driven by increases in participation and spending on online gambling.

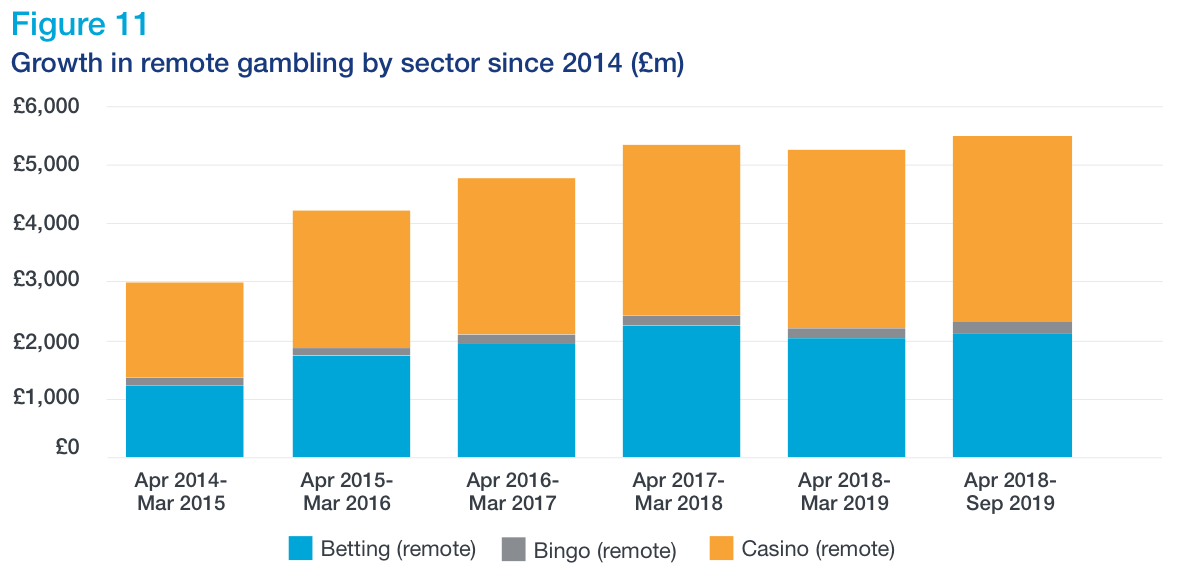

This growth in online GGY was significantly impacted by the shift to point of consumption regulation in November 2014 4. The 2015/16 figures represent a better benchmark from which to assess changes in consumer behaviour, as that was the first full year the Commission collected the data directly.

Our data shows that online gambling has grown by 30% since 2015/16, compared with a 8% decline in premises based gambling.

In overall terms, the combination of lower levels of participation and increases in industry GGY means that average gambling loss per consumer has increased. We explore the risks posed by the increase in customer losses from certain products such as online slots in Chapter 3.

1Gambling participation in 2019 behaviour awareness and attitudes (PDF) (opens in new tab) Throughout this document, when using statistics from our quarterly telephone survey, we have drawn these from the most recent annual report published in February 2020 which covers the year to December 2019, and therefore predates the coronavirus (COVID-19) period. Please see Chapter 6 for more detail on our research during the coronavirus period.

2Gambling participation in 2019 behaviour awareness and attitudes (PDF) (opens in new tab)

3 GGY is effectively stakes minus prizes

4 Gambling (Licensing and Advertising) Act 2014

Understanding why people gamble

As a regulator we put consumers at the heart of our work. It is therefore important to understand why people gamble, the choices they make and how it fits into their lives. This adds important context to headline participation data.

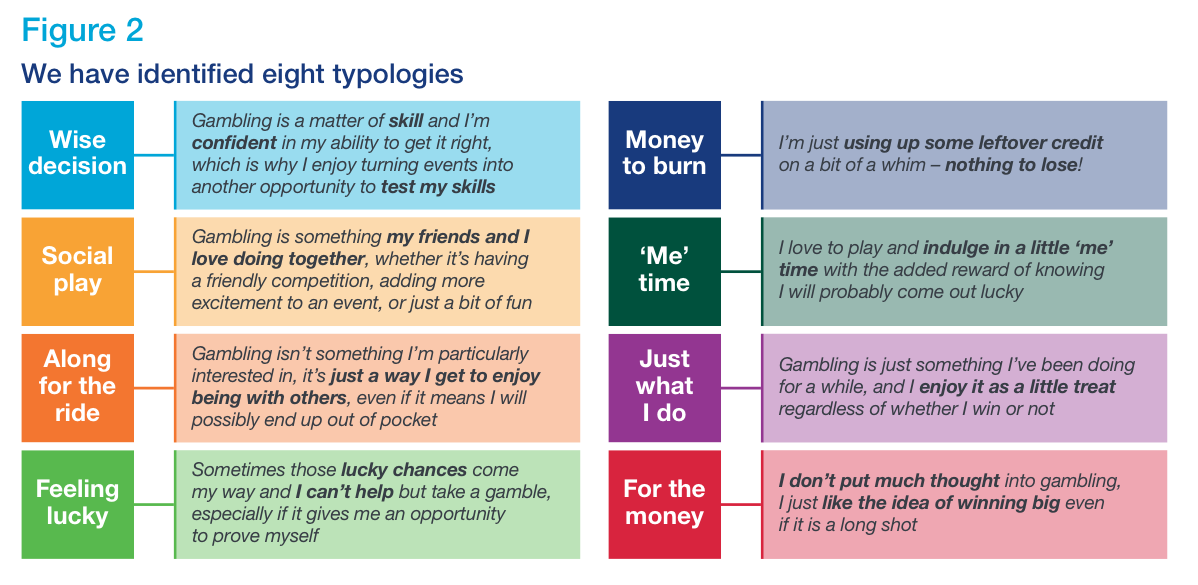

Through in-depth qualitative research validated and refined by quantitative research, we have explored the reasons why people gamble and how gambling fits into their lives. We understand from this research that different consumers have different drivers for playing, for different products and at different times 5.

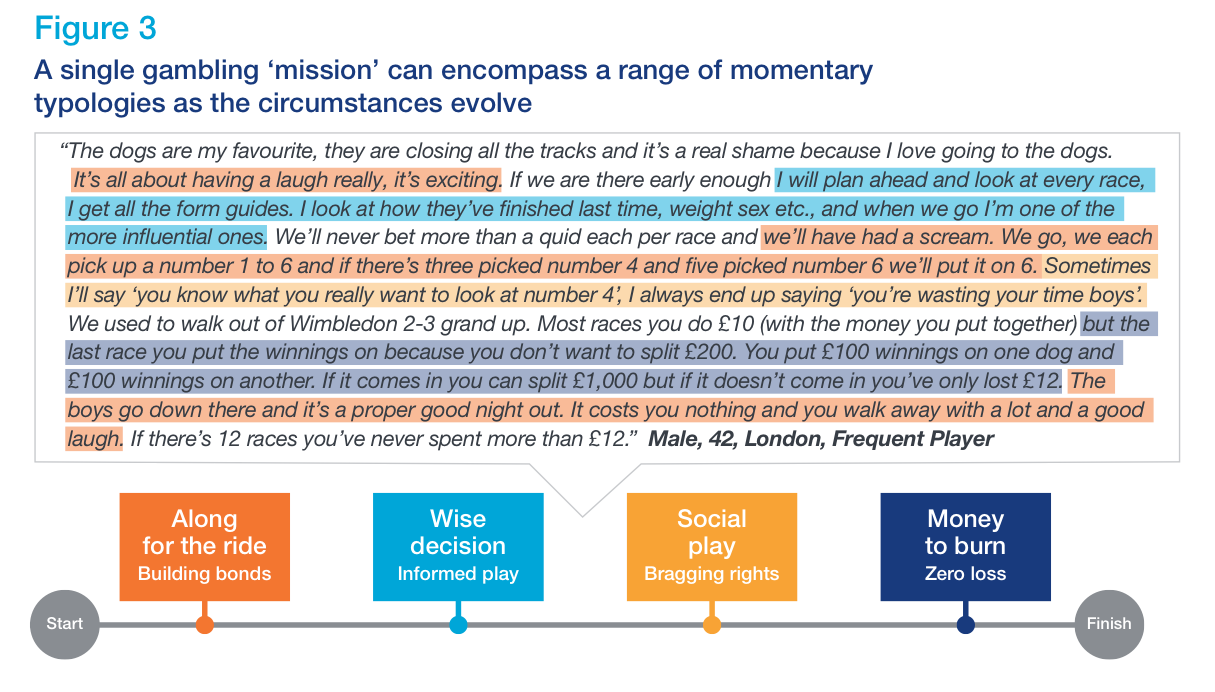

The research identified eight broad groups, summarised in Figure 2 and examples of how these may apply to a real-life scenario in Figure 3:

Those people participating in the research perceived their own gambling behaviour as ‘normal’ and saw others as at risk of problems. They perceived minimal conscious cross-over between their passions/interests and their gambling behaviour – it is perceived as a self-indulgence or a treat.

Responsibility for safer gambling needs to be shared between consumers, gambling companies and the Commission as a regulator. For most consumers, gambling is ‘just for fun’ and yet vigilance and risk is never too far from consideration and this provides a strong context to understand where the points are that this fun may cross over into harm.

5How gambling fits into people's lives (opens in new tab)

Problem and at-risk gambling

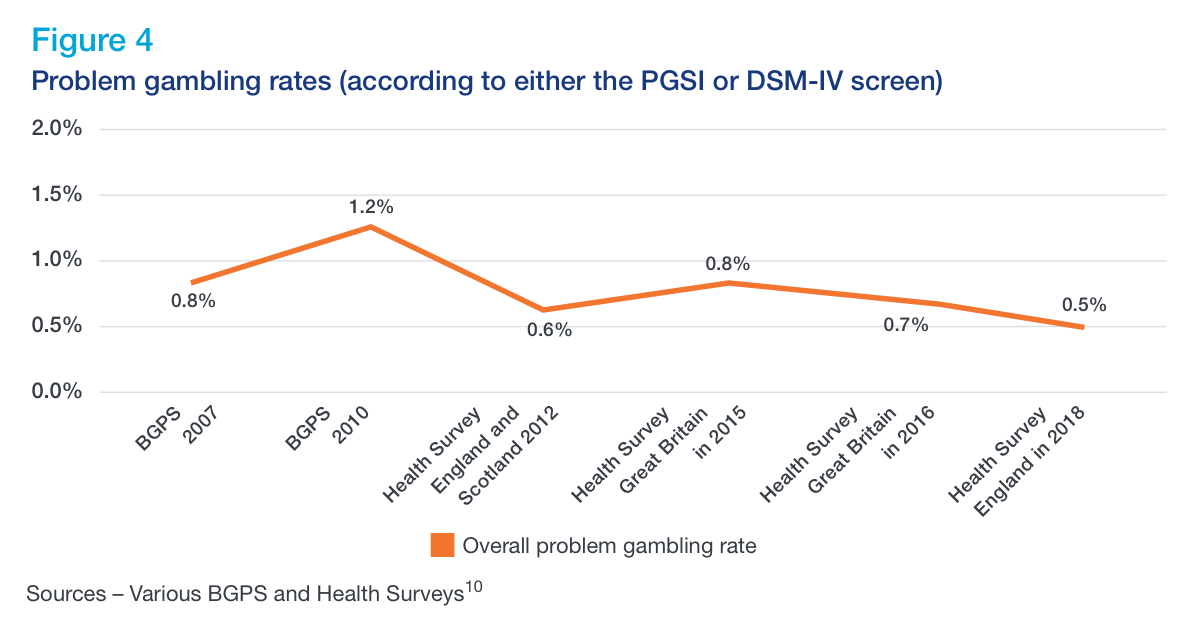

Problem gambling rates are not increasing. Figure 4 sets out problem gambling rates from the best available survey data 6. The data indicates that the overall rate of problem gambling has been statistically stable since 2012 as defined by either the Problem Gambling Severity Index (PGSI) or Diagnostic and Statistical Manual of Mental Disorders (DSM-IV) screens. Our latest annual telephone survey7 suggests 0.6% of the population are classified as problem gamblers8 compared with 0.7% in 2016.

