- Print the full document

- Save the page as a HTML document to your device

- Save the page as a PDF file

- Bookmark it - it will always be the latest version of this document

This box is not visible in the printed version.

The prevention of money laundering and combating the financing of terrorism

Gambling Commission guidance for remote and non-remote casinos: Fifth edition (Revision 5).

Published: 13 November 2020

Last updated: 22 October 2025

This version was printed or saved on: 15 February 2026

Online version: https://www.gamblingcommission.gov.uk/guidance/the-prevention-of-money-laundering-and-combating-the-financing-of-terrorism

Introduction

1 Introduction

The law concerning money laundering is based on the general and wide-ranging prevention and detection of the use of any proceeds of crime, and the prevention and detection of terrorist financing and proliferation financing. For some businesses (including casinos) this includes the more specific requirements of the business and its employees to have policies, procedures and controls in place covering the risks they face from money laundering and terrorist financing.

Using money in casinos, regardless of the amount, that is the proceeds of any crime can amount to money laundering if the person using or taking the money knows or suspects that it is the proceeds of crime. Money laundering offences can be committed by both the customer and casino employees, depending on their respective levels of knowledge or suspicion.

What is meant by the proceeds of crime and money laundering?

Broadly, the terms 'proceeds of crime' or 'criminal proceeds' refers to all property from which a person benefits directly or indirectly, by being party to criminal conduct, for example, money from drug dealing or stolen in a burglary or robbery (this is commonly referred to as criminal property). It also includes property that a person gains by spending the proceeds of criminal conduct (for example, if a person uses money earned from drug dealing to buy a car or a house, or spends money gained in a bank robbery to gamble).

Money laundering is a term that is often misunderstood. It is defined in section 340 of the Proceeds of Crime Act 2002 (POCA)1 and covers wide ranging circumstances involving any activity concerning the proceeds of any crime. By way of example, this may include:

- trying to turn money raised through criminal activity into 'clean' money (that is, classic money laundering)

- possessing or transferring the benefit of acquisitive crimes such as theft and fraud, and funds generated from crimes like tax evasion (this includes the possession by an offender of the proceeds of their own criminal activity)

- possessing or transferring stolen goods

- being directly involved with any criminal or terrorist property, or entering into arrangements to facilitate the laundering of criminal or terrorist property

- criminals investing the proceeds of their crimes in the whole range of financial products.

Typically, classic money laundering consists of a number of stages:

- placement

- layering

- integration.

Placement is the first stage in the money laundering cycle. The laundering of criminal proceeds is often required because of the cash-intensive nature of the underlying crime (for example, drug dealing where payments are in cash, often in small denominations). The monies are placed into the financial system or retail market or are smuggled to another country. The aim of the money launderer is to avoid detection by the authorities and to then transform the criminal proceeds into other assets.

Layering is the next stage and is an attempt to conceal or disguise the source and ownership of the criminal proceeds by creating complex layers of financial transactions which obscure the audit trail and provide anonymity. The purpose of layering is to disassociate the criminal proceeds from the criminal activity which generated them.

Typically, layers are created by moving monies in and out of various accounts and using electronic fund transfers.

Integration is the final stage in the process. It involves integrating the criminal proceeds into the legitimate economic and financial system and assimilating it with other assets in the system. Integration of the 'clean' money into the economy is accomplished by the money launderer making it appear to have been legally earned or obtained.

There is potential for the money launderer to use gambling at every stage of the process. The land-based gambling industry is particularly vulnerable during the placement stage as the use of cash is prevalent. Although the remote gambling industry might appear less vulnerable as electronic transfers are required for placements, identity theft and identity fraud can enable the money launderer to move criminal proceeds with anonymity. Furthermore, the use of multiple internet transactions can also facilitate the layering stage of money laundering.

Casino operators should be mindful that the offence of money laundering also includes simple criminal spend (the use of criminal proceeds to fund gambling as a leisure activity or to fund a gambling addiction) and may not include all the typical stages of the laundering process (if any at all).

1 Proceeds of Crime Act 2002 (POCA) (opens in new tab)

2 Legal background

The Financial Action Task Force (FATF) Recommendations

The Financial Action Task Force (FATF) is the inter-governmental body responsible for setting the international standards for anti-money laundering (AML), countering terrorist financing (CTF) and proliferation financing (PF). They issue recommendations which member countries should implement in order to combat money laundering and terrorist financing. These recommendations are implemented by over 200 countries.

The FATF Recommendations2 set out the essential measures that countries should have in place to:

- identify the risks, develop policies and provide domestic coordination

- pursue money laundering, terrorist financing and the financing of proliferation

- apply preventative measures for the financial and other designated sectors

- establish powers and responsibilities for competent authorities and implement other institutional measures

- enhance the transparency and availability of beneficial ownership information of legal persons and arrangements

- facilitate international cooperation.

The Proceeds of Crime Act (POCA)

Criminal offences of money laundering were first introduced in the United Kingdom in the Criminal Justice Act 1988 (opens in new tab) and the Drug Trafficking Offences Act 1986 (opens in new tab). POCA consolidated, updated and reformed the criminal law relating to money laundering to include any dealing in 'criminal property', which is defined widely as the proceeds of any type of crime, however small the amount.

POCA establishes several money laundering offences including:

- the principal money laundering offences

- offences of failing to report suspected money laundering

- offences of tipping off about a money laundering disclosure, tipping off about a money laundering investigation and prejudicing money laundering investigations.

The principal offences criminalise any involvement in the proceeds of any crime if the person knows or suspects that the property is criminal property.3 These offences relate to the concealing, disguising, converting, transferring, acquisition, use and possession of criminal property, as well as an arrangement which facilitates the acquisition, retention, use or control of criminal property.

Section 327 of POCA provides that a person commits an offence if the person:

- conceals criminal property (for example, by depositing funds obtained through criminal activity into a gambling account)

- disguises criminal property (for example, by placing funds obtained through criminal activity into a gambling account and then withdrawing them later)

- converts criminal property (for example, by placing bets in a gambling establishment and then cashing in the winnings)

- transfers criminal property (for example, by transferring property to another person or to a casino operator)

- removes criminal property from the UK (for example, by taking their winnings overseas).

Concealing or disguising property includes concealing or disguising its:

- nature

- source

- location

- disposition

- movement or ownership

- or any rights with respect to it.

Whilst 'converting' criminal property is not defined in POCA, it is suggested that this be given its conventional legal meaning, that is that the 'converter' has dealt with the property in a manner inconsistent with the rights of the true owner of the property. For example, a criminal steals cash in a bank robbery and then uses that cash to open a gambling account and gamble.

Section 328 of POCA (opens in new tab), provides that a person commits an offence if they enter into or become concerned in an arrangement which they know or suspect facilitates, by whatever means, the acquisition, retention, use or control of criminal property by or on behalf of another person.

Example

An example of this in the gambling industry would be for a casino operator knowingly to accept stakes that are the proceeds of criminal activity.

Section 329(1) of POCA provides that a person commits an offence if the person:

- acquires criminal property

- uses criminal property

- has possession of criminal property (for example, via stakes).

Acquisition, use and possession under section 329(1) (opens in new tab) includes, for example, when a person carries, holds or looks after criminal property or acquires criminal property for 'inadequate consideration'. This means when a person buys or exchanges something which is significantly below market value (inadequate consideration). However, a person does not commit such an offence if they acquired or used or had possession of the property for adequate consideration.4

The principal money laundering offences are wide and can be committed by any person. For example, a casino employee who has knowledge or suspicion that a customer is using the proceeds of crime, or has possession of the proceeds of criminal activity.

