Strategy

National Strategic Assessment 2020

This report sets out our latest assessment of the issues we face and the risks that gambling poses to consumers and the public

What we learnt in phase one

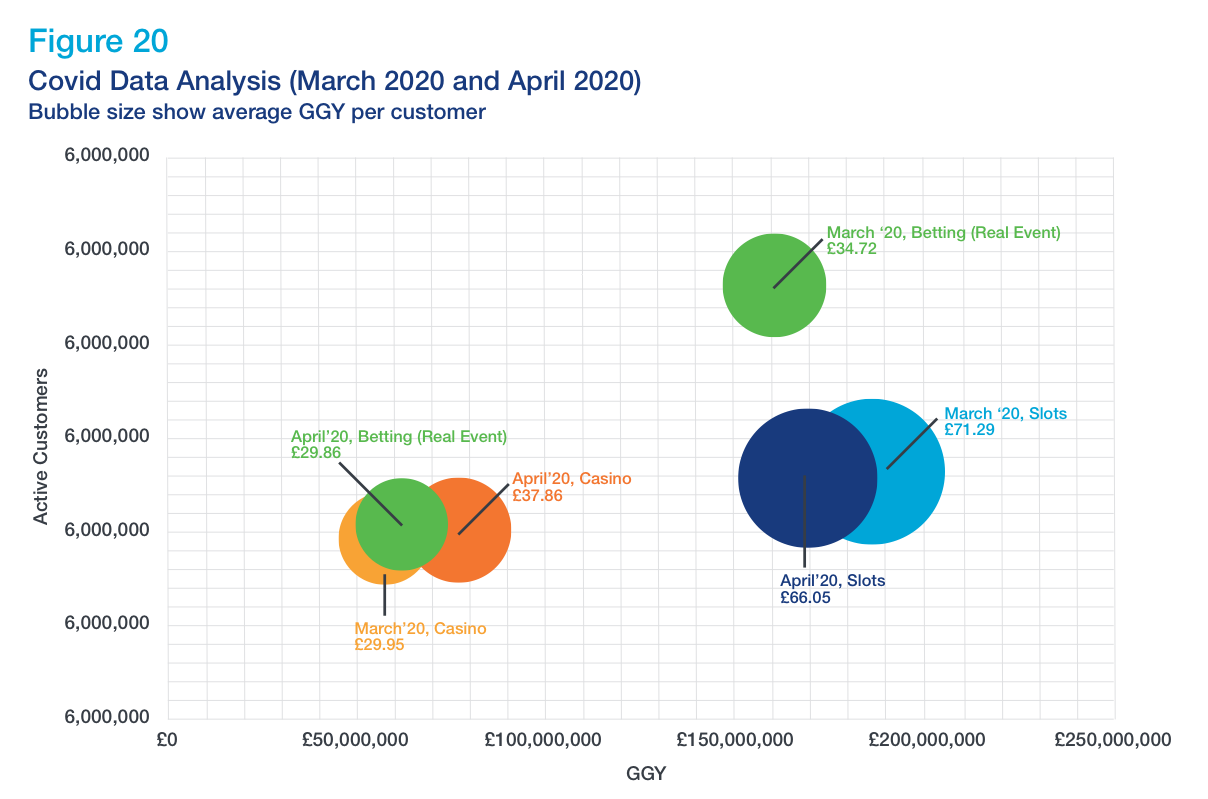

Retail premises closed on 20 March and online the overall number of active players decreased by 5% between March and April.

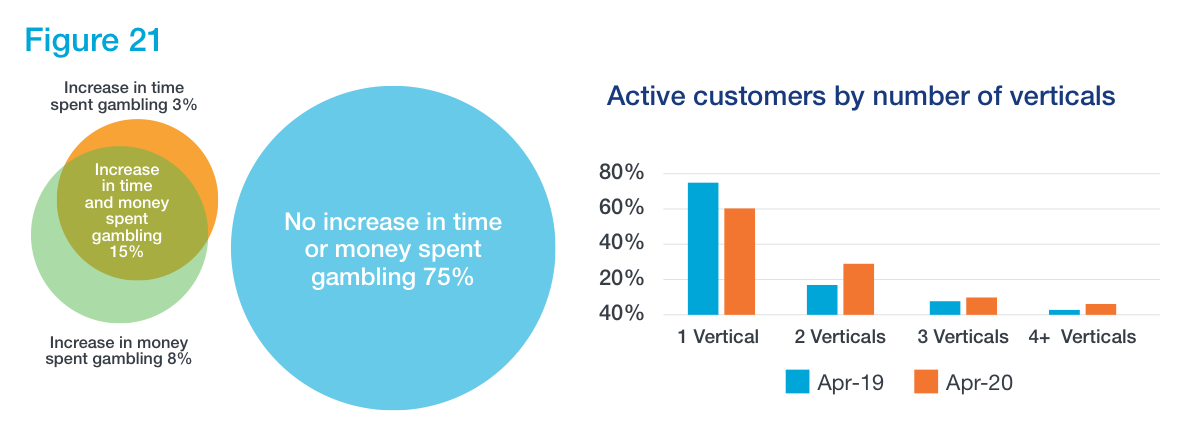

0.2% of adults surveyed stated they had started gambling for the first time during the previous four weeks, compared with 2% who had stopped gambling altogether46.

Some existing gamblers participated in new products. YouGov research showed that around three in ten (31%) past-four-week gamblers said that they had tried one or more gambling activities for the first-time during lockdown47.

This figure increased to almost half (48%) of engaged gamblers participating in three or more activities. This was relevant to products such as online slots which are not dependent on the outcome of real events and importantly have features which can be associated with higher intensity of play and therefore can pose heightened risk to players.

For example, the number of bets placed on slot games saw a 18% increase between March and May 2020, with the number of casino bets increasing by 22% during the same period. GGY for slots during May was just below the peak figure for March but was still comfortably bigger than the figure for April. The number of bets on slots games per customer increased by 27% between March and May.

Although most did not, certain groups were more likely to increase their gambling during lockdown:

- younger people

- already engaged gamblers (3+ products)

- with a high crossover in this group between additional time and money spent.

Engagement was noticeably higher in April 2020 than the previous year. Particularly high engagement can correlate with higher risk.

References

46YouGov Covid-19 tracker from 16-17 April

47In the first wave (16-17 April) the last four weeks could include a short period pre-lockdown, but we do not think this point impacts the finding significantly. For clarity this also includes NL products. By the engaged here we mean those who have participated in three or more gambling activities in the last four weeks (n=248).

Tackling impact of coronavirus (COVID-19) Next section

Our assessment of the risks and issues during phase 1

Last updated: 25 July 2024

Show updates to this content

Formatting issues corrected only.