In any event, according to the combined England, Scotland and Wales ‘Gambling behaviour in Great Britain 2016’ data there are approximately 340,000 problem gamblers in Great Britain9. That is simply unacceptable and, as we have repeatedly made clear, needs to be drastically reduced.

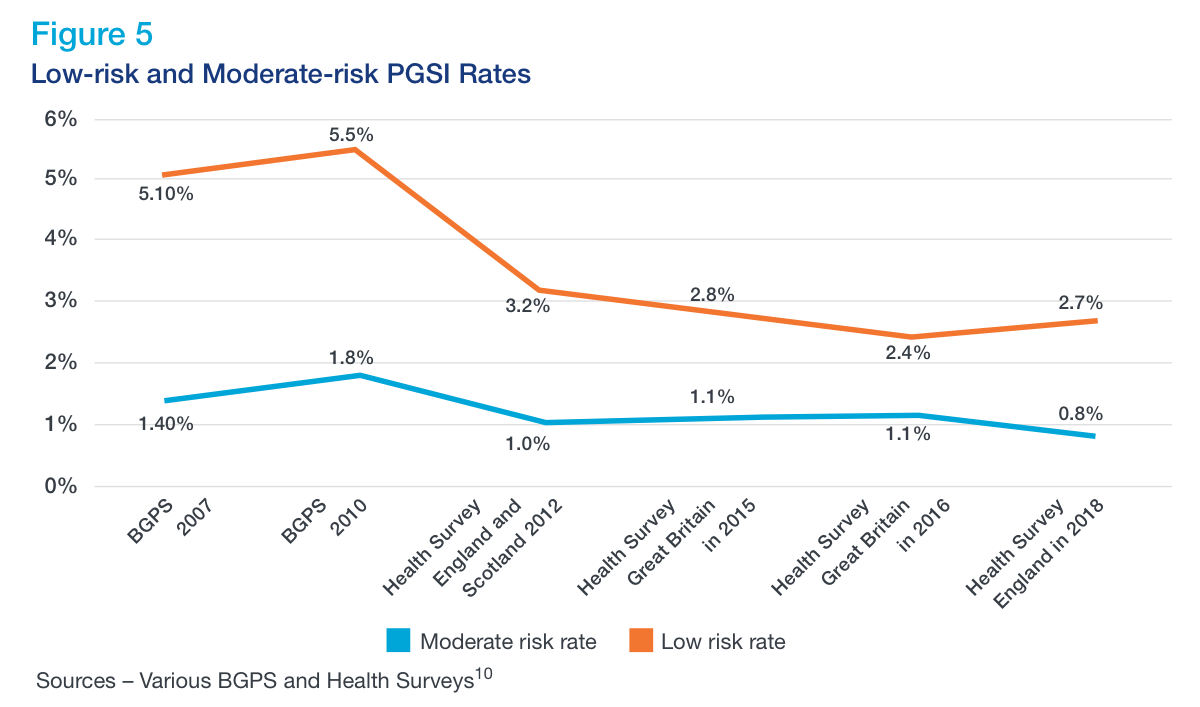

Whilst our data suggests that the problem gambling rate is broadly stable, the data on at-risk rates suggests that progress is being made to reduce the numbers of people at low or moderate risk. Figure 5 sets out the relevant data 11.

Whilst the data suggests that the proportion of people at moderate or low risk of harm has reduced, we need to see those numbers decline further.

The majority of people who gamble do so without experiencing harm. But too many people get into difficulty as a result of gambling and can experience very significant harms, including mental health and relationship problems, debts that cannot be repaid, crime and suicide in extreme cases12. The fact that problem gambling rates have been broadly stable since 2012, does not alter the fact that more needs to be done to understand how gambling related harm can be reduced with actions implemented to achieve a significant reduction. The National Strategy to Reduce Gambling Harms provides an agreed framework for action.

Understanding the prevalence and causes of problem gambling is not straightforward; it is constantly changing as individuals who have experienced gambling harms recover and other people become problem gamblers (due to the onset of problem gambling behaviour or relapses). We need to understand why people become problem gamblers, why some people recover and why some who recover relapse.

To do this we need to understand the incidence rate (new cases occurring over time) and the number of people who relapse. Understanding the incidence rates will inform whether more effort needs to be put into prevention measures (for new cases of problem gambling) or treatment (for those who are relapsing).

Longitudinal studies in Australia show that about half of the prevalence rate is made up of new cases, meaning new people are being classified as problem gamblers at each survey point and that means some people have moved out of problematic gambling 13. Equivalent UK data would be a valuable addition to the available evidence base.

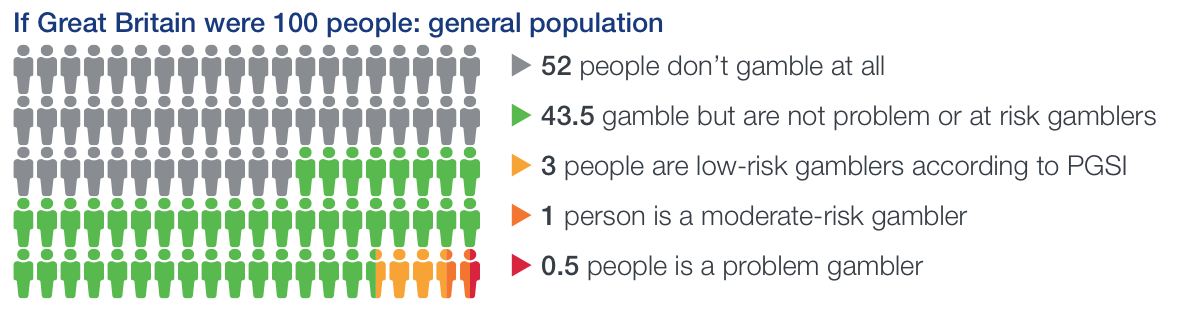

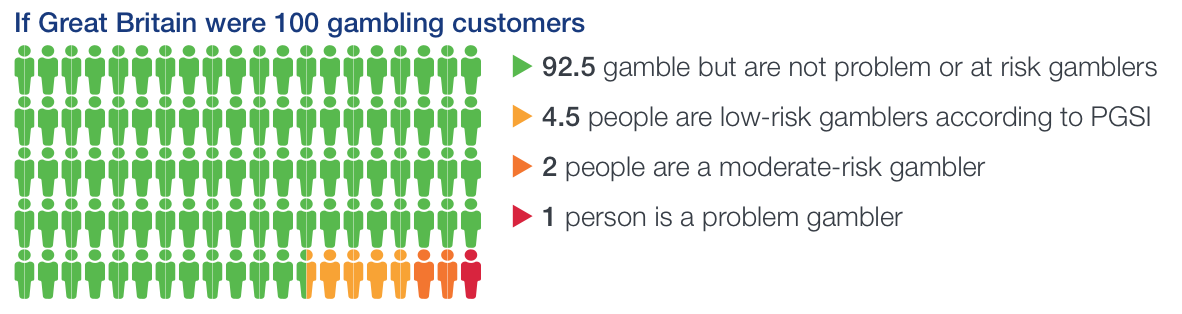

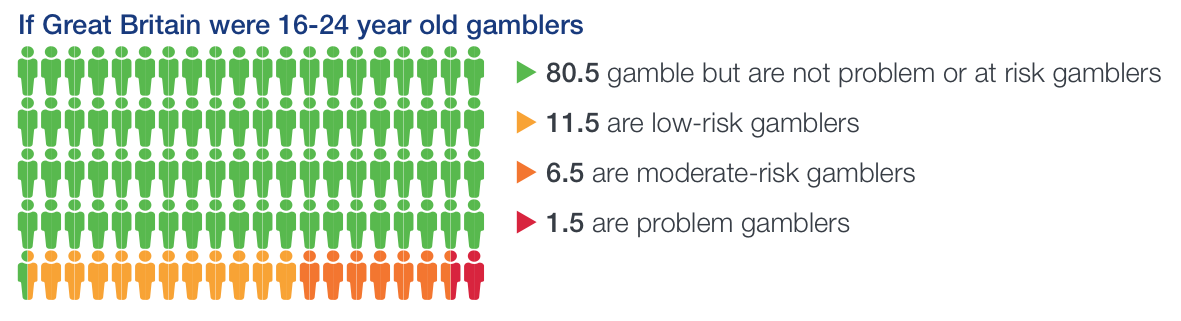

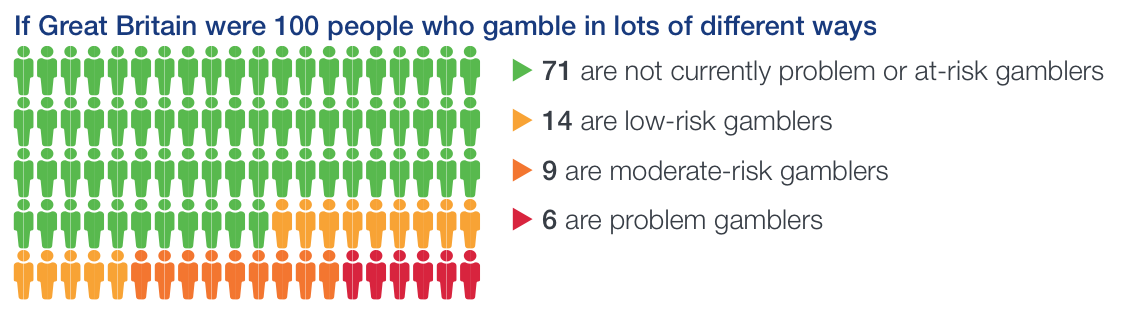

It is important to note that focussing on percentages across the total population risks overlooking issues within specific groups such as women or BAME communities. Figure 6 breaks down the data to present the number of at risk or problem gamblers if the world were 100 British adults. More than half of those adults do not gamble, and half a person is a problem gambler. The figure is then broken down into different scenarios to demonstrate some the key demographic risks associated with the person gambling.

6Information about the PGSI and DSM-IV screens

7Gambling participation in 2019 behaviour awareness and attitudes

8 According to the PGSI mini-screen

9Gambling behaviour in Great Britain (opens in new tab)(PDF)This is the most recent Health Survey data we have for the whole of Great Britain. More recent data has been released from the Health Survey England 2018 and Wales Problem Gambling Survey 2018 but this is not reflective of the whole of Great Britain.

10 Please note that a different methodology was used for BGPS, so care should be taken making comparisons between these survey vehicles.

11The Problem Gambling Severity Index uses the following definitions:

- problem gambling – gamble with negative consequences and a possible loss of control. For example, they may often spend over their limit, gamble to win back money and feel stressed about their gambling

- moderate-risk gamblers – experience a moderate level of problems leading to some negative consequences. For example, they may sometimes spend more than they can afford, lose track of time or feel guilty about their gambling

- low-risk gamblers – experience a low level of problems with few or no identified negative consequences. For example, they may very occasionally spend over their limit or feel guilty about their gambling.

12Measuring gambling-related harms: A framework for action, Wardle and Reith et al (2018)

14For the purposes of this illustration, figures have been rounded up or down, to the nearest 0.5, to ensure that figures sum to 100.

15Participate in four or more different gambling activities.

The person gambling - What are the issues?

Knowing your customer is crucially important and this does not just mean knowing the person in terms of their personal details, age and account history. It is also about understanding affordability and a customer’s personal circumstances, how they react to products, play patterns and behaviours.

When we look at the growing range and complexities of products, the changing nature of the market and the current economic environment, a holistic view of the customer is vital. Knowing and identifying customers at risk of or experiencing harm and acting early and quickly could help stop or prevent the harm worsening.