The offence of money laundering and the duty to report under POCA apply in relation to the proceeds of any criminal activity, wherever conducted, including abroad, that would constitute an offence if it took place in the UK. However, a person does not commit an offence of money laundering where it is known or believed, on reasonable grounds, that the relevant criminal conduct occurred outside the United Kingdom and the relevant conduct was not criminal in the country where it took place and is not of a description prescribed by an order made by the Secretary of State.5

The money laundering offences assume that a criminal offence has occurred in order to generate the criminal property which is now being laundered. This is often known as a predicate offence. No conviction for the predicate offence is necessary for a person to be prosecuted for a money laundering offence.6

In addition, POCA contains provisions for the recovery of the proceeds of crime and forfeiture can be granted, regardless of whether a conviction for any offence has been obtained or is intended to be obtained. Under certain circumstances, criminal property can be recoverable even if it is disposed of to another person.8

The Terrorism Act

The Terrorism Act 2000 (the Terrorism Act) (opens in new tab) establishes several offences about engaging in or facilitating terrorism, as well as raising or possessing funds for terrorist purposes. It establishes a list of proscribed organisations that are believed to be involved in terrorism. In December 2007, tipping off offences and defences to the principal terrorist property offences were introduced.9

The Terrorism Act applies to all persons and includes obligations to report suspected terrorist financing. The offences of failing to disclose and tipping off are specific to people working in firms covered by the Money Laundering Regulations (the Regulations), and who are therefore in the regulated sector, which includes casinos.

The Money Laundering Regulations

The Regulations10 represent the UK's response to the FATF Recommendations and implement the law in the UK on this topic. They set requirements for the AML and CTF regime within the regulated sector, which includes casinos.

The Regulations apply to non-remote and remote casinos (including remote casino host operators), licensed by the Commission, who act in the course of business carried on by them in the UK.

This includes remote casinos which either:

- have at least one piece of remote gambling equipment situated in Great Britain

- do not have remote gambling equipment situated in Great Britain, but the gambling facilities provided by remote casino are used in Great Britain.11

The Regulations impose additional requirements on the regulated sector

These include:

- risk assessments and requirements in respect of written policies procedures and controls

- internal controls

- customer due diligence (CDD)

- record keeping

- training.

This guidance sets out how casino operators must and can comply with the law governing money laundering, terrorist financing and proliferation financing. The law places responsibilities on the Commission as the supervisory authority for casinos. The Commission should produce guidance that helps casino operators to meet the requirements of the law, is workable in the remote and non-remote casino environments and is approved by HM Treasury. This guidance, therefore, covers the full requirements of the UK law as it affects casinos.

2 The latest recommendations are available here (opens in new tab)

3 Sections 327 (opens in new tab),

328 (opens in new tab) and

329 (opens in new tab) of the Proceeds of Crime Act.

4 Section 329(2)(c) of POCA (opens in new tab).

5 Sections 327(2A) (opens in new tab),

328(3) (opens in new tab) and

329(2A) (opens in new tab) of POCA.

6 Note that, following the decision in relation to R v Anwoir (2008) 2 Cr. App. R. 36, the Prosecution does not need to prove a specific criminal offence, but can instead show that it derived from conduct of a specific kind or kinds and that conduct of that kind or those kinds was unlawful, and by evidence of the circumstances in which the property had been handled, which were such as to give rise to the irresistible inference that it could only have been derived from crime.

7 Section 334 (opens in new tab) of POCA.

8 Section 304 (opens in new tab) of POCA.

9 Introduced by the Terrorism Act 2000 and Proceeds of Crime Act 2002 (Amendment) Regulations 2007.

10 The current regulations (The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017) came into effect on 26 June 2017 and implemented the 4th EU Anti-Money Laundering Directive. Amending Regulations implementing the 5th EU Anti-Money Laundering Directive were promulgated in January 2020. The United Kingdom’s exit from the European Union has does not have a substantive impact on the Regulations.

11 Regulations 8 and 9.

3 The role of gambling operators

Operators have a responsibility to uphold the 3 licensing objectives set out in the Gambling Act 2005 (the Act) (opens in new tab). The first of those licensing objectives is to prevent gambling from being a source of crime or disorder, being associated with crime or disorder or being used to support crime.

As described previously, money laundering in the gambling sector takes 2 main forms:

- Exchanging money, assets, goods and property that were acquired criminally for money or assets that appear to be legitimate or 'clean' (so called classic money laundering). This is frequently achieved by transferring or passing the funds through some form of legitimate business transaction or structure.

- The use of criminal proceeds to fund gambling as a leisure activity (so called criminal or 'lifestyle' spend).

In order to avoid committing offences under POCA, operators should report instances of known or suspected money laundering or terrorist financing by customers to the National Crime Agency (opens in new tab) (the NCA) and, where a defence (appropriate consent) is requested, wait for such defence (consent) to deal with a transaction or an arrangement involving the customer, or wait until a set period has elapsed before proceeding.

Operators should be aware that there is no minimum financial threshold for the management and reporting of known or suspected money laundering or terrorist financing activity.

4 The role of the Gambling Commission

The Commission requires operators to prevent gambling being a source of crime or disorder, being associated with crime or disorder or being used to support crime. This guidance document is an important frame of reference to help casino operators meet that objective.

Whilst potential breaches of POCA and the Terrorism Act (opens in new tab) will normally be reported to the NCA and fall to the police to investigate, the Commission, in its role as the gambling regulator, seeks assurance that risks to the licensing objectives posed by money laundering activity and terrorist financing are effectively managed, and this guidance will assist casino operators to meet their obligations under POCA, the Regulations and the Terrorism Act (opens in new tab), where appropriate.

Supervisory authority

Under the Regulations,12 the Commission is designated as the supervisory authority for casinos.

The Regulations13 stipulate that a supervisory authority must:

- effectively monitor the relevant persons for which it is the supervisory authority and take necessary measures for the purpose of securing compliance by such persons with the requirements of the Regulations

- adopt a risk-based approach to the exercise of its supervisory functions, having identified and assessed the risks of money laundering and terrorist financing to which the relevant persons for which it is the supervisory authority are subject

- ensure that its employees and officers have access to relevant information on the risks of money laundering and terrorist financing which affect its sector

- base the frequency and intensity of its on-site and off-site supervision on the risk profiles it has prepared

- keep a record in writing of the actions it has taken in the course of its supervision and of its reasons for deciding not to act in a particular case

- take effective measures to encourage its sector to report breaches of the provisions of the Regulations to it14

In accordance with its risk-based approach, the supervisory authority must take appropriate measures to review:

- the risk assessments carried out by relevant persons to identify and assess the risks of money laundering and terrorist financing to which the business is subject

- the adequacy of the policies, procedures and controls adopted by the relevant persons and the way that those policies, procedures and controls have been implemented.15

The Commission therefore adopts a risk-based approach to its role as supervisory authority. We focus our attention on circumstances where the processing of criminal funds or criminal spend indicates serious failures in an operator’s arrangements for the management of risk and compliance with POCA, the Regulations and the Terrorism Act (opens in new tab) or a breach of a licence condition, or makes a reasonably significant contribution to the financial performance of the business, particularly concerning their continued suitability to hold a licence.16

Where a casino operator fails to uphold the licensing objectives, for example by being ineffective in applying AML or CTF controls or ignoring their responsibilities under POCA, the Regulations and the Terrorism Act (opens in new tab), or breaches an applicable licence condition, the Commission will consider reviewing the operating licence under section 116 (opens in new tab) of the Act.

Certain activities carried out by casinos in respect of the services they offer to customers are categorised as money service business (MSB) activities. By cashing third-party cheques (those made payable to customers), acting as a currency exchange, and/or accepting or conducting third party money transfers (money transmission) casinos are subject to registration with, and supervision by, HM Revenue and Customs (HMRC). The exemptions that remove this requirement, where the MSB activities are occasional or very limited, do not apply to casinos because of the value of the transactions typically involved. However, in order to avoid dual regulation, and as provided by the Regulations17 there is an agreement between HMRC and the Commission that the Commission performs the supervisory role for the MSB activities in question. As part of this agreement (which is publicised on the Commission’s website), the Commission conducts an annual survey to ascertain which casino operators offer MSB activities, to what extent they are offered and what controls the operators have in place. Under the terms of the agreement with HMRC, the Commission provides the names of operators offering MSB activities to HMRC for inclusion on their MSB register. Casinos should also note that, in its capacities as a supervisory authority and a law enforcement authority, HMRC may use the UK AML regime to gather information for tax purposes.18

12 Regulation 7(1)(d).

13 Regulation 46(1) and (2).

14 This requirement is implemented through licence condition 15.2.3(1).

15 Regulation 46(4).

16 The public statements are available on the Gambling Commission website (opens in new tab).

17Regulation 7(2) and (3).

