Statistics and research release

Understanding how consumers engaged with gambling advertising in 2020

This release uses online survey data to reflect on consumers’ awareness of advertising, social media use and the impact it has in the context of gambling in 2020.

Summary

Key facts

- Gambling advertising and sponsorships widely and frequently reach consumers, with 6 in 10 seeing gambling adverts or sponsorships at least once a week.

- Whereas sponsorships and traditional advertising have been seen by all age groups, online advertising is more likely to be seen by younger adults.

- Just over a third of past 12-month gamblers claimed to have been prompted to spend money on a gambling activity by advertising they had seen in the past 12 months.

- Around one in six adults follow gambling companies on social media. Those that do are more likely to be male, aged 18 to 44 and past four-week gamblers.

Details

The UK advertising market continues to grow, with net advertising spending across all sectors and industries reaching circa £22 billion in 20191. With the arrival of the coronavirus (COVID-19) pandemic however, the advertising landscape has changed significantly with numerous media sectors experiencing a shrink in traditional advertising spend; though increases have been seen with tech platforms such as Google and Facebook2.

Consumers are reporting a change in how they consume media, with research from Ofcom demonstrating that the move to online services has accelerated in 2020, with UK adults spending more time online on desktop computers, smartphones or tablets than comparable European countries3.

Since March 2020, the coronavirus pandemic has had a significant impact on the gambling industry with land-based gambling venues instructed to close. In the context of gambling advertising4, there have been numerous changes. The Betting and Gaming Council (BGC) announced the removal of TV and radio gaming product advertising during the first national lockdown5, and unveiled new measures to stop under 18s from seeing betting advertisements6. We have also consulted on the requirement that licensees include consideration of whether there is a need to prevent bonus offers and promotions being sent or applied to individual customers where there are indicators of harm7.

This release uses online survey data to reflect on consumers’ awareness of advertising, social media use and the impact it has in the context of gambling in 2020, and builds on a previous release, ‘Taking a more in-depth look at online gambling’.

About the online survey

The data is based on the Gambling Commission’s quarterly online survey conducted by Yonder Consulting. A nationally representative sample of approximately 8,000 adults aged 18 and over in Great Britain were interviewed during March, June, September and December 2020. All the data was collected during either national or some element of local restrictions.

Approximately 6,000 respondents were asked questions relating to gambling advertising, marketing and social media throughout the March, June and September waves of the online tracker.

Further details on the quarterly online survey methodology can be found in the notes section as follows.

Comparisons to previous years’ data are not