The person gambling - Customer affordability

Individuals spending more than they can afford to lose is one of the harms most associated with gambling. Harm can be significant even at low spending levels as the level of spend at which harms begin to occur depends on the consumer’s discretionary income. Licensees are not sufficiently equipped to support and, in some cases, protect consumers to mitigate against the risk of gambling beyond their means.

The following table provides the levels of discretionary income using YouGov survey data. Discretionary income is how much an individual has left at the end of the month after accounting for taxes, bills, food and accommodation. The table is based on population level data.

Percentage of discretionary income by age (January 2020)

| Amount | All | 18-24 | 25-34 | 35-44 | 45-54 | 55+ |

|---|---|---|---|---|---|---|

| Nothing | 9% | 10% | 7% | 9% | 11% | 9% |

| Less than £125 | 25% | 31% | 20% | 25% | 26% | 25% |

| £125 to £249 | 20% | 21% | 20% | 19% | 19% | 21% |

| £250 to £499 | 19% | 15% | 23% | 20% | 19% | 19% |

| £500 to £999 | 16% | 15% | 18% | 16% | 15% | 15% |

| £1,000 to £1,999 | 9% | 7% | 10% | 9% | 8% | 9% |

| Over £2,000 | 2% | 1% | 1% | 2% | 3% | 3% |

Another source of data is provided by the Office for National Statistics (ONS) on disposable household income, combined with information on living costs and spending.

According to the ONS Annual Survey of Hours and Earnings:

- median gross weekly earnings for full-time employees is £585

- the occupation group with the highest median weekly earnings for full time employees is still managers, directors and senior officials for which median gross weekly earnings has increased is £862

- based on this data, 50% of full-time employees in the UK receive less than £30,500 gross earning per year and 50% of the full-time managers, directors and senior officials in the UK receive less than £45,000 gross earnings.

The following case studies which have all resulted in regulatory action, demonstrate the ineffective control frameworks used to identify and manage the risk. Common issues include interventions not happening in a timely way with customers flagged as needing an interaction, but this not happening until the next day, or later, after the customer had spent life-changing sums of money.

Threshold levels for review continue to be set at levels that do not take account of the affordability of a typical consumer. As illustrated by the income data, gambling activity at these levels over the periods of time reviewed would be clearly unaffordable for all but the very wealthiest individuals.

The person gambling - Case studies - Clearly unaffordable gambling

Operator A

This customer’s first deposit was £10,000 which triggered the operator to ask the customer to complete a safer gambling self-assessment. Eleven days later, the customer deposited another £40,000 within an hour and a further £10k the following day. Open source checks resulted in the operator estimating the customer’s annual salary to be £416,743 per annum.

However, Gambling Commission compliance staff discovered the searches showed the highest possible salary for the customer was £122,683. The customer’s account was reviewed by the operator several months after registration and suspended because it was deemed there was insufficient information to support the level of spend. The customer had lost half their known salary in two weeks, most of this within one hour.

Operator B

A customer lost £34,849 in four months, of which £33,000 was lost in the last nine weeks of play. Although the customer hit various bet frequency triggers and deposit triggers and received pop-ups, no evaluation was carried out to see if these had been effective.

Human interaction was not attempted until four months had passed, and the customer did not respond. Shortly after, the customer requested self-exclusion for five years, suggesting they were likely to be experiencing gambling related harm. The operator held no information on the customer to support this level of spend.

Operator C

A customer lost approximately £33,000 in three months without any source of income being identified or any affordability assessment taking place. This is despite the customer hitting several triggers for potential gambling harm.

The customer admitted on a phone call to spending more than usual. Compliance staff examined the information held by the operator and this suggested the customer had an income of only £8,500 each year. After approximately ten weeks, the customer admitted during a telephone call to losing too much money and was only then proactively barred by the operator.

Operator D

A customer lost £54,000 within a month of signup despite the operator not having established affordability for the customer. Shortly after joining the customer’s account was suspended due to safer gambling concerns. When a successful call was made, the customer said they had ‘had a shocker over the weekend’ but were happy to lose £20,000 a month. The customer said they would be happy for the operator to set a deposit limit for them, but this was not done.

During a follow up call two days later, the customer said they had been spending more than usual due to having ‘nothing to do for eight weeks’ due to lockdown. They said they had then had a spree because sports betting had started up again. A £20,000 deposit limit was put on the customer’s account and the account was reactivated, despite the operator still not having conducted an affordability assessment. Two days after the account had been reactivated the customer removed the deposit limit and continued to deposit funds, losing approximately £25,000 in two weeks. At the time of our assessment the operator had still not established affordability for the customer.

Operator E

The customer was not identified as a potential gambling harm concern until they had lost £11,000 in 6 weeks. The interaction appeared to have no impact as the customer went on to lose a further £22,000 within a month. The customer was able to lose over £33,000 in around ten weeks without any affordability assessment taking place.

Operator F

The customer lost £24,800 within three days. The operator had not carried out any affordability assessment for the customer.

The person gambling - GC action

It is unacceptable that unaffordable gambling is still featuring in our casework, and this is why we have launched a consultation to explore how unaffordable gambling can be reduced.

GC action

We will respond to our consultation and accompanying call for evidence on how best to improve the effectiveness of customer interaction. This consultation is exploring the themes of affordability, vulnerability and identifying and acting on indicators of harm.

Our compliance and enforcement teams continue to see cases where individuals have exhibited clear indicators of gambling- related harm but have been able to continue to gamble without effective action being taken by the licensee. Some of these individuals have funded their gambling through crime but most cases were customers relying on unsustainable funds such as loans; credit; inheritance; personal injury or redundancy payments.

GC action

Our Compliance team regularly investigate operators and their adherence to the Social Responsibility code provisions as well as reviewing commitments such as those made in Assurance Statements.

Our action to ban gambling by credit cards from April 2020 is intended to mitigate against the risk of financial harms arising from gambling. Evaluation of the change in consumer behaviour that causes is also an important next step.

The person gambling - Identification of at-risk behaviours and vulnerability

Identifying customers at risk of, or experiencing harm, can be complex. It is true that each consumer is different, and licensees cannot – in isolation – be sure that an indicator of harm for one consumer is relevant to their circumstances. Some consumers respond negatively to interventions by licensees.

However, the reality is that it is simple to identify consumers that may be at risk of harm, based on financial, time and behavioural indicators and applying knowledge about average consumers or what is already known about a particular consumer based on their behaviour and previous engagement with the licensee. Tailored interventions minimise the risk of alienating consumers.

There is a growing evidence base about patterns of play and behavioural indicators that are linked to risk. This knowledge is not consistently used to consider the position of a consumer and undertake proportionate customer interaction.

Often monitoring and oversight of customers to enable early identification of changes in behaviour which may indicate a risk of harm are ineffective. Identifying at-risk behaviour and interacting effectively are central to harm prevention.

We will continue to support collaborative projects to understand how research can guide operator processes to raise standards in the real world. As an example, Gambling Research Exchange received funding from regulatory settlements to deliver research and knowledge exchange to support the National Strategy to Reduce Gambling Harms. In November, they began a trial project with a representative sample of gambling operators to share knowledge and learning about customer interaction approaches.

The prioritisation of commercial considerations over regulatory requirements in respect of managing High Value Customers (HVC) has been a recurring theme of our casework. We have found the use of incentivisation schemes as aggravating factors in circumstances where indicators of harmful play have been missed or overlooked. The pursuit of aggressive commercial outcomes using HVC schemes has also resulted in lax controls in preventing the acceptance of proceeds of crime.

HVC schemes should only be offered with rigorous oversight, clear senior accountability for their operation and outcomes, and should only serve those consumers for whom the licensee has undertaken thorough due diligence checks. That is why we recently strengthened the requirements around how these schemes operate.

GC action

We are implementing the outcome of the consultation strengthening requirements on how licensees manage high value customers (VIPs).

When consumers are in a vulnerable situation, they may be less able to understand the risks of gambling and the terms and conditions; consequently, they may be at higher risk of experiencing negative outcomes.

There are many reasons a person may be in a vulnerable situation and changes to an individual customer’s circumstances may mean that a person becomes more or less vulnerable to experiencing negative outcomes. A vulnerable situation can be permanent, temporary or intermittent, and may be related to health, capability, resilience, or the impact of a life event.

Those circumstances could include bereavement, loss of income or other factors. This information may not always be available to a licensee, but they should be ensuring staff ask questions when there are potential signs of vulnerability, to help to determine whether those individual circumstances present an increased risk.

Persons in vulnerable situations can face challenges when interacting with a range of financial, digital or complex consumer products. The Financial Lives 2020 survey conducted by the Financial Conduct Authority (FCA) has found that just under half (46%) of UK adults, aged 18 and over display one or more characteristics of vulnerability.

The risk increases as more than one vulnerability characteristic is present and where those needs are not met. The Money and Mental Health Policy Institute (MMHPI) found that people with mental health problems are three and a half times more likely to be in problem debt.

When looking at gambling specifically, a recent report by the Money and Mental Health Policy Institute included findings from a survey of their research community of people with lived experience of mental health problems 16. This identified that a quarter (24%) of respondents have experienced financial problems because of gambling online, and one in three (32%) have bet more than they could afford to lose.

Licensees are not consistently taking account of information that may indicate vulnerability which they receive as part of customer service, information about source of funds or in dealing with complaints. This means they are missing the opportunity to take account of vulnerability.

GC action

We will publish a statement setting out the principles and key areas of work in our approach to vulnerability.

16A Safer Bet (opens in new tab)

The person gambling - Engaged gamblers who participate in multiple products across different providers

A challenge to addressing the person-centric risk to the licensing objectives is the ability for consumers to circumvent any individual operator-led controls by gambling with several different companies. This is not an impediment to progress on controls to address the risk in those scenarios where significant markers of harm, criminal spend, or suspicious activity is confined to activity with a single licensee or group.