18Regulations 3 and 44 define HMRC as a law enforcement authority for the purposes of the Regulations. Regulation 52 allows supervisory authorities to disclose AML information to law enforcement authorities to fulfil the law enforcement authorities' functions, which, in the case of HMRC, includes collecting information for tax purposes. There are also obligations at regulations 21, 43-45, 49-50, 52, 63 and 64 in respect of law enforcement authorities, which broadly require relevant persons to respond to certain enquiries from law enforcement authorities and to provide information, and for law enforcement authorities and supervisors to cooperate and share information.

5 Purpose of the guidance

All gambling operators have a responsibility to keep financial crime out of gambling. POCA places an obligation on gambling operators to be alert to attempts by customers to gamble money acquired unlawfully, either to obtain legitimate or 'clean' money in return (and, in doing so, attempting to disguise the criminal source of the funds) or simply using criminal proceeds to fund gambling. Both modes of operation are described as money laundering.

The purpose of this guidance is to:

- outline the legal framework for AML and CTF requirements and systems across the remote and non-remote casino sector

- summarise the requirements of the relevant law and regulations, and how they may be implemented in practice

- indicate good industry practice in AML and CTF procedures through a proportionate risk-based approach

- assist casino operators to design and implement the policies, procedures and controls necessary to mitigate the risks of being used in connection with money laundering and the financing of terrorism.

This guidance sets out what is expected of casino operators and their employees in relation to the prevention of money laundering, terrorist financing and proliferation financing, but allows them some discretion as to how they apply the requirements of the AML or CTF regime in the particular circumstances of their business. It will be of direct relevance to senior management and nominated officers in remote and non-remote casinos.

While the guidance focuses primarily on the relationship between casino operators and their customers, and the money laundering risks presented by transactions with customers, operators should also give due consideration to the money laundering risks posed by their business-to-business relationships, including any third parties and white label partners19 they contract with.20

19 Licensees’ responsibilities for third parties.

20 Attention is drawn to risk assessment and code provision 1.1.2.

6 How should the guidance be used?

The purpose is to give guidance to those who set casino operators’ risk management policies, procedures and controls for preventing money laundering, terrorist financing and proliferation financing. The guidance aims to assist casino operators with detail about how to comply with the Regulations and the wider legal requirements, and is intended to allow operators flexibility as to how they comply. Casino operators will need to establish more detailed and more specific internal arrangements directed by senior management and nominated officers to reflect the risk profile of their business.

This guidance is not intended to be a substitute for legal advice and nothing in this document should be construed as such. Anyone requiring clarification on the legal issues contained in this document should seek their own independent legal advice. Neither is this document a substitute for casino operators’ individual risk management plans. Casino operators should refer to the Regulations and associated legislation in making decisions in relation to the Regulations.

The examples used throughout are for illustrative purposes only. The references to legislation and case law are accurate at the time of writing, but these may be subject to repeal or amendment.

7 Content of the guidance

In this guidance, the word 'must' denotes a legal obligation, while the word 'should' is a recommendation of good practice, and is the standard that the Commission expects casino operators to adopt and evidence. The Commission will expect casino operators to be able to explain the reasons for any departures from that standard.

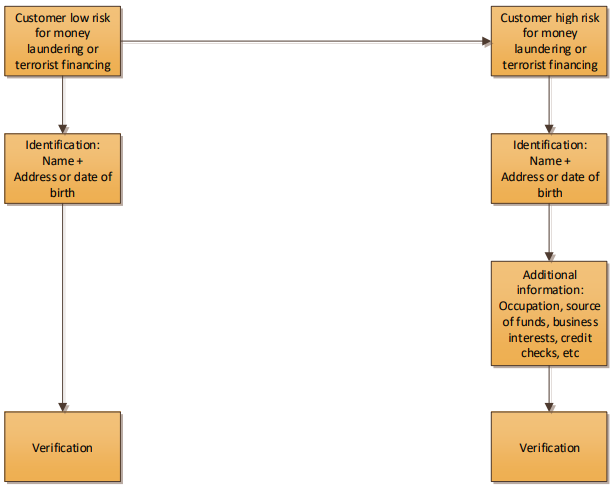

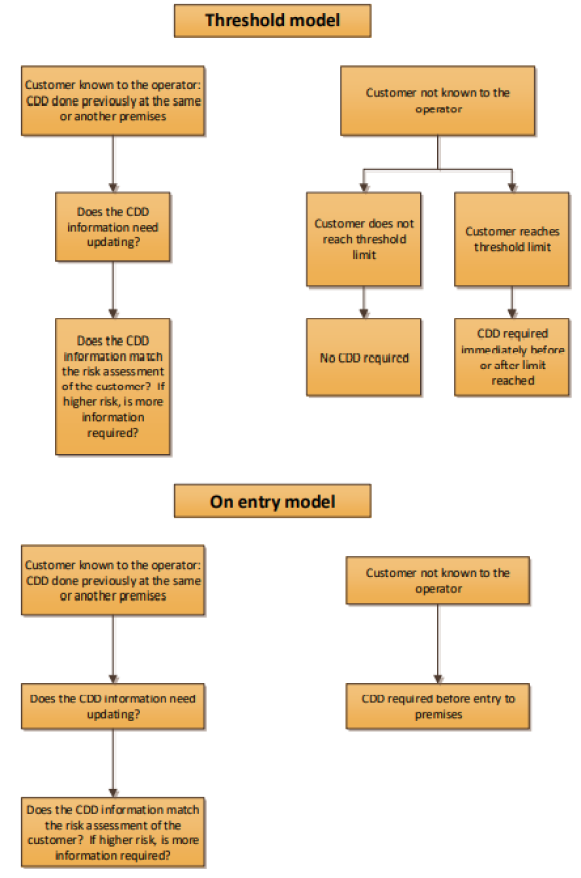

The guidance emphasises the responsibility of senior management to manage the casino operator’s money laundering, terrorist financing and proliferation financing risks, and how this should be carried out on a risk-based approach. It sets out a standard approach to the identification of customers and verification of their identities, separating out basic identity from other measures relating to customer due diligence (CDD), including the obligation to monitor customer activity.

It is accepted that a proportionate risk-based approach must meet a variety of scenarios and, as such, must be based on an understanding of how the business is designed to operate. There is, therefore, a need for ongoing and repeated assessments of risk to meet changing circumstances.

The guidance contains the following sections:

- the importance of adopting a risk-based approach

- the importance of senior management taking responsibility for effectively managing the money laundering, terrorist financing and proliferation financing risks faced by the casino operator’s businesses

- the role and responsibilities of the nominated officer

- the proper carrying out of the CDD obligations, including monitoring customer transactions and activity

- record keeping

- the identification and reporting of suspicious activity.

8 Status of the guidance

POCA requires a court to take account of industry guidance, such as this, that has been approved by a Treasury minister when considering whether a person within the regulated sector has committed the offence of failing to report. Similarly, the Terrorism Act (opens in new tab) requires a court to take account of such approved industry guidance when considering whether a person has failed to report under that Act21. The Regulations require that a court must consider whether someone has followed this guidance if they are prosecuted for failing to comply with the Regulations.22

Casino operators must be able to demonstrate that they have taken all reasonable steps to comply with all the AML requirements. If they can demonstrate to a either a court and/or the Commission that they have followed this guidance, then the court or the Commission is obliged to take that into account.

While the Commission is not a 'designated supervisory authority' under the Regulations23 an ordinary code provision24 within the licence conditions and codes of practice requires casino operators to act in accordance with this guidance.

