Guidance

The prevention of money laundering and combating the financing of terrorism

Gambling Commission guidance for remote and non-remote casinos: Fifth edition (Revision 5).

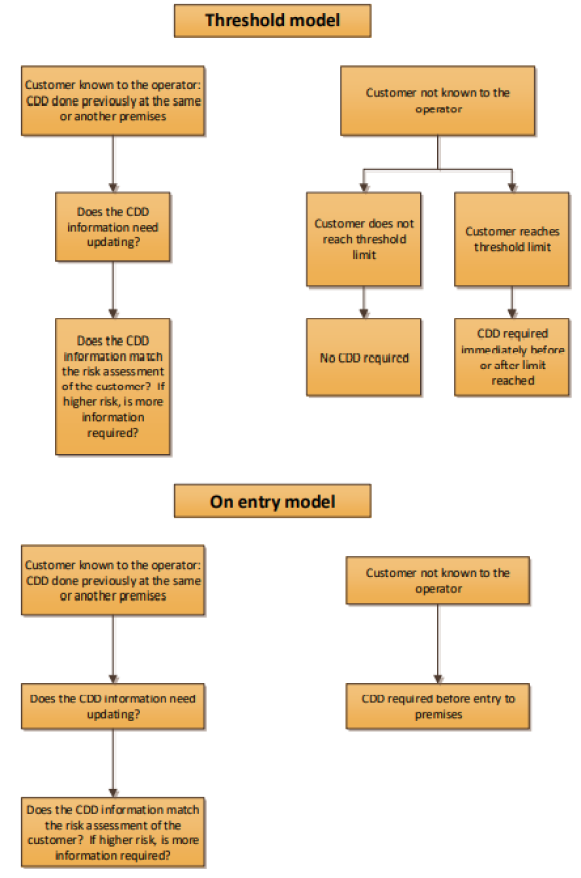

Figure 4 - Customer due diligence

Notes:

- Operator to be reasonably satisfied that the customer is who they claim to be.

- The requirement applies to an operator, not to each premises.

- Identification: Name, plus residential address or date of birth.

- Verification: Documents or electronically.

- Records of CDD to be kept for five years from the end of the business relationship or last visit to the premises run by the operator.

The risk framework and risk-based customer due diligence Next section

Determining when the threshold is reached (non-remote casinos) – tokens and gaming machines

Last updated: 30 May 2023

Show updates to this content

Updated in line with version 3 of the guidance. References to 'proliferation financing' added.