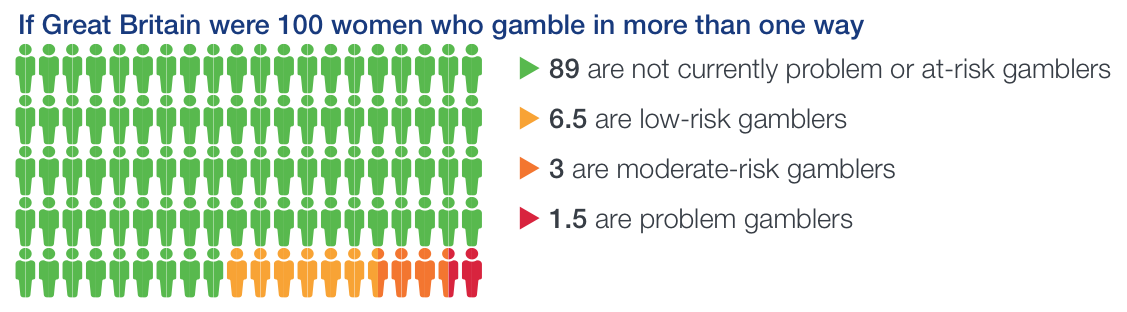

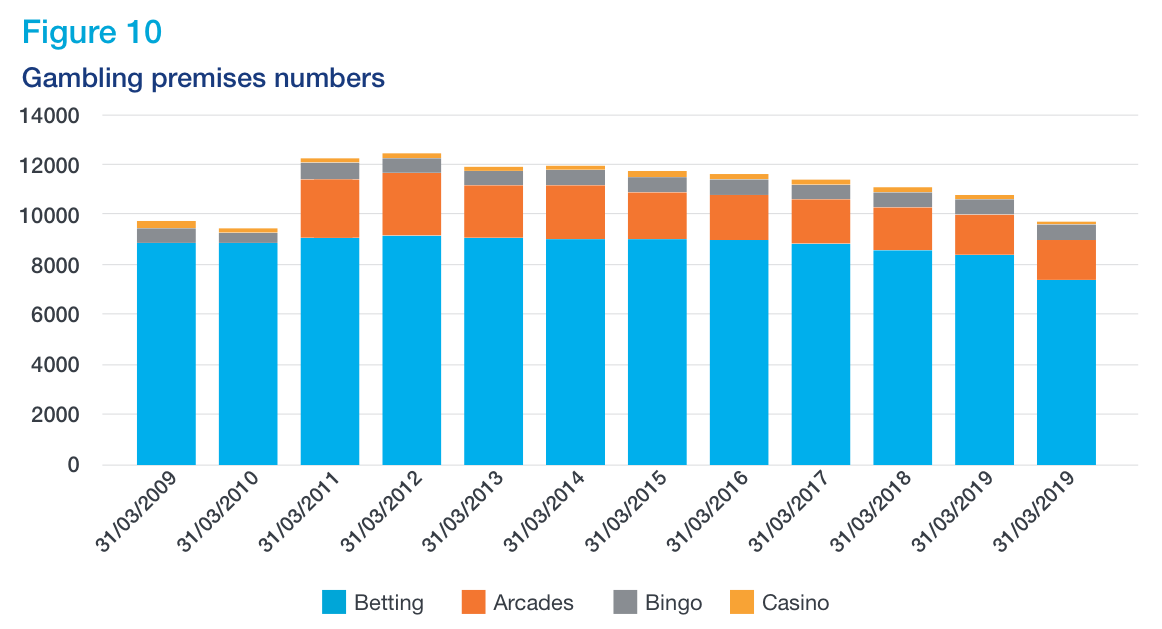

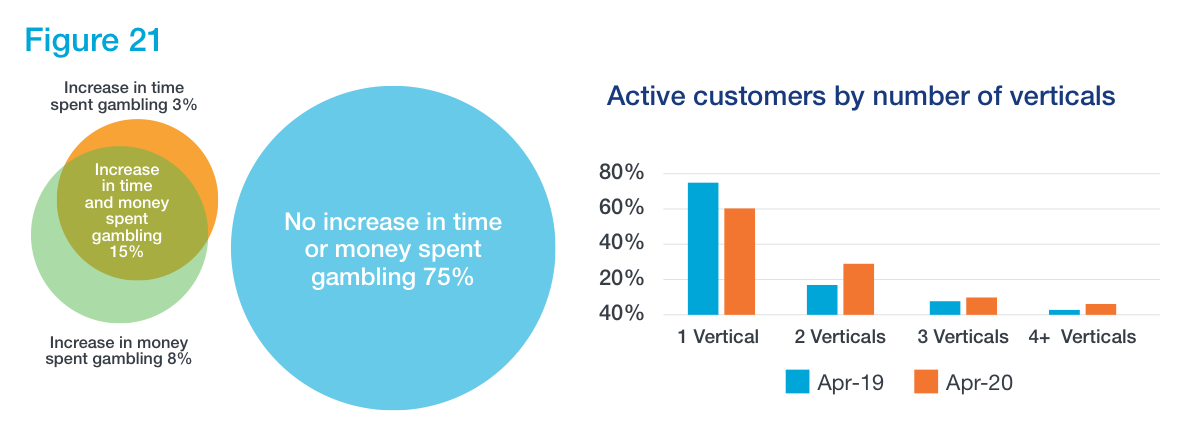

This issue is highlighted by data which shows 56% of online gamblers have more than one gambling account and on average they have 3 accounts as shown in Figure 8 17.

The following table shows the proportion of customers who play multiple activities and the equivalent prevalence of problem gambling for each of these groups 18.

Aged 16 and over with a valid DSM-IV or PGSI score

| Number of gambling activities | Combined GB Health Surveys 2016 | Health Survey England 2018 |

|---|---|---|

| 1 | 0.3% | 0.2% |

| 2-3 | 0.4% | 0.7% |

| 4-6 | 3.2% | 1.2% |

| 7 or more | 13.2% | 15.1% |

The implementation of multi-operator self- exclusion schemes and other gambling management tools which are player rather than operator centric have demonstrated how progress can be made. Supporting those who wish to limit or stop gambling is a regulatory focus. Our data shows 5% of adult gamblers in Great Britain (1.9 million) have ever excluded 19.

GC action

We are continuing to press the industry to use technology to create a single view of the consumer. We recognise the challenge of keeping a customer safe where operators currently only have a partial view of a customer’s behaviour. That is why we have bought together technology providers, data scientists, academics, researchers and financial service providers to work with us to develop solutions to provide a ‘single customer view’.

17 Online gamblers who hold one or more gambling accounts. Gambling participation in 2019 behaviour awareness and attitudes (opens in new tab)

18Gambling behaviour in Great Britain 2016and Health Survey for England 2018 supplementary analysis on gambling – December 2019 update (opens in new tab)

19Gambling participation in 2019 behaviour awareness and attitudes (opens in new tab)

Underage gambling

With some limited exceptions, gambling activities regulated under the Gambling Act 2005 are restricted to over 18s. Central to a licensee’s permission to provide facilities for gambling is that they prevent underage access.

For premises-based gambling, test purchasing is one approach by which the Commission or licensing authorities can test the effectiveness of operators’ controls. Operators of licensed gambling premises are required to undertake test-purchasing under agreed methodologies to test ‘Challenge 21’ processes. Data representative of 90% of gambling premises across betting premises and arcades shows sustained improvement with the most recent pre-coronavirus (COVID-19) data indicating that in 9 out of every 10 tests the 18/19yr old test purchaser was challenged to verify their age during their visit. The current rate of 1 in 10 visits resulting in a failure to challenge for ID demonstrates the need for continued vigilance on the part of licensees.

Other locations where children and young people can access gambling continue to present a higher risk of underage gambling. Pre-coronavirus test purchase activity on access to gaming machines in pubs and betting at racecourses exposed serious weaknesses in controls. Such gambling environments pose a heightened risk due to the ability of under 18s to be in the vicinity of gambling facilities. As these premises reopen following the coronavirus restrictions it is important that efforts are redoubled to prevent underage access.

Children and young people can be harmed not only by their own gambling, but also by the gambling of family members for example because of neglect or financial harm. There is evidence of intergenerational transfer of risk behaviours with parental problem gambling a strong predictor of problem gambling among children 20.

In Great Britain, children and young people are legally permitted to gamble in limited ways, although most commercial gambling is restricted to over 18-year olds. In overall terms the levels of gambling by children has been falling over time. Our data found that 11% of 11-16-year olds surveyed had spent some of their own money on gambling activities in the last seven days in 2019 21.

The value of this headline figure in informing regulatory risk is undermined as it includes gambling activities which respondents are lawfully permitted to participate in, such as a private bet for money with family or friends (mentioned by 5%) and fruit/ slot machines (4%). The sample size for the 2020 report is smaller as a result of being disrupted by coronavirus but we are also looking at how this source of evidence can be strengthened further to specifically track prohibited gambling by children and young people as a measurement of licensees’ controls.

GC action

Having strengthened age verification controls for online gambling we will continue to use our compliance and enforcement powers to ensure they are complied with22.We will continue to support those licensing authorities, local police or trading standards who undertake test purchasing in response to heightened risk or as part of their general legal and regulatory oversight.

20 Children and young persons gambling research review, G Valentine, 2016

21Young people and gambling report (opens in new tab)

22 New age and identity verification rules - changes to the LCCP from Tuesday 7 May

Gaps in the evidence and understanding of gambling related harms

Building and maintaining a first-rate evidence base on gambling harms is essential to inform effective regulation.

The national Health Surveys across Great Britain23 look at changes in the health and lifestyle of people and, where possible, include questions on gambling participation and problem gambling. The Health Surveys provide robust, high quality data; however, they are typically able to include gambling questions only every 2-3 years, and the speed of reporting is relatively slow. The most recent Health Survey data relates to England and Wales in 2018, however the last combined Great Britain report was published based on 2016 data.

To ensure a more up-to-date picture and to fill in evidence gaps between Health Surveys, we conduct a quarterly telephone survey (nationally representative of adults in Great Britain), amongst other research, to see how behaviour is changing and the impact of regulatory changes to the industry24.

GC action

We will launch a review of our approach of tracking participation in gambling and the prevalence of at-risk and problem gambling. This review will examine options for consolidating the multiple survey vehicles currently used into a single robust, efficient and flexible approach. We will be publishing a consultation to seek input from interested parties including experts in the field later this year, and we will start implementing outcomes in 2021.

Gambling-related harms are the adverse impacts from gambling on the health and wellbeing of individuals, families, communities and society25. These harms affect resources, relationships and both physical and mental health.

GC action

We will establish a permanent Experts by Experience advisory group to build on the valuable input provided by our interim arrangements.

Collectively, we are moving away from solely counting the number of problem gamblers in the population, towards also developing approaches to comprehensively measure the different harms caused by gambling.

The current practice of assessing the extent of gambling-related harms by problem gambling prevalence rates can be misleading. Prevalence rates fail to capture important dimensions of harm, including those experienced by others than gamblers themselves (affected others). This means they are potentially underestimating the scale of harm.

Understanding and measuring gambling- related harms should therefore be one of the top priorities for everyone involved in gambling.

GC action

We are piloting a new set of questions on our quarterly online omnibus survey to understand the public’s experience of gambling-related harms. This work builds on the framework of harms devised by academics in 2018. The first wave of this survey data was collected in June, with further waves to be completed by December. Subject to appropriate validation this data will provide valuable insight into the type, severity and extent of gambling harm being experienced and provide a rich dataset to sit alongside more regular tracking of problem and at-risk gambling rates.

Longitudinal research is a potential component of the programme of work to understand and measure gambling-related harms.

GC action

We will scope feasibility of a longitudinal study of gambling behaviours and problem gambling to inform the next steps on improving research into gambling.

23Health Survey for England, Scottish Health Survey, supplemented by a similar survey in Wales (currently the National Survey for Wales)

24More detail about the Gambling Commission’s official statistics on gambling participation and prevalence.

25Measuring gambling-related harms: A framework for action, Wardle and Reith et al (2018)

The place where gambling is occurring

Key risks and issues

Key issues and risks

- Accessibility of online gambling: The 24/7 availability of online gambling has changed how and when consumers gamble

- Anonymity within premises-based gambling: Most land based gambling is conducted without identification of customers limiting the scope for player-centric controls

- Advertising: Gambling advertising must be socially responsible, it must not be targeted at under 18s, and its content must not encourage irresponsible gambling behaviour.

What do we know?

Overview of how and where people gamble in Great Britain

The place where a person gambles is an important factor in the management of risks to the licensing objectives. The approaches taken to ensure gambling is fair, safe and crime free differ depending on whether the gambling is provided by remote means or from gambling premises. The Gambling Commission wants consumers to be able to enjoy gambling safely, whether they are playing online or in premises.

More than 18 million people report gambling in premises authorised to provide gambling (including National Lottery products purchased in retail outlets), in the past 4 weeks. Licensed gambling premises are operated under an operating licence granted by the Commission and premises licences granted by the 368 licensing authorities.