The Commission and other agencies or authorities that have the appropriate authorisation under POCA in England and Wales25 can, in certain circumstances, apply for orders and warrants in relation to money laundering, for the purpose of, for example:

- requiring a specified person to produce certain material

- permitting the search of and seizure of material from specified premises

- requiring a financial institution to provide customer information relating to a specified person.

The guidance provides a sound basis for casino operators to meet their statutory and regulatory obligations when tailored by operators to their particular business risk profile. Departures from this guidance, and the grounds for doing so, should be documented and may have to be justified to, amongst others, the Commission.

21 Section 21(A)6 (opens in new tab) of the Terrorism Act.

22 Sections 330 (opens in new tab)

and 331 (opens in new tab)

of POCA, section 21(6) (opens in new tab) of the Terrorism Act and Regulation 86(2).

23 Regulation 76.

24 Ordinary code provision 2.1.1.

25 See The Proceeds of Crime Act 2002 (References to Financial Investigators) (England and Wales) Order 2015 (Statutory Instrument No. 2015/1853) (opens in new tab), as amended.

9 Licence conditions and codes of practice

Casino operators are required to comply with the applicable licence conditions and codes of practice26 and should read this guidance in conjunction with the conditions and codes. Should casino operators breach the licence conditions or not follow the code provisions, the Commission may consider reviewing the operating licence in accordance with section 116 (opens in new tab) of the Act. This could result in the suspension or revocation of the operator’s licence under sections 118 (opens in new tab) and 119 (opens in new tab) of the Act. The Commission may also consider imposing a financial penalty where we think that a licence condition has been breached, in accordance with section 121 (opens in new tab) of the Act.

Operators should take note of the following licence conditions and codes of practice

Licence condition 1.2.1

This requires:

- the person responsible for the licensee’s anti-money laundering and counter-terrorist financing function as head of that function to hold a personal management licence (PML)

- the person responsible for the submission of reports of known or suspected money laundering or terrorist financing activity under the Proceeds of Crime Act 2002 and Terrorism Act 2000 to hold a PML.

Licence condition 12.1.1

This requires operators to:

- conduct an assessment of the risks of their business being used for money laundering and terrorist financing27

- have appropriate policies, procedures and controls to prevent money laundering and terrorist financing28

- ensure that such policies, procedures and controls are implemented effectively, kept under review, revised appropriately to ensure that they remain effective, and take into account any applicable learning or guidelines published by the Gambling Commission from time to time.

Licence condition 12.1.2

This requires operators based in foreign jurisdictions to comply with Parts 2 and 3 of the Regulations.

Licence condition 15.2.1(4)(c)

This requires operators to report the appointment of a person to a position where the holder of which has overall responsibility for the licensee’s AML or CTF compliance and/or for the reporting of known or suspected money laundering or terrorist financing activity.

Licence condition 15.2.2(1d)

This requires operators to report any actual or potential breaches by the licensee of the requirements imposed by or under Parts 7 (opens in new tab) or Part 8 (opens in new tab) of the Proceeds of Crime Act 2002, or Part 3 (opens in new tab) of the Terrorism Act (opens in new tab).

Licence condition 15.2.3

This requires operators to report:

- any actual or potential breaches by the licensee of the provisions of the Regulations

- the appointment, replacement, departure or removal of the officer responsible for the licensee’s compliance with the Regulations or the nominated officer.

Ordinary code provision 2.1.1

This requires operators to take into account the Commission’s guidance on anti-money laundering.

26 Read the Licence conditions and codes of practice.<

27 This must be done in writing, see what casino operators must do for identifying and addressing risks.

28 This must be done in writing, see what casino operators must maintain a record in writing of.

Risk-based approach

1 Introduction

The Regulations impose compulsory requirements and a breach can constitute a criminal offence29. However, within this legal framework of requirements, casinos have flexibility to devise policies, procedures and controls which best suit their assessment of the money laundering, terrorist financing and proliferation financing risks faced by their business. The Regulations require the identification and assessment of money laundering, terrorist financing and proliferation financing risks, and the establishment and maintenance of proportionate policies, procedures and controls to mitigate and manage effectively the risks identified.30

Operators are already expected to manage their operations with regard to the risks posed to the licensing objectives in the Act, and measure the effectiveness of the policies, procedures and controls they have put in place to manage the risks to the licensing objectives. The approach to managing the risks of the operator being used for money laundering, terrorist financing or proliferation financing is consistent with the regulatory requirements.

Most operators manage their commercial or business risks and measure the effectiveness of the policies, procedures and controls they have put in place to manage those risks. A similar approach is appropriate to managing the operator’s regulatory risks, including money laundering, terrorist financing and proliferation financing risks. Existing risk management systems should, therefore, address the regulatory and money laundering and terrorist financing risks, or a separate system should be in place for that purpose. The detail and complexity of these systems will depend on the operator’s size and the complexity of their business.

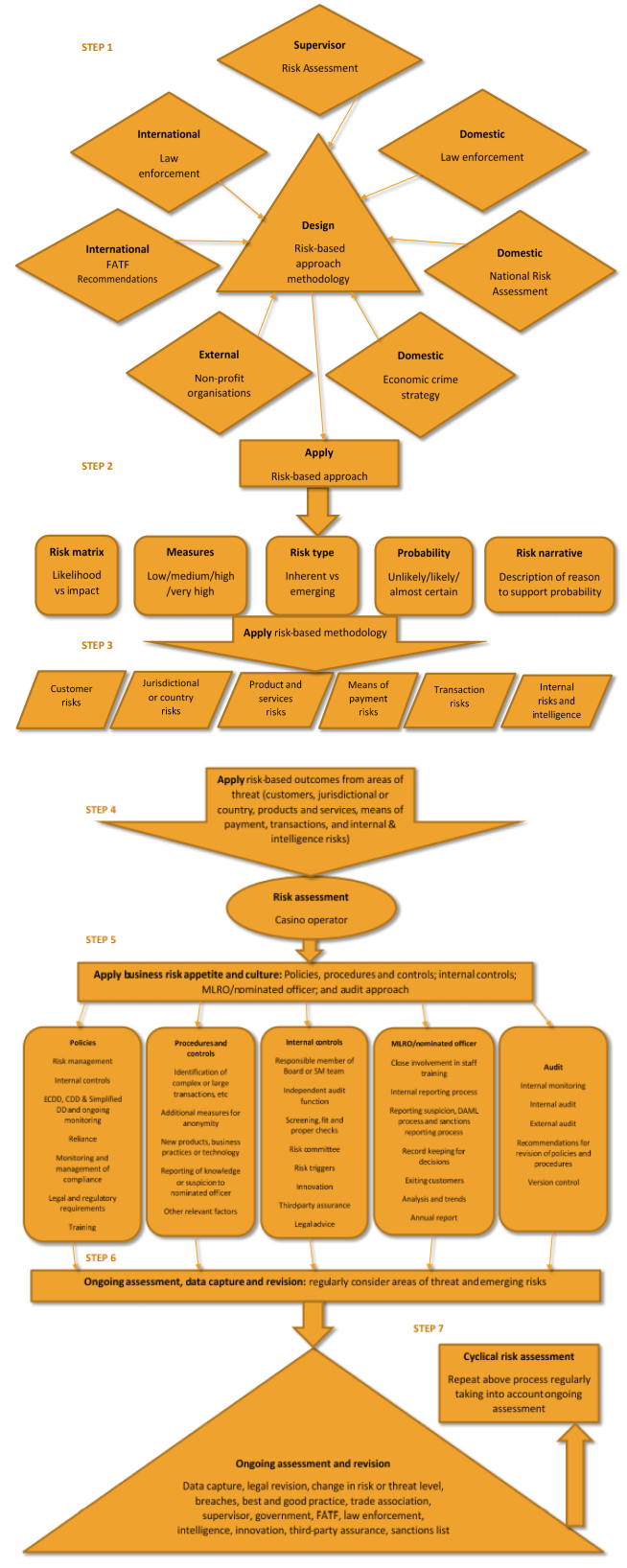

Risk-based approach

The risk-based approach involves a number of discrete steps in assessing the most proportionate way to manage and mitigate the money laundering and terrorist financing risks faced by the operator.