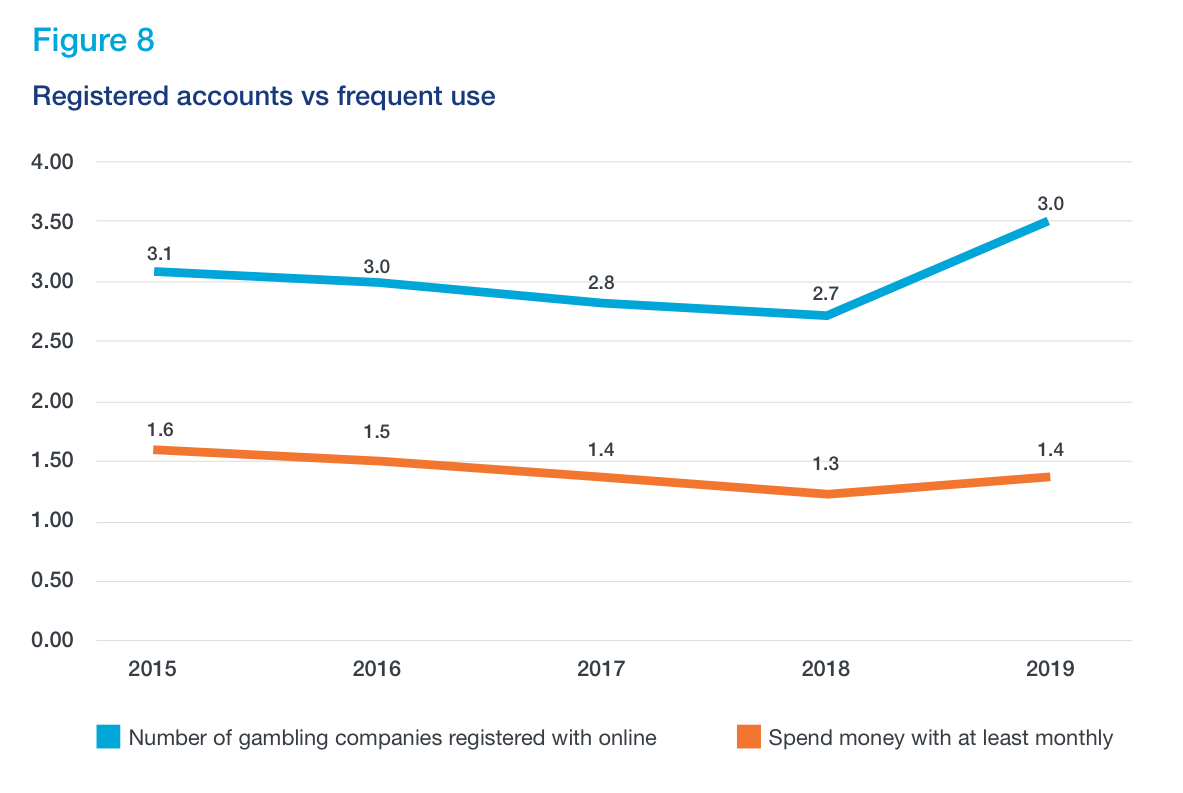

Prior to coronavirus (COVID-19) there were 9,745 licensed gambling premises in Great Britain made up of the following premises types:

| Type | Number |

|---|---|

| Betting premises | 7,315 |

| Arcades | 1,633 |

| Bingo premises | 642 |

| Casinos | 155 |

Our industry statistics show the number of licensed gambling premises is declining.

The gambling participation rates in licensed gambling premises has also been declining. For example, in 2016 38% of adults reported they had gambled in premises in the past four weeks; in 2019 this reduced to 35% 27.

26 Data for arcades is unavailable for 2009-10

27 Source – Quarterly Telephone Survey – Year to December data periods

Accessibility of online gambling

The decline in premises-based gambling has coincided with an increase in online gambling. In 2016, 17% of adults reported they had gambled online in the past four weeks; that had increased to 21% in 201928. . Data from our industry stats shows the growth in remote gambling GGY by sector as shown in Figure 11.

If extrapolated, our latest data, equates to 11 million adults having gambled online in the last 4 weeks.

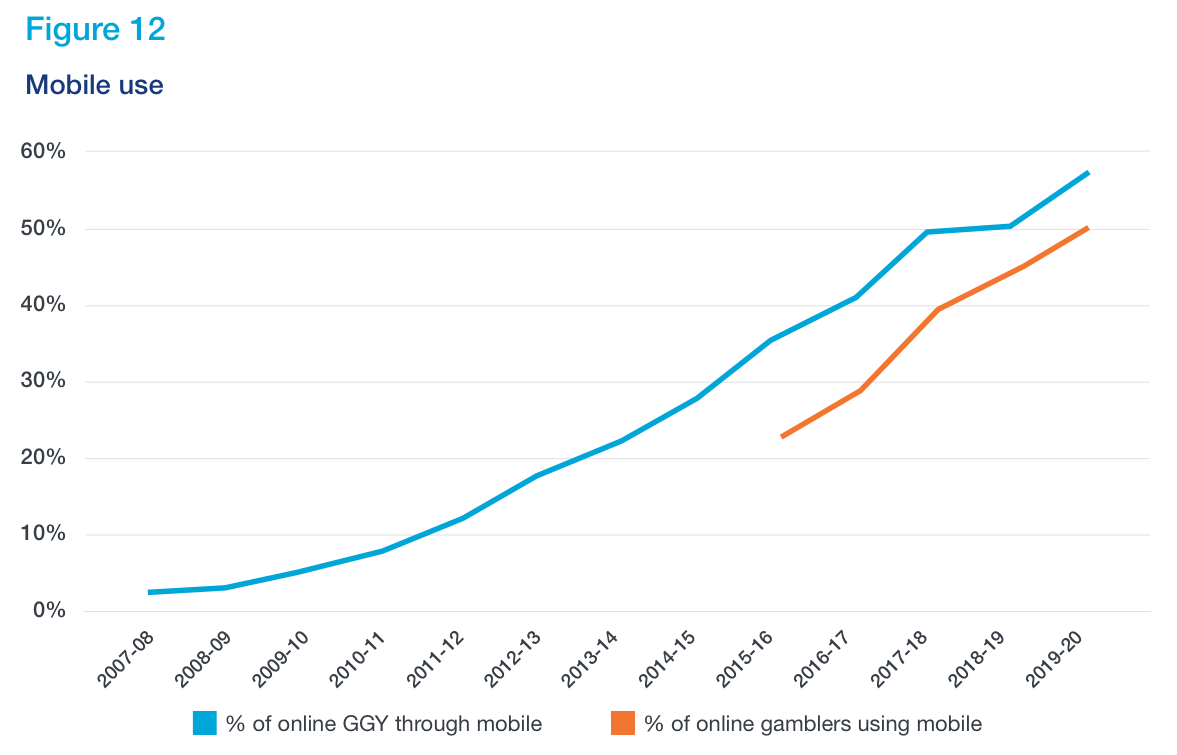

As figure 12 shows, 50% of online gambling now takes place on a mobile phone 24.

The emergence of online gambling, in particular mobile gambling means consumers have far greater access to a wider range of gambling products. Many large online licensees provide a one-stop shop for gambling facilities incorporating betting, casino games (live and virtual), slot games, bingo and poker all accessible from a single app. 56% of online gamblers have more than one gambling account and on average they have 3 accounts 29.

In 2019 we asked our Advisory Board for Safer Gambling (ABSG) and the Digital Advisory Panel (DAP) to review and advise our ongoing work and future approach to tackling online gambling harms. Their recommendations for priority actions included addressing the risks of game design and habit- forming apps, making more use of data through a ‘single customer view’ and harnessing the use of ad tech to reduce vulnerable adult and children’s’ exposure to online gambling advertising'.

28 Gambling participation in 2019 behaviour awareness and attitudes (opens in new tab)

Advertising

The Gambling Act 2005 permits licensed gambling businesses to advertise subject to reasonable consistency with the licensing objectives and a range of legal and regulatory controls. Powers to regulate gambling advertising are shared between the Secretary of State, Ofcom, the Advertising Standards Authority (ASA) and us.

The UK Advertising Codes, which are written by the Committees of Advertising Practice (CAP) and enforced by the ASA, are designed to ensure that marketing communications for gambling products are socially responsible, with particular regard to the need to protect children, young persons under 18 and other vulnerable persons from being harmed or exploited by advertising that features or promotes gambling. Gambling advertising must not be targeted at under 18s or be of particular appeal to them. We work very closely with the ASA and if a gambling business is found to be in serious or repeated breach of the rules, we can act.

Ipsos MORI research commissioned by GambleAware in response to our research priorities, found that there has been a clear increase in the volume of, and spend on, gambling advertising in recent years. Lotteries and bookmakers were the top spenders across all types of media. This matches YouGov data that tracks the public’s awareness of advertising which consistently finds Lotteries (both National Lottery and Society Lotteries) to be the advertised products most recalled.

Data shows between 18-21% of the public report awareness of Lottery advertising versus between 4-5% who report being aware of non-Lottery gambling advertising.

What are the issues - online gambling

Online gambling

Online gambling presents a distinct set of risks and opportunities. It is important to look at the risks at each stage of a consumer’s experience with online gambling:

Before a consumer decides to play, where licensees and affiliates seek to influence decisions through their advertising, marketing, and incentives such as bonus offers.

At the point of sign-up/log-in, where licensees have an opportunity to collect and verify know your customer information and understand a player’s preferences.

Before play begins, when licensees can nudge customers to apply safer gambling tools, or automatically apply them subject to understanding more about a customer such as how much time and money individuals can afford to spend gambling. Licensees should also be providing clear information to players about how their products work to enable consumers to make an informed choice on what products they wish to participate in.

During play, where game or platform features can encourage harmful play or support safer play. Where customers can gamble with the assurance that they will be treated fairly, and any winnings will be paid promptly.

Before, during or after play, where operators can act on information about individual player behaviour to initiate an interaction and support safer play. Where player activity is monitored to ensure suspicious activity is identified and reported. Where customers are given clear accessible information on how they can raise queries or complaints and be reassured their concerns will be addressed promptly and fairly.

GC action

We will continue to use our regulatory powers to make online gambling safer through targeted action to improve standards.

GC action

We will continue to use the expertise of our advisory groups including the insight provided by our Digital Advisory Panel, formed with online industry and digital commerce experts, to give us access to expertise on digital industries and emerging technologies. This is to ensure regulation remains fit for purpose and helps us respond to new and emerging risks.

What are the issues? Anonymity within premises-based gambling

Premises-based gambling presents different challenges and opportunities to online gambling. Offering gambling in person provides the opportunity to observe and engage with customers face to face. However, where gambling is not account-based it is more difficult to track consumer behaviour and provide gambling management tools to players. Most premises-based gambling can be undertaken anonymously.

Anonymity within premises-based gambling combined with the use of cash poses inherent challenges to identifying and acting on suspicious gambling activity. Even when identity is not a factor, we still see the challenge that premises-based environments such as casinos encounter, in delivering regulatory requirements when interacting with customers who are primarily engrossed in a social leisure activity. Operators must implement successful methods to engage to prevent harm and comply with preventative money laundering measures required in legislation.

The risk of harm in premises-based environments is linked to the number of staff working in those premises, as that determines the type and level of interaction that can take place with consumers.

Premises can be locations for crime, and we see examples such as violent or abusive behaviour toward staff or other customers, physical damage to the premises, money laundering and drug use or dealing.

Schemes such as Betwatch, a community-based crime prevention scheme between the Gambling Commission, the police, local council, and bookmakers, are designed to tackle localised anti-social and criminal behaviour in and around betting shops. Whilst these schemes have been successful in tacking some of these issues, they are not nationally nor industry wide.

GC action

We will continue to work closely with key regulatory partners to ensure gambling is fair, safe and crime free – including local licensing authorities.

GC action

We will continue to engage with premises-based gambling operators to deliver industry engagement and a programme of initiatives to raise standards informed by and complementary to our compliance and enforcement activity.

Coronavirus (COVID-19) has had a severe impact on premises-based gambling and the full impact of this on consumer behaviour is not yet known. As premises reopen and adapt to the new environment, there is an opportunity for land-based gambling to make a case for creative solutions to enhance their products and services in a way which goes hand in hand with enhanced consumer protections.

GC action

We will continue to challenge industry to implement consumer protections through a product design working group.

What are the issues? - Advertising

Advertising is another area that is constantly evolving. Traditional advertising methods such as print, broadcasting, and sponsorship are being supplemented by digital marketing which can be far more personalised and direct than for example TV or radio campaigns. While the growth of digital marketing presents some risks it also presents opportunities – not available in traditional media – for targeting away from vulnerable audiences, including children and young people. For example, social media platforms can restrict what adverts are served to users based on age, preferences, or explicit requests.

GC action

We directed licensees to make progress on the use of ad-tech to proactively target online marketing for gambling away from children, young people and those who are vulnerable to harms. We will monitor the effectiveness of the updated version of the Gambling Industry Code for Socially Responsible Advertising which came into effect on 1 October 2020.

During the period 2015-19, the number of licensed brands lawfully permitted to be marketed increased from 2,714 to 4,968, an 83% increase. Ad volume and spend increases do not necessarily equate to increased ad exposure. There are more opportunities to advertise than ever before (hundreds of TV channels, thousands of websites, social media platforms etc) meaning advertising is spread out across a number of diverse media channels.

Our tracker data 30 shows that overall exposure to gambling advertising has remained stable since 2016. The ASA’s latest report 31 on TV ad exposure found that children saw, on average, 2.2 and 2.7 gambling ads on TV per week in 2008 and 2009, respectively; in 2019, children saw a weekly average of 2.5 gambling ads on TV. Children’s exposure to gambling ads on TV peaked in 2013 (seeing, on average, 4.4 gambling ads on TV per week) and has since declined slowly. Ads for bingo, lottery and scratchcards continue to make up most gambling ads that children see on TV.

Studies looking at the impact of advertising on adult gambling behaviours have indicated that exposure to advertising may be linked to a greater likelihood to gamble. However, the existing evidence base does not demonstrate a causal link between exposure to gambling advertising which complies with the current rules and problem gambling at a population level.

The Ipsos MORI research reached the following key conclusions:

There are reasonable grounds for concern about the impact of marketing and advertising, and there is a link between gambling advertising and the attitudes, current and likely future behaviours of children, young people and vulnerable adults. However, the research was not able to find a causal link between exposure to gambling advertising and problem gambling in later life 32.

This is not to say that gambling cannot be enjoyed recreationally at legal age; however, children, young people and vulnerable adults have already been identified as being more likely to experience gambling disorder or be vulnerable to gambling related harms.

Changes to advertising practices should be an intrinsic part of a wider policy initiative that also considers the influence of peers and family members in exposure to gambling brands and practices, as the research shows that these factors correlate more closely with current gambling behaviour than exposure to or engagement with advertising.

The report suggests applying the precautionary principle and that action would be warranted in:

- Reducing exposure to gambling advertising

- Reducing the appeal of gambling advertising

- Improving customer protection messaging within advertising

- Improving wider education initiatives

- Improving understanding through further research

GC action

We have supported the ASA’s recent proposals to further restrict the content of gambling ads to limit their potential to appeal to, and adversely affect, u18s and vulnerable adults. We will continue to work closely with the ASA to enforce the gambling advertising rules.

Gambling advertising will continue to be scrutinised as part of the public policy debate on gambling. Aside from the debate on the role of gambling advertising and its effects, there is scope for licensees to continue to improve standards on how advertising is currently conducted.

GC action

We published new guidance to further protect consumers during the coronavirus (COVID-19) lockdown, which made clear that licensees must cease to offer bonuses or promotions to those displaying markers of harm. We are proposing, as part of the planned customer interaction consultation, to make this a permanent requirement.

We estimate there are many thousands of marketing affiliates in operation in the gambling industry. Licensees must ensure that any affiliate acting on their behalf is doing so in full compliance with the rules around gambling content and placement and in a manner, which does not undermine the licensing objectives.

Licensees must also ensure they or affiliates are not placing adverts on illegal copyright infringing websites. Gambling ads are often placed on pirate publishers due to poor algorithmic decision-making that associates pirate sports streaming with legitimate sports websites. The problem arises when technology fails to filter out risky publishers like pirate streaming websites. Until brands have complete transparency over their advertising supply chains, this issue will continue.

Our work with the City of London Police’s Intellectual Property Crime Unit (PIPCU) has resulted in a dramatic decline in gambling advertising on pirate websites. Having previously been identified as the top sector for such adverts, White Bullet data 33 from April 2020 showed gambling now represents less than 2% of adverts. Licensees must build on these positive developments by maintaining proactive control over all aspects of their advertising activity.

Foreign gambling companies are entering into advertising arrangements with British licensees to support sponsorship deals which seek to benefit from the global exposure of high-profile sports events such as the English Premier League. These companies often have little commercial interest in offering gambling in Great Britain but do want to use the Premier League to advertise their products in other jurisdictions where the Premier League is popular.

Such ‘white label’ arrangements have in some cases been found to present risks to the licensing objectives. These arrangements cannot be used to circumvent the robust licensing controls in place in Great Britain. Licensees must conduct appropriate due diligence checks on any prospective partners before entering a business relationship. Responsibility for compliance will always sit with the licence holder so they must satisfy themselves that appropriate safeguarding measures and controls are in place before committing to contractual obligations.

Case study

In May 2020 FSB Technology Limited was required to change its operation following the imposition of additional licence conditions. FSB had to pay £600,000 for advertising, money laundering and social responsibility failings.

FSB’s business model included contracting provisions of its licensed activities to third parties. This arrangement, often referred to as a ‘white label’, places responsibility on the licensee to ensure that its third-party partners keep gambling fair, safe and crime-free.

An investigation found FSB did not have sufficient oversight of third-party websites or effective policies and procedures in place between January 2017 and August 2019 resulting in:

- ineffective customer interactions with, and source of funds checks on, a customer who displayed indicators of problem gambling and spent £282,000 over an 18-month period

- sending a marketing email to 2,324 customers who had previously self-excluded

- a VIP team manager acting without adequate oversight and not receiving sufficient AML training

- placement of an inappropriate banner advertisement containing cartoon nudity on a Great Britain facing website which was providing unauthorised access to copyrighted content.

30 Children's exposure to TV ads for gambling and alcohol 2019 update (opens in new tab)

31 Gambling Commission online tracker survey

32 Longitudinal research is required to assess this – last year we commissioned a scoping study to determine the best methodology for a longitudinal study. This has been identified as a priority under the National Strategy for Reducing Gambling Harms.

Case study

Case study

In May 2020 FSB Technology Limited was required to change its operation following the imposition of additional licence conditions. FSB had to pay £600,000 for advertising, money laundering and social responsibility failings.

FSB’s business model included contracting provisions of its licensed activities to third parties. This arrangement, often referred to as a ‘white label’, places responsibility on the licensee to ensure that its third-party partners keep gambling fair, safe and crime-free.

An investigation found FSB did not have sufficient oversight of third-party websites or effective policies and procedures in place between January 2017 and August 2019 resulting in:

- ineffective customer interactions with, and source of funds checks on, a customer who displayed indicators of problem gambling and spent £282,000 over an 18-month period

- sending a marketing email to 2,324 customers who had previously self-excluded

- a VIP team manager acting without adequate oversight and not receiving sufficient AML training

- placement of an inappropriate banner advertisement containing cartoon nudity on a Great Britain facing website which was providing unauthorised access to copyrighted content.

The gambling product

Key issues and risks

Key issues and risks

- Online game and platform design: Understanding product and game characteristics and their links to harm should inform how games and platforms are made safer by design.

- Gaming machines: The product characteristics of gaming machines combined with the environments in which they are made available present regulatory risks.

- Higher risk products: Core product characteristics such as speed of play, frequency, staking options, return to player and accessibility should inform the risks to players and should guide the controls applied.

- Product innovation: Product innovation should deliver positive consumer and regulatory outcomes and not be focused on commercial outcomes alone.

What do we know?