These steps require the operator to:

- identify the money laundering, terrorist financing and proliferation financing risks that are relevant to the operator

- design and implement appropriate policies, procedures and controls to manage and mitigate the identified and assessed risks

- monitor and improve the effective operation of these policies, procedures and controls

- record what has been done and why.

The possibility of gambling facilities being used by criminals to assist in money laundering, terrorist financing or proliferation financing poses many risks for casino operators. These include criminal and regulatory sanctions for operators and their employees, civil action against the operator and damage to the reputation of the operator, leading to a potential loss of business.

Casino operators can offset any burden of taking a risk-based approach with the benefits of having a realistic assessment of the threat of the operator being misused in connection with money laundering, terrorist financing or proliferation financing. It focuses the effort where it is most needed and will have most impact. It is not a blanket one size fits all approach, and therefore operators have a degree of flexibility in their methods of compliance.

A risk-based approach requires the full commitment and support of senior management, and the active co-operation of all employees. It should be part of the casino operator’s philosophy and be reflected in the operator’s policies, procedures and controls. There needs to be a clear communication of the policies, procedures and controls to all employees, along with robust mechanisms to ensure that they are carried out effectively, weaknesses are identified, and improvements are made wherever necessary. Where the casino operator forms part of a larger group of companies, there needs to be sufficient senior management oversight of the management of risk.

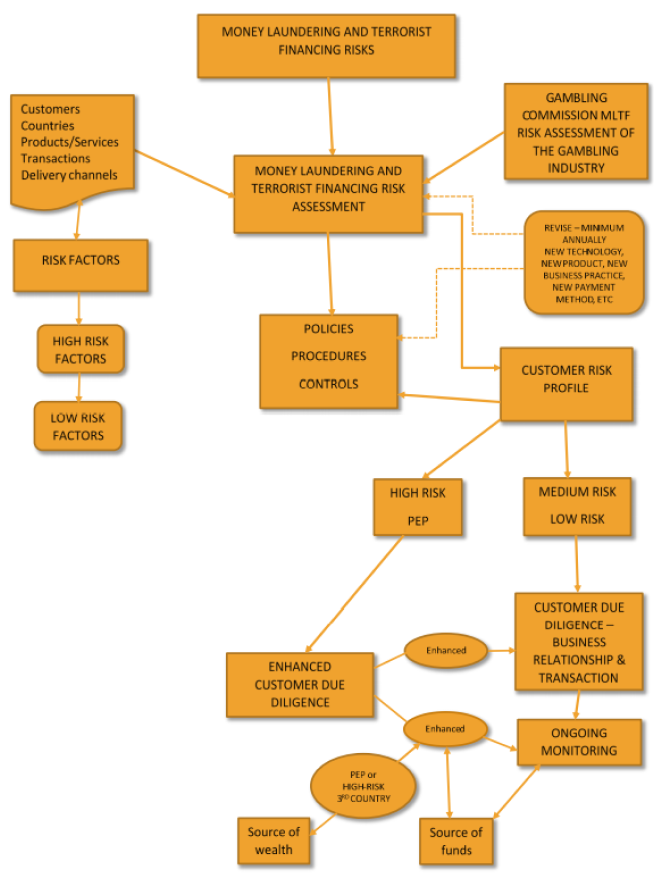

The figures in this guidance include a proposed architecture for the risk-based process which operators can adopt as good practice within their businesses. While this architecture represents a suggested approach, it does nonetheless contain elements which are requirements under the Regulations or other financial crime legislation. These requirements are detailed throughout the guidance.

29 Regulation 86.

30 Regulations 18, 18A, 19 and 19A.

2 Identifying and assessing the risks

The Regulations require casino operators to take appropriate steps, taking into account the size and nature of its business, to identify and assess the risks of money laundering, terrorist financing and proliferation financing to which its business is subject, taking into account the following:

- information on the risks of money laundering and terrorist financing made available to them by the Commission and, in the case of proliferation financing, information in the report by Treasury referred to in Regulation 16A (the proliferation financing risk assessment)31

- risk factors.

Risk factors include factors relating to:

- its customers

- the countries or geographic areas in which it operates

- its products or services

- its transactions

- its delivery channels.32

Casino operators must:

- keep an up-to-date record in writing of all the steps taken to identify and assess the risks of money laundering, terrorist financing and proliferation financing to which its business is subject

- provide the written record, the risk assessment it has prepared and the information on which it was based to the Commission on request.33

The casino operator should assess its risks in the context of how it is most likely to be involved in money laundering, criminal spend, terrorist financing or proliferation financing.

Assessment of risk is based on a number of questions, including:

- what risk is posed by the business profile and customers using the casino?

- what risk is posed to the casino operator by transactions with business associates and suppliers, including their beneficial ownership and source of funds?

- is the business high volume consisting of many low spending customers?

- is the business low volume with high spending customers, perhaps who use and operate within their cheque cashing facilities?

- is the business a mixed portfolio? Are customers a mix of high spenders and lower spenders and/or a mix of regular and occasional customers?

- are procedures in place to monitor customer transactions across outlets, products and platforms and to mitigate any money laundering potential?

- is the business local with regular and generally well-known customers?

- are there a large proportion of overseas customers using foreign currency or overseas based bank cheque or debit cards?

- are customers likely to be individuals who hold public positions (PEPs)?

- are customers likely to be engaged in a business which involves significant amounts of cash?

- are there likely to be situations where the source of funds cannot be easily established or explained by the customer?

- are there likely to be situations where the customer’s purchase or exchange of chips is irrational or not linked with gaming?

- is the majority of business conducted in the context of business relationships?

- is there a local clustering of gambling outlets which makes it easier for a person to launder criminal proceeds over multiple venues and products?

- does the customer have multiple or continually changing sources of funds (for example, multiple bank accounts and cash, particularly where this is in different currencies or uncommon bank notes)?

- does the customer have multiple or changing addresses?

- has the customer ever presented a fraudulent identity document or failed to provide an identity document repeatedly on request?

- does the customer’s behaviour follow a pattern or is it constantly changing, or did it change suddenly recently?

- in relation to remote gaming, does the customer use shared internet protocol addresses, dormant accounts or virtual private network (VPN) connections? Among other things, this could indicate that a group of people are using the same device or location to gamble for the purposes of committing fraud.

Operators should also give due consideration to the money laundering risks posed by their business-to-business relationships, including any third parties they contract with34. The assessment of these risks is based, among other things, on the risks posed to the operator by transactions and arrangements with business associates and third-party suppliers such as payment providers and processors, including their beneficial ownership and source of funds. Effective management of third-party relationships should assure operators that the relationship is a legitimate one, and that they can evidence why their confidence is justified.35

31Regulation 18A

32Regulation 18(1), (2) and (3), and 18A

33Regulation 18(4) and (6).

34 Licensees’ responsibilities for third parties.

35An example of good practice guidelines on conducting third-party due diligence can be found here (opens in new tab).

3 Risk assessments

A money laundering and terrorist financing risk assessment is a product or process based on a methodology, agreed by the parties involved, that attempts to identify, analyse and understand money laundering and terrorist financing risks. It serves as the first step in addressing the risks and, ideally, involves making judgments about threats, vulnerabilities and consequences.

Risk, therefore, is a function of three factors:

- threats - which are persons, or groups of people, objects or activities with the potential to cause harm, including criminals, terrorist groups and their facilitators, their funds, as well as past, present and future money laundering or terrorist financing activities

- vulnerabilities - which are those things that can be exploited by the threat or that may support or facilitate its activities and means focussing on the factors that represent weaknesses in AML/CTF systems or controls or certain features of a country, particular sector, financial product or type of service that make them attractive for money laundering and terrorist financing

- consequences - which refers to the impact or harm that money laundering or terrorist financing may cause, including the effect of the underlying criminal and terrorist activity on financial systems and institutions, the economy and society more generally.

The key to any risk assessment is that it adopts an approach that attempts to distinguish the extent of different risks to assist with prioritising mitigation efforts, rather than being a generic box-ticking exercise.

The risk assessment process should consist of the following standard stages:

-

Identification

The identification process begins by developing an initial list of potential risks or risk factors when combating money laundering and terrorist financing. Risk factors are the specific threats or vulnerabilities that are the causes, sources or drivers of money laundering and terrorist financing risks. This list will be drawn from known or suspected threats or vulnerabilities. The identification process should be as comprehensive as possible, although newly identified or previously unidentified risks may also be considered at any stage in the process.

-

Analysis

Analysis involves consideration of the nature, sources, likelihood, impact and consequences of the identified risks or risk factors. The aim of this stage is to gain a comprehensive understanding of each of the risks, as a combination of threat, vulnerability and consequence, in order to assign a relative value or importance to each of them. Risk analysis can be undertaken with varying degrees of detail, depending on the type of risk, the purpose of the risk assessment, and the information, data and resources available.

Evaluation

The evaluation stage involves assessing the risks analysed during the previous stage to determine priorities for addressing them, taking into account the purpose established at the beginning of the assessment process. These priorities can then contribute to development of a strategy for the mitigation of the risks.

Money laundering and terrorist financing risks may be measured using a number of factors. Application of risk categories to customers and situations can provide a strategy for managing potential risks by enabling casino operators to subject customers to proportionate controls and monitoring.

The standard risk categories used by FATF for casinos are:

- country or geographic risk

- customer risk

- transaction risk.

Casinos should also consider the risks posed by particular products they offer.36

Country and geographic risk

Some countries pose an inherently higher money laundering and terrorist financing risk than others. In addition to considering their own experiences, casino operators should take into account a variety of other credible sources of information identifying countries with risk factors in order to determine that a country and customers from that country pose a higher risk. Casino operators may wish to assess information available from FATF and non-governmental organisations which can provide a useful guide to perceptions relating to corruption in the majority of countries.

Customers that are associated with higher risk countries, as a result of their citizenship, country of business or country of residence may present a higher money laundering and terrorist financing risk, taking into account all other relevant factors. Remote casinos should check customer location because of the additional risks which arise from cross-border operations.

The country or geographic risk can also be considered in conjunction with the customer risk.

Customer risk

Determining the potential money laundering and terrorist financing risks posed by a customer, or category of customers, is critical to the development and implementation of an overall risk-based framework. Based on its own criteria, a casino should seek to determine whether a particular customer poses a higher risk and the potential impact of any mitigating factors on that assessment. Application of risk variables may mitigate or exacerbate the risk assessment.

Categories of customers whose activities may indicate a higher risk include:

- customers who are PEPs, family members of PEPs or known close associates of PEPs37

- high spenders – the level of spending which will be considered to be high for an individual customer will vary among casino operators, and among casinos managed by the same operator

- disproportionate spenders – casino operators should obtain information about customers’ financial resources so that they can determine whether customers’ spending is proportionate to their income or wealth

- casual customers – this includes tourists, participants in junkets and local customers who are infrequent visitors

- regular customers with changing or unusual spending patterns

- improper use of third parties – criminals may use third parties or agents to avoid CDD undertaken at the threshold or to buy chips, or they may be used to gamble so as to break up large amounts of cash

- junkets – junkets can pose several higher risks, including criminal control of the junket operator or participants, the movement of funds across borders which obscures the source and ownership of the money gambled by participants and their identities, and structuring, refining and currency exchange risks

- multiple player accounts – some customers will open multiple player accounts under different names to hide their spending levels or to avoid breaching the CDD threshold

- unknown or anonymous customers – these customers may purchase large amounts of chips with cash at casino tables, and then redeem the chips for large denomination notes after minimal or no play.

Transaction risk including means of payment

Casinos should consider operational aspects (products, services, games, accounts and account activities) that can be used to facilitate money laundering and terrorist financing. In addition, land-based and remote casinos also have the following potential transaction risks:

- proceeds of crime – there is a risk that the money used by a customer has been gained through criminal activity, so greater monitoring of high spenders will help to mitigate the risk

- cash – customers may use non-remote casinos to exchange large amounts of criminal proceeds, or may deposit criminal proceeds into an internet gambling account at a non-remote casino

- transfers between customers – customers may transfer money between themselves or may borrow money from unconventional sources, including other customers, which can offer criminals an opportunity to introduce criminal proceeds into the legitimate financial system through the casino

- use of casino deposit accounts – criminals may use accounts to deposit criminal proceeds and then withdraw funds with little or no play

- redemption of chips, tickets or tokens for cash or cheque, particularly after minimal or no play

- particularly in remote casinos:

- multiple gambling accounts or wallets – customers may open multiple accounts or wallets with an operator in order to obscure their spending levels or to avoid CDD threshold checks

- changes to bank accounts – customers may hold several bank accounts and regularly change the bank account they use for the remote casino operator

- identity fraud – details of bank accounts may be stolen and used on remote gambling websites, or stolen identities may be used to open bank accounts or remote gambling accounts

- pre-paid cards – these cards pose the same risks as cash, as remote casino operators normally cannot perform the same level of checks on the cards as they can on bank accounts

- e-wallets – some e-wallets accept cash on deposit or cryptocurrencies, which pose a higher risk, and some customers may use e-wallets to disguise their gambling

- games involving multiple operators – for example, poker games often take place on platforms shared by a number of remote gambling operators, which can facilitate money laundering by customers, such as chip dumping.

Product risk

Product risk includes the consideration of the vulnerabilities associated with the particular products offered by the casino operator. In non-remote casinos there are a number of gambling opportunities that offer the potential for a money launderer to place funds and generate a winning cheque or similar with minimal play. These are more fully discussed in transaction risk including means of payment and include the use of cash and casino deposit accounts, and the redemption of chips. Also, a number of gambling activities take place in remote and non-remote casinos where customers effectively play against each other. This offers the money launderer a means to transfer value by deliberately losing to the individual to whom they want to transfer the funds.

Products which may pose a money laundering risk for the casino operator include:

- peer to peer gaming

- gaming where two or more persons place opposite, equivalent stakes on even, or close to even, stakes (for example, the same stake on red and on black in a game of roulette, including electronic roulette)

- gaming machines which can be used to launder stained or fraudulent bank notes.

The risk categories or factors described previously are not intended to be prescriptive or comprehensive. They will not apply universally to all casino operators and, even when they are present, there may be different risk outcomes for different operators and premises, depending upon a host of other factors. However, the factors are intended as a guide to help casino operators conduct their own risk assessments, and to devise AML or CTF policies, procedures and controls which accurately and proportionately reflect those assessments.

The weight given to the risk factors used by the casino operator in assessing the overall risk of money laundering and terrorist financing, both individually or in combination, may vary from one operator or premises to another, depending on their respective circumstances. Consequently, casino operators also must make their own determination as to the weight given to risk factors.

Risk levels may be impacted by a number of variables, which will also have an impact on the preventative measures necessary to tackle the risks in a proportionate manner. These variables include:

- whether the casino operator’s business model is focused on:

- atracting a large number of customers who gamble relatively small amounts

- attracting a small number of customers who gamble relatively large amounts

- speed and volume of business

- for non-remote casinos, the size of the premises

- the customer profile, for example whether:

- the majority of customers are regular visitors or are members

- the casino relies on passing trade, including tourists or those who are part of junkets (for non-remote casinos)

- for non-remote casinos, whether the casino has VIP rooms or other facilities for high rollers

- types of financial services offered to customers, including MSB facilities

- types of customer payments and payment methods

- types of gambling products offered

- the customers’ gambling habits

- staffing levels and staff experience and turnover

- the type and effectiveness of existing gambling supervision measures and mechanisms

- whether the casino operator:

- owns or manages other non-remote and remote casinos

- offers different types of gambling

- has other internet gambling websites

- whether the casino is standalone or integrated with other leisure facilities

- whether the casino operator is based in one country or has a gambling presence in multiple countries.