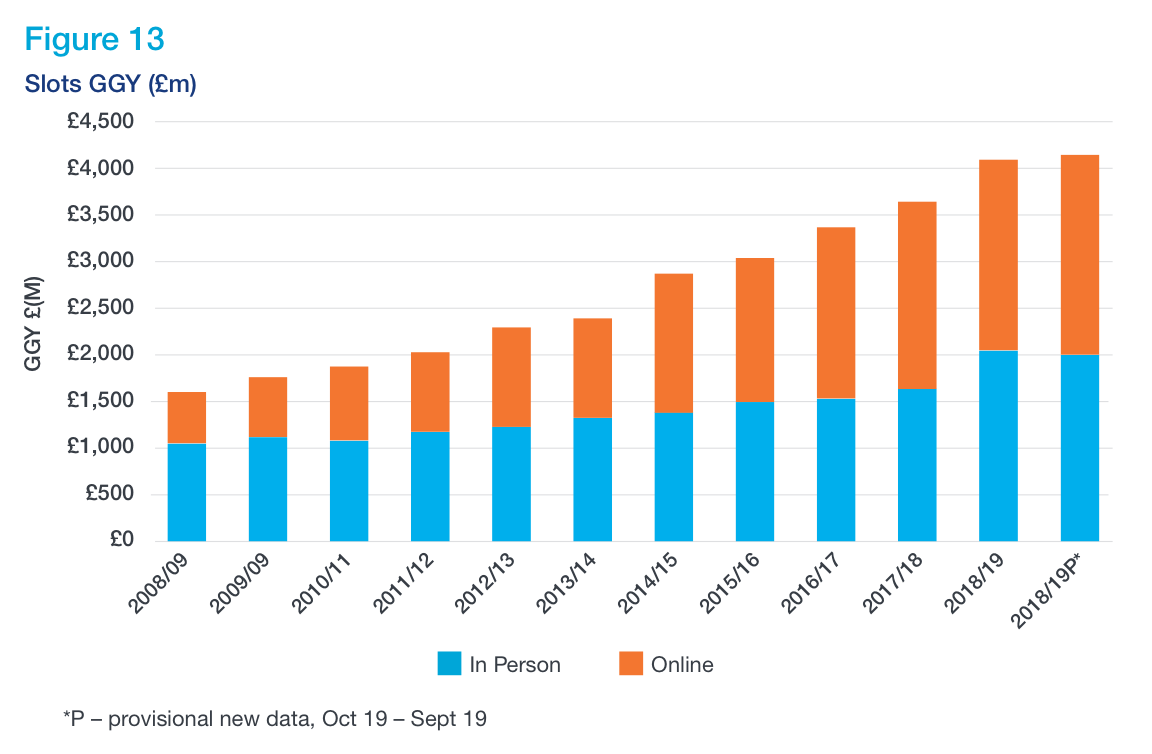

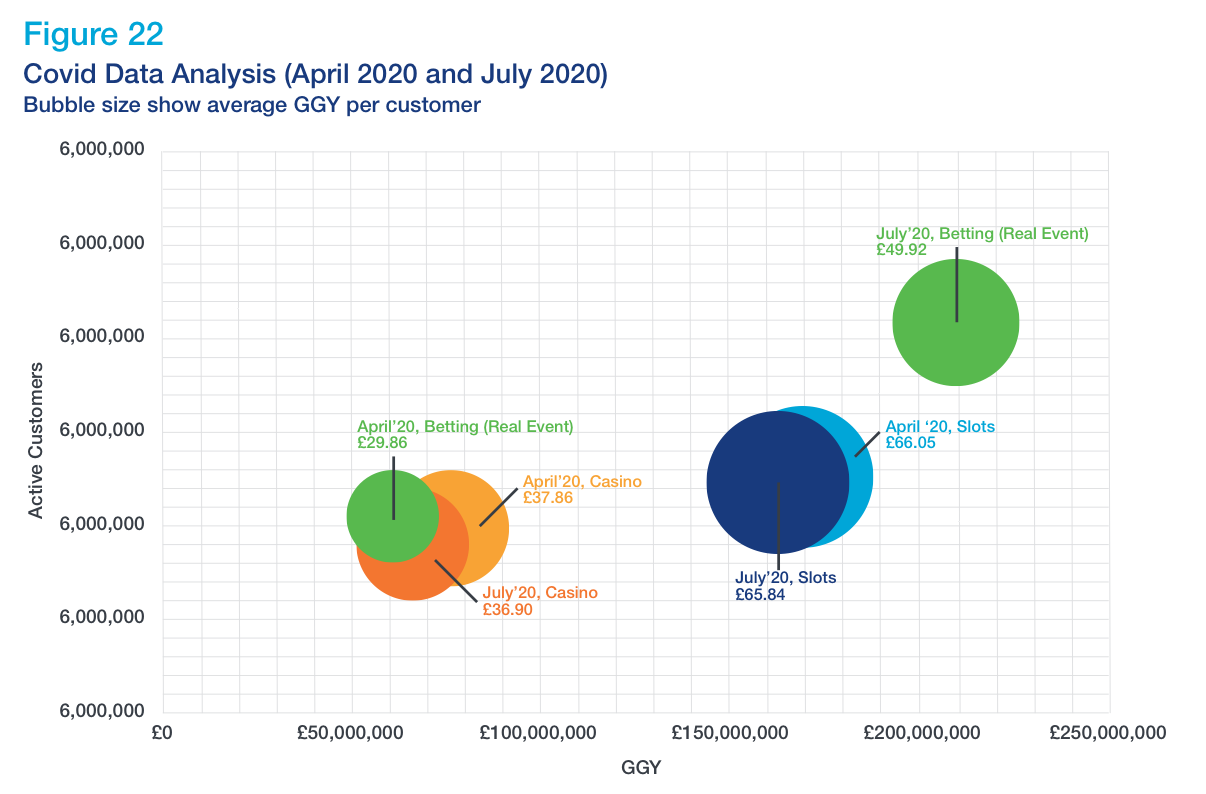

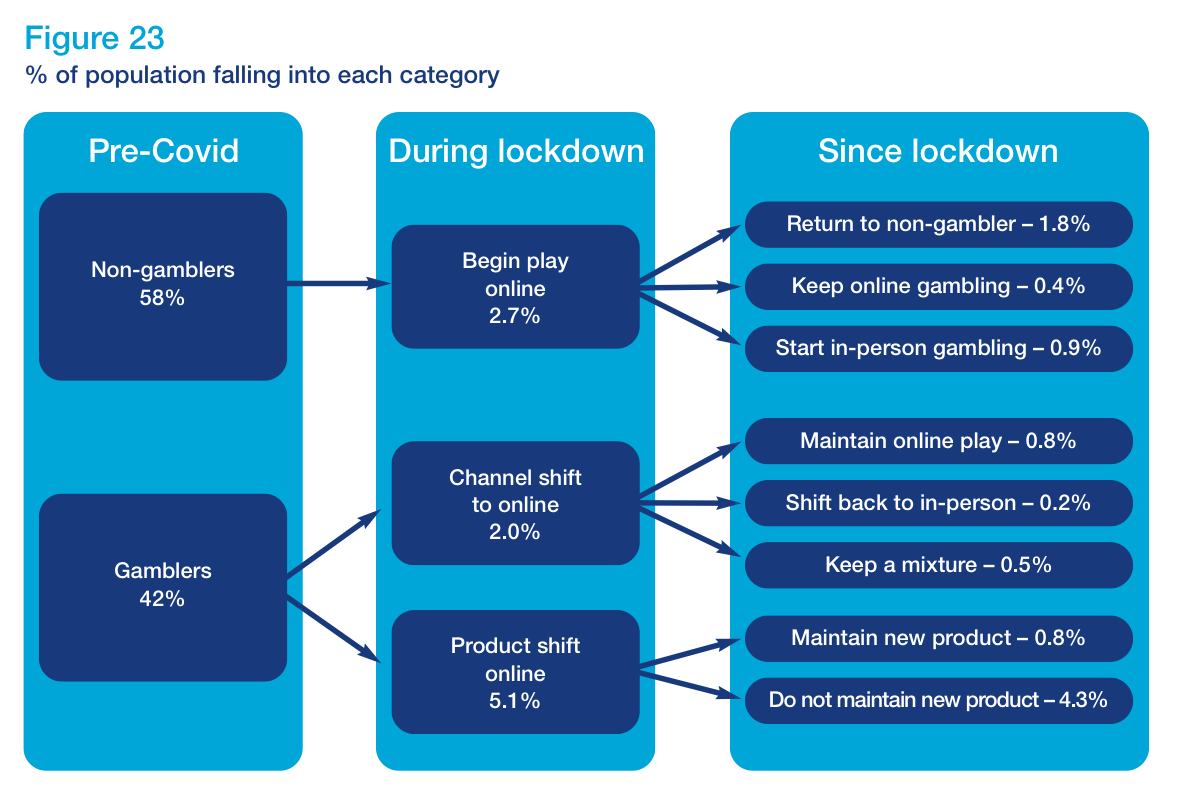

There has been an increase in the proportion of players who play slot games either online or in person. Online slots are the largest online gambling product by Gross Gambling Yield34 .

With an increasing proportion of players playing these higher risk products an area of focus is ensuring games are safer by design and consumers understand how they operate to enable them to make an informed choice.

The Gambling Commission knows that problem gambling rates associated with online slots, casino or bingo games are higher than the land-based equivalents. We have therefore focused on the drivers behind these products and how they can be made safer for consumers.

We also know the success of content creators and games designers depends on their ability to establish and maintain the engagement of their consumers. We know that this can be done by behavioural techniques which has the potential to unconsciously change consumer behaviour.

GC action

We will publish the findings of the randomised controlled trials with three large operators into anchoring and commitment devices.

There are many contributing factors the risks associated with a gambling product, including the speed and frequency of play, ease of access and scope to deposit and lose funds as a result of the design of games and the platforms they are made available from.

Gambling-related harm occurs at all levels of staking and across different gambling products. Rates of problem gambling across different gambling products should inform how licensees identify and mitigate the risks associated with their product range.

No single policy change can make gambling products safe. Addressing the risks associated with the products people play - such as stake limits or speed of play - should be considered alongside a package of complementary initiatives which impact each stage of a customer’s interaction with a given product. That is why our approach includes looking at affordability measures, better identification of vulnerability, earlier preventative action, safer game design, responsible marketing and advertising, and customer interaction.

To date, stake and prize limits have not been imposed on online gambling in Great Britain. They have been a longstanding feature of gaming machine regulation and are set by the Government. The majority of gaming machine play remains anonymous making personalised gambling management tools less effective.

Conversely, the potential for effective player- centric consumer protection that account- based play offers online licensees has not been sufficiently seized.

The following table provides a snapshot of the levels at which players staked when playing online slot games. It is important to note this data has been collected from licensees during the coronavirus (COVID-19) period where consumer behaviour has been impacted by factors including the closure of gambling premises. This analysis builds on an earlier snapshot of staking behaviour from January 201735.

| Online slots staking levels | April to August 2020 |

|---|---|

| £1 and below | 88% |

| £1.01 to £2 | 8% |

| £2.01 to £5 | 3% |

| £5.01 to £10 | 1% |

| £10.01 to £20 | 0.2% |

| £20.01 to £50 | 0.1% |

| £50.01 to £100 | 0.01% |

| >£100 | 0.004% |

Parity in consumer protection between online games and games played in premises would require the implementation of stake and prize-controls for online games and a requirement for account-based play on gaming machines.

To help inform consumers about how products operate there needs to be better communication of key gambling concepts to help consumers to understand their chances of winning. Research has found that consumers often struggle to understand ‘industry jargon’ and associated mathematical concepts and this is also apparent in customer complaint data36.

Research commissioned by Gamble Aware considered several options for better communicating concepts such as house edge, return to player and game volatility to players. But we have not seen licensee make sufficient progress in this key area to ensure gambling is as fair and open as possible.

GC action

To improve understanding of player experience of gambling products, we are actively engaged in several research programmes including the large scale GambleAware-funded project into online patterns of play being led by NatCen.

What are the issues - Online game and platform design

There has been an increase in the proportion of players who play slot games either online or in person. Online slots are the largest online gambling product by Gross Gambling Yield – played by relatively few but with a higher average spend. Structurally it has several features which can combine to significantly increase intensity of play.

This is an area of focus for us because the Health Survey for England 2018 (opens in new tab) records the problem gambling rate37 for online slots, casino or bingo games as 8.5%. For online betting with a bookmaker it is 3.7% and 10.7% for betting on a betting exchange.

Online gambling is, therefore, an area of relatively high risk. Our research into why consumers gamble indicates that 14% of participants had experienced a gambling ‘binge’, with 24% of those binging having done so on online slots. This finding ranks online slots as the gambling product with the highest binge rate amongst the respondents to this research.

This finding ranks online slots as the gambling product with the highest binge rate amongst the respondents to this research. We also know problem gambling and moderate-risk rates are higher for online slots as a product, but importantly that these rates increased for certain groups such as young adults, for whom the risk of gambling-related harm appears higher.

GC action

We will publish a response to our consultation on Safer Game Design.

The way a player can add funds, and how easy it is to do also plays a role in risk. Non-cash payment methods without suitable controls may facilitate increased spending and disrupt a player's cognition of the perceived impact on their finances. Such a risk is exacerbated by platform designs which discourage the cashing out of winnings or provide the opportunity to reverse withdrawal requests.

This risk is heightened by the conduct of some licensees who institute additional player checks at the point of withdrawal and not at deposit or prior to gambling.

Licensees cannot demand that customers submit information as a condition of withdrawing funds from their account, if they could have reasonably asked for that information earlier.

GC action

We will publish a response to our proposal to ban reverse withdrawals. Licensees were instructed in May 2020 to prevent further reverse withdrawals as an immediate player protection measure, whilst this issue was considered.

37Defined by classification as a problem gambler by either or both of the PGSI and DSM-IV screens

What are the issues - Higher risk products

The speed and frequency of the gambling opportunity within a game impacts the risk. Activities that permit high frequency participation are more likely to be associated with harm and more readily facilitate problematic behaviour, such as loss chasing.

This type of game may mean that some players experience greater feelings of 'punishment' (as opposed to reward), which can cause persistent play as the player tries to get away from that uncomfortable feeling. In practice, though, there is likely to be a limit to how slow a gaming opportunity can be made before a customer seeks alternative forms of stimulation.

Higher risk products typically provide players with the opportunity for fast-paced, repetitive and chance-based games which are available 24 hours a day.

Problem gamblers tend to be more motivated to gamble because of the need to relax or escape or modify their mood, and evidence suggests that faster, more continuous or repetitive games best accommodate that need.

Activities with high event frequency are likely to be the most attractive. As a result, online slots, casino and bingo are higher risk. We are focusing on products that behave like this, and the measures that can be put in place to make these products safer.

Case study

A Commission investigation found that 6 licensees were offering products providing ‘feature buy-in’ facilities on slots style games. This facility gave consumers the option of staking significant amounts of money to access the bonus feature without playing the initial stages of the game. One game was charging more than £3,000 to enter the bonus feature.

The option of purchasing a feature in a slot game raised huge concerns linked to social responsibility.

After considering Remote Technical Standards section 3A and 14A, the 6 Licensees were instructed to remove these products. This included withdrawing the identified games in their current form and any games with similar game features and functionality. Further licensees were contacted and instructed to remove games with the option to buy a feature.

The Commission’s remote gambling and software technical standards contain the following requirements:

- RTS requirement 3A: An explanation of the applicable rules must be easily available to the customer before they commit to gamble

- the content including artwork and text must be accurate, and sufficient to explain all of the applicable rules and how to participate. All reasonable steps must be taken to ensure that the content is understandable

- RTS requirement 14A: Gambling products must not actively encourage customers to chase their losses, increase their stake or increase the amount they have decided to gamble, or continue to gamble after they have indicated that they wish to stop.

The focus when discussing higher risk products is often on gaming products. However, product characteristics which traditionally acted as a natural brake on the intensity of sports betting have been eroded with the growth in in-play betting.

In-play betting allows for rapid, repeat activities, which are risk factors for problem gambling, and blur the distinction between online gaming and online betting38.