Deciding that a customer presents a higher risk of money laundering or terrorist financing does not automatically mean that the person is a criminal, money launderer or terrorist financier. Similarly, identifying a customer as presenting a low risk of money laundering or terrorist financing does not mean that the customer is definitely not laundering money or engaging in criminal spend. Employees therefore need to remain vigilant and use their experience and common sense in applying the casino operator’s risk-based criteria and rules, seeking guidance from their nominated officer as appropriate.

Many customers carry a lower money laundering or terrorist financing risk. These might include customers who are regularly employed or who have a regular source of income from a known source which supports the activity being undertaken. This applies equally to pensioners, benefit recipients, or to those whose income originates from their partner’s employment or income.

Conversely, many customers carry a higher risk of money laundering. These may include known criminals, customers who are not regularly employed or who do not have a regular source of income from a known source which supports the level of activity being undertaken, or problem gamblers.

Case studies

Cash transactions

A drug dealer, whose only legitimate source of income for ten years was state benefits, spent more than £1 million in various gambling establishments over the course of two years, and lost some £200,000. All the transactions appeared to involve cash.

Suspicious activity

A grandparent with no previous gambling history, on a state pension, began to make weekly bets of about £100. Investigations later revealed that the grandparent was placing the bets on behalf of a grandson, a known criminal, and that the money spent was the proceeds of his criminal activity.

Multiple sources of funds

An individual was in receipt of state benefits with no other apparent form of income, but then gambled significant amounts through a licensed operator. Deposits of over £2 million were made to an online gambling account over the course of about two years from multiple sources, such as debit card and credit card, and various e-money and e-wallet services. Investigations revealed that their gambling was funded by criminal activity.

Multiple gambling transactions

Over an extended period, an individual who claimed to be a gambling addict stole equipment worth a substantial amount of money from their employer and resold it for their own gain. They then used most of these criminal proceeds to gamble, depositing almost £6 million into an online gambling account and losing almost £5 million, involving about 40,000 individual gambling transactions. The individual remained in employment throughout this period.

Large volumes of cash

A customer spent a large volume of cash at a casino, including a significant quantity of Northern Irish and Scottish bank notes. The customer told staff that the cash came from restaurants and takeaway food establishments that they ran around the UK. This explanation was accepted at face value by the staff. However, in reality the customer did not own any legitimate businesses and was later convicted of money laundering offences arising from criminal activity.

Where a customer is assessed as presenting higher risk, additional information in respect of that customer should be collected. This will help the casino operator judge whether the higher risk that the customer is perceived to present is likely to materialise, and provide grounds for proportionate and recorded decisions. Such additional information should include an understanding of where the customer’s funds and wealth have come from. While the Commission recognises that some relationships with customers will be transient or temporary in nature, casino operators still need to give consideration to this issue.

If casinos adopt the threshold approach to CDD, part of the risk-based approach will involve making decisions about whether or when verification should take place electronically. Casino operators must determine the extent of their CDD measures, over and above the minimum requirements, on a risk-sensitive basis depending on the risk posed by the customer and their level of gambling.

In order to be able to detect customer activity that may be suspicious, it is necessary to monitor all transactions or activity.38 The monitoring of customer activity should be carried out using the risk-based approach. Higher risk customers should be subjected to a frequency and depth of scrutiny greater than may be appropriate for lower risk customers. Casino operators should be aware that the level of risk attributed to customers may not correspond to their commercial value to the business.

Casino operators are best placed to identify and mitigate risks involved in their business activity. A crucial element of this is to have systems and controls to identify and link player activity, and for senior management to oversee risk management and determine whether their policies, procedures and controls are effective in design and application. Reliance on third parties to conduct risk assessment and management functions does not relieve the operator of its responsibility to assess and manage its own risks. Third party services should not be used in isolation or relied upon solely, and casino operators should be satisfied that the information supplied by the third party is sufficiently detailed, reliable and accurate.

There is a risk that customers will place and layer criminal proceeds through gambling transactions. We recommend that one way of mitigating this risk is to link the pay out of winnings with the means by which a customer pays for gambling transactions. We acknowledge that this will not eliminate the risk, but returning winnings in the same form, for example in cash or back to the same bank account, limits the opportunity for a money launderer to layer the proceeds of criminal activity. Where it is not feasible to return funds to the source or in the same form, casino operators should have controls in place to manage the risk of money laundering or terrorist financing occurring in these circumstances.

36 The risk categories used by the Commission in its 'money laundering and terrorist financing risks within the British gambling industry' publication are customer, product and means of payment (as well as operator controls, and licensing and integrity controls). Regulation 18 of the Regulations require casinos to take into account risks factors, including factors in relation to their customers, the countries or geographic areas in which they operate, their products or services, transactions and delivery channels.

37 This includes domestic and non-domestic PEPs, as noted under Regulations 35(3A) and 35(12)(e) (as amended by The Money Laundering and Terrorist Financing (Amendment) Regulations 2023 (opens in new tab). See Politically exposed persons (PEPs) section for further information.

38 Regulation 8.

4 Dynamic risk management

A money laundering or terrorist financing risk assessment is not a one-off exercise. Casino operators must therefore ensure that their policies, procedures and controls for managing money laundering and terrorist financing risks, including the detection of criminal spend, are kept under regular review.

For example, industry innovation may expose operators to new risks and an appropriate assessment of the risk is recommended before implementing any new product, system, control, process or improvement.39

Casino operators need to continually identify, assess and manage risks, just like any other business risk. They should assess the level of risk in the context of how their business is structured and operated, and the controls in place to minimise the risks posed to their business by money launderers and terrorist financers, including those engaged in criminal spend. The risk-based approach means that casino operators focus their resources on the areas which represent the greatest risk. The benefits of this approach include a more efficient and effective use of resources, minimising compliance costs and the flexibility to respond to new risks as money laundering and terrorist financing methods change.

There is a specific requirement in the Regulations that, when new products, business practices or technology are adopted by casino operators, appropriate measures are taken in preparation for, and during, the adoption of such products, business practices or technology to assess and, if necessary, mitigate any money laundering or terrorist financing risks the new product, business practice or technology may cause.40

Proliferation financing risk assessment

Casino operators must also compile a proliferation financing risk assessment. This risk assessment must take into account the following:

- the size and nature of its business

- information in the report by Treasury referred to in Regulation 16A (the proliferation financing risk assessment)

- risk factors relating to:

- its customers

- the countries or geographic areas in which it operates

- its products or services

- its transactions

- its delivery channels.41

It is recommended that casino operators follow the same approach and methodology as that used for the money laundering and terrorist financing risk assessment discussed in the preceding paragraphs.

39 In relation to specific requirements for the adoption of new products, business practices or technology.

40 Regulation 19(4)(c).

42 Regulation 18A.

Customer relationships

1 Customer relationships

Casino operators should be mindful that some risk indicators, for example, a pattern of increasing spend or spend inconsistent with apparent source of income could be indicative of money laundering, but also equally of problem gambling, or both.

There may also be patterns of play, for example, chasing losses that appear to be indicative of problem gambling that could also be considered to indicate other risks. For example, spend that is inconsistent with the individual’s apparent legitimate income could be the proceeds of crime.

While patterns of play may be one indicator of risk, casino operators should satisfy themselves that they have asked, or are prepared to ask, the necessary questions of customers when deciding whether to establish a business relationship, maintain the relationship or terminate the relationship.

In summary, it is perfectly plausible that an individual attempting to spend criminal proceeds or launder money could also be a problem gambler, but one does not necessarily follow the other. The responsibility is on the operator to be able to understand these dynamics and mitigate any risks to the licensing objectives.

Casino operators are subject to certain provisions of POCA, the Regulations and the Act (and the relevant licence conditions and codes of practice).

Operators have the responsibility to comply with the licensing objectives and, therefore, they should carry out appropriate enquiries and assessments to ensure they do so. While the conclusions drawn and actions taken may differ according to whether money laundering and/or social responsibility risks are identified, the effective identification and management of these risks rests upon the ability of casino operators to have a comprehensive knowledge of their customer relationships and for managers to be clear on their responsibilities.

It is also important that the casino operator is able to reconcile information relating to customers’ gambling activities in different parts of the business (including across different brands and different accounts) so that they have a more complete picture of the risks posed by the activities of individual customers.

Commercial and business information should be considered for AML as well as social responsibility purposes when transacting with an individual. This should include arrangements for the monitoring of customers with whom a business relationship has been established. For example, information about customer spend can be used by the casino operator to proactively monitor high risk customers in relation to their money laundering risk.

Customer relationships need to be managed proficiently and records should be maintained as to what information was communicated to the customer, why it was communicated and what considerations were made. If players expect that customer interaction is likely should they play with large amounts of money, or for lengthy periods, and such interaction is consistently applied, there would be less reason for players to question or become suspicious of the motives of these interactions. Casino operators may find it helpful to provide their customers with a leaflet which explains why they are being asked questions about their game play.

Operator obligations

The Commission recognises that some casino operators may find their obligations under POCA and the Regulations challenging, particularly in relation to the management of customer relationships, but it is incumbent on operators to have policies, procedures and controls in place to ensure that they comply with all relevant provisions of POCA and the Regulations (and the Act and the relevant licence conditions and codes of practice), in particular in relation to CDD, the reporting of money laundering activity by customers and the obtaining of a defence (appropriate consent) where necessary.

Customer relationships for AML purposes consist of 3 aspects:

- the establishment of the business relationship with the customer, including verification of the customer’s identity to a reasonable degree

- the monitoring of customer activity, including account deposits and withdrawals

- the termination of the business relationship with the customer.

At all stages of the relationship it is necessary to consider whether the customer is engaging in money laundering or terrorist financing (including criminal spend); whether there is a need to report suspicious activity or seek a defence (appropriate consent); and any risks posed to the licensing objectives.

2 Establishment of business relationship

A business relationship is a business, professional or commercial relationship between a casino operator and a customer which arises out of the business of the casino operator and is expected by the operator, at the time when the contact is established, to have an element of duration42. Casino operators are advised to interpret this definition widely.

A business relationship with a customer of a casino operator:

- is likely to occur when, for example:

- a customer opens an account with the casino operator or becomes a member of a casino (when a membership scheme is operated by the casino), or

- a customer obtains a cheque cashing facility.

- may occur when, for example:

- the casino starts tracking a customer's drop/win figures, other than to establish when the customer reaches the €2,000 CDD threshold for transactions.

This list is not exhaustive and a casino operator will need to form its own view of when contact is established, or circumstances otherwise arise, with a customer from which it expects, or it could reasonably be inferred that it expects, that the relationship with the customer will have an element of duration. The Commission acknowledges that this may not necessarily be the case when a casino operator permits a customer to join a casino loyalty scheme.

When establishing a business relationship, casino operators will need to give consideration to the following:

- the potential risk posed by the customer

- appropriate due diligence checks on the customer

- whether it is known or suspected that the customer may launder money (including criminal spend).

Where it is known that the customer is attempting to use the casino operator to launder criminal proceeds (including criminal spend), the operator must carefully consider whether either not to establish the business relationship, or to suspend or terminate the business relationship at the earliest opportunity. In either case, it is recommended that a SAR is submitted to the NCA and, where there are funds to be returned to the customer, seek a defence (appropriate consent) to a principal money laundering offence where the funds being returned to the customer for the purposes of terminating the relationship are higher than the exemption provision of £3,000 for the regulated sector43.

There is further discussion of business relationships in section '2 - Business relationships' of this guidance.

42 Regulation 4(1).

3 Customer monitoring

Where, through their customer profile or known pattern of gambling activity, the customer appears to pose a risk of actual or potential money laundering, the casino operator must monitor the gambling activity of the customer and consider whether further due diligence measures are required. This should include a decision about whether a defence (appropriate consent) should be sought for future transactions (on a transaction by transaction basis), or whether the business relationship with the customer should be terminated where the risk of breaches of POCA are too high.

Casino operators should ensure that the arrangements that they have in place to monitor customers and the accounts they hold across outlets, products and platforms (remote and non-remote) are sufficient to manage the risks that the operator is exposed to. This should include the monitoring of account deposits and withdrawals. Those casino operators that rely heavily on gaming machines should also have practical systems in place to effectively monitor and reconcile customer spend on gaming machines. Any suspicious activity should be reported by means of a SAR to the NCA.

Once knowledge or suspicion of criminal spend is linked to a customer in one area of the business, for example gaming machine play, casino operators should monitor the customer’s activity in other areas of the business, for example table games.

If the customer’s patterns of gambling lead to an increasing level of suspicion of money laundering, or to actual knowledge of money laundering, casino operators should seriously consider whether they wish to allow the customer to continue using their gaming facilities, otherwise the operator may potentially commit one of the principal money laundering offences.

Customer monitoring forms part of ongoing monitoring, which is discussed in section 2 - 'Business relationships' and Section 6 - 'Ongoing monitoring' of this guidance.

4 Termination of business relationship

As already discussed, to avoid potentially committing one of the principal money laundering offences, casino operators need to consider ending the business relationship with a customer in the following circumstances:

- where it is known that the customer is attempting to use the operator to launder criminal proceeds or for criminal spend

- where the risk of breaches to POCA are considered by the operator to be too high

- where the customer’s gambling activity leads to an increasing level of suspicion, or actual knowledge of, money laundering

- where the customer is proven to a reasonable degree of confidence to not be the identity they claim to be.

Additionally, where, in relation to any customer, the casino operator is unable to apply CDD measures, the business relationship with the customer must be terminated and the operator must submit a SAR to the NCA where they consider the circumstances to be suspicious44.

Where the casino operator terminates a business relationship with a customer and they know or suspect that the customer has engaged in money laundering, they should seek a defence (appropriate consent) from the NCA before paying out any winnings or returning funds to the customer, where the funds being returned to the customer for the purposes of terminating the relationship are higher than the exemption provision of £3,000 for the regulated sector45.

44 Regulation 31.

Senior management responsibility

1 Introduction

For the purposes of the Regulations and this guidance 'senior management' means officers or employees of the casino operator with sufficient knowledge of the operator's money laundering and terrorist financing risk exposure, and of sufficient authority, to take decisions affecting its risk exposure.46

Senior management must be fully engaged in the processes for a casino operator’s assessment of risks for money laundering, terrorist financing and proliferation financing, and must be involved at every level of the decision making to develop the operator’s policies and processes to comply with the Regulations. Disregard for the legal requirements, for example, turning a blind eye to customers spending criminal proceeds, may result in criminal or regulatory action.

It is considered best practice, and is explicit in parts of the Regulations, that a risk-based approach should be taken to tackling money laundering, terrorist financing and proliferation financing.

Casino operators, using a risk-based approach, should start from the principle that most customers are not money launderers, terrorist financers or proliferation financers. However, operators should have policies, procedures and controls in place to highlight those customers who, according to criteria established by the operator, may present a higher risk. The policies, procedures and controls should be proportionate to the risks presented.

Where the casino operator appoints a board member as the officer responsible for the operator's compliance with the Regulations, it is important that this member and the director or senior manager who is allocated the overall responsibility for the establishment and maintenance of the operator's AML and CTF systems (where they are not the same person) are clear on their responsibilities. As discussed in Section 8 - 'Status of the guidance', the person responsible for compliance with the relevant regulations (and appointed in accordance with those regulations) must hold a PML47. Also see further detail in this guidance.

46 Regulation 3(1).

47 LCCP Condition 1.2.1 - Specified management offices – personal management licences

2 Obligations on all casino operators

Operators should note that an officer of a licensed casino operator which is subject to the Regulations (that is, a director, manager, secretary, chief executive, member of the management committee, or a person purporting to act in such a capacity) who consents to, or connives in, the commission of offences under the Regulations, or where the commission of any such offence is attributable to any neglect on their part, will be individually liable for the offence. 48