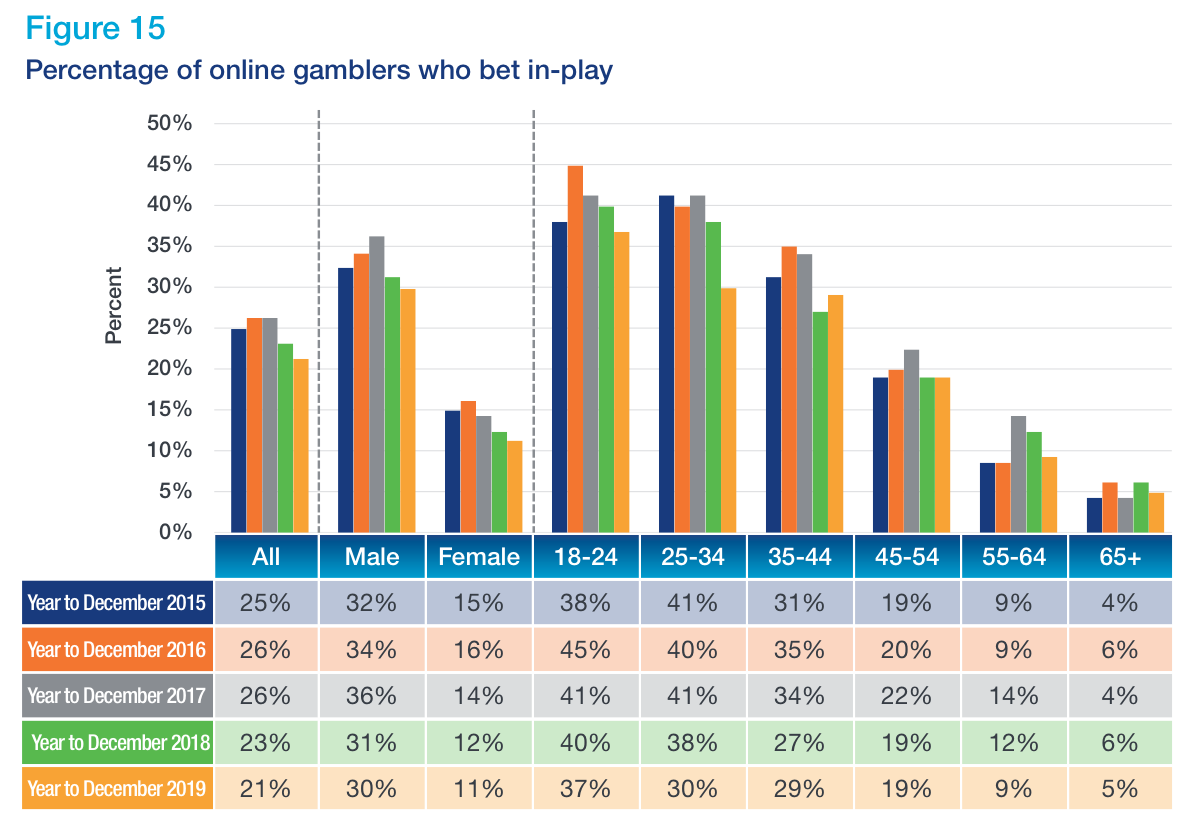

Figure 15 shows the proportion of online gamblers who bet in play. Since 2015 the proportion who do so appears to have declined from one-quarter to just over one-fifth, with the main decreases being seen in the 25-34 age groups and in females39.

Percentage of online gamblers who bet in-play

| Year | All | Male | Female | 18-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ |

|---|---|---|---|---|---|---|---|---|---|

| Year to December 2015 | 25% | 32% | 15% | 38% | 41% | 31% | 19% | 9% | 4% |

| Year to December 2016 | 26% | 34% | 16% | 45% | 40% | 35% | 20% | 9% | 6% |

| Year to December 2017 | 26% | 36% | 14% | 41% | 41% | 34% | 22% | 14% | 4% |

| Year to December 2018 | 23% | 31% | 12% | 40% | 38% | 27% | 19% | 12% | 6% |

| Year to December 2019 | 21% | 30% | 11% | 37% | 30% | 29% | 19% | 9% | 5% |

Our data shows the importance of in-play GGY to licensees, with in-play betting generating over one-half of GGY for sports where consumers can bet in play.

In-play has successfully utilised the increase in use of mobile for online gambling particularly in terms of removing friction and the constraints of pre-event betting only.

Figure 16 compares the proportion of online gamblers who bet in-play (shown on the left hand side of the infographic), currently at 21% and contrasts this figure with the proportion of relevant sports betting GGY which is derived through in-play (54%) – shown on the right hand infographic.

This illustrates the commercial importance of in-play betting to operators where a relatively small portion of online gamblers accounts for a large portion of betting GGY.

Given the risk factors associated with in-play betting, it is important that licensees ensure appropriate consumer protections are put in place. That includes controls to prevent excessive gambling, and to ensure responsible advertising and promotion of these products.

It is also important that clear player information is available on how in-play markets operate including ‘cash-out’ features and accompanying risks associated with delayed video streams or data provided to the player.

38 Killick, E. A., & Griffiths, M. D. (2018). In-play sports betting: A scoping study https://www.researchgate.net/publication/324550767_In-Play_Sports_Betting_a_Scoping_Study (opens in new tab)

39 Gambling participation in 2019: behaviour, awareness and attitudes Annual report (PDF) via online tracker

Product innovation - Betting Exchanges, Pool betting and Crossover products

Innovation in product design with a clear focus on the licensing objectives, helps an industry embrace new technologies and adapt to societal changes to the benefit of consumers. Some product innovation has not given due consideration to the possible impact on the licensing objectives.

Betting Exchanges pose different risks due to their peer to peer nature. This year has seen increased regulatory activity related to betting exchanges, an area of growing complexity as operators expand the breadth of markets available and the jurisdictions from which they draw their customers. This creates inherent challenges of matching customers who may be operating under different regulatory requirements.

There is no ambiguity in respect of the standards we expect to be applied to any bet struck under an operating licence issued by the Commission. Licensees must comply fully with requirements of the Gambling Act and the Licence Conditions and Codes of Practice including Social Responsibility and Anti Money Laundering (AML) provisions.

Operators of betting exchanges must apply critical risk-based thinking in advance to address these challenges – assuming something good enough for one regulator will be acceptable to another is flawed and is not likely to withstand scrutiny where there is reason to believe inferior standards are being applied instead of British requirements.

Efforts to reinvigorate pool betting products with notional co-mingling have also combined with the increasingly globalised gambling market. Whilst product innovation can benefit consumers, licensees need to ensure that products are licensed and operate transparently, and our standards of consumer protection are reflected in any international commercial arrangements.

Another area of product innovation that we continue to scrutinise are new business models which risk blurring the lines between betting regulated by us, and spread-betting or other instruments regulated by the FCA.

GC action

We will continue to:

- engage with DCMS to provide advice on the resources required to regulate effectively.

- understand new technologies.

- improve our understanding of new products, delivery mechanisms and payment methods.

What are the issues - Gaming machines in premises

Whilst a lot of our focus relates to the shift of consumers toward online gambling and gambling on mobile phones, we remain mindful that playing gaming machines in premises also presents issues and risks.

There are 185,203 gaming machines in Great Britain according to the most recent industry statistics40. Gaming machines are subject to categorisation which determines their maximum stake, prize, speed of play and location41. The Gambling Commission sets the speed of play on gaming machines via technical standards.

The Health Survey for England 2018 records the problem gambling rate for those playing gaming machines in bookmakers at 12.7% and for slot machines at 5.1%, with the moderate risk rate being 14.5% and 9% respectively. This is in addition to low-risk rates of 21.8% for machines in bookmakers and 15.8% for slot machines.

The gaming machine market has had two significant recent interventions. Firstly, the reduction in the maximum stake for B2 gaming machines from £100 to £2 was implemented in April 2019. Subsequently licensed premises providing access to gaming machines were closed due to the coronavirus (COVID-19) outbreak and since reopening have been subject to restrictions. The impacts of these two interventions are still being assessed.

The stake cut to £2 has prompted the withdrawal of B2 gaming machines from the market. It is important that the risks posed by other categories of gaming machines are not overlooked. Remaining category B and C gaming machines share several risk factors considered concerns in relation to category B2 machines and have some additional environmental factors such as the availability of some machines in alcohol licensed premises.

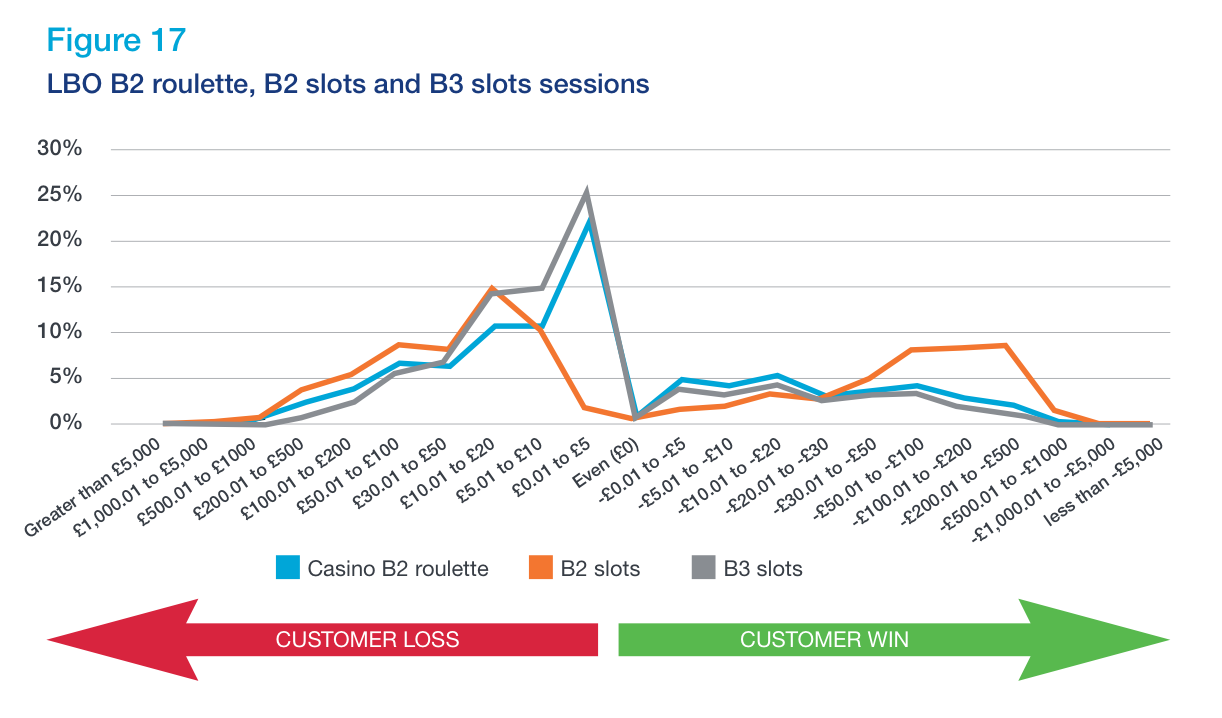

Risks in relation to gaming machines include their location and accessibility, anonymous and untracked play, intensity of play (based on stake, speed of play and return to player) and the effectiveness of oversight and intervention by licensees. Figure 13 illustrates the distribution of session outcomes across different category B2 content and B3 slots prior to the B2 stake cut.

Additional analysis undertaken on category B3 patterns of play since the B2 stake cut has identified a relatively strong correlation between sessions lasting for longer than 60 minutes and sessions ending in a sizeable loss. For example:

- 33% of all sessions losing more than £200 last longer than 60 minutes

- 69% of all sessions losing more than £500 last longer than 60 minutes

- 96% of all sessions losing more than £1,000 last longer than 60 minutes.

This analysis indicates that length of session (i.e. more than 60 minutes) is an important potential proxy for sizeable loss in the absence of real-time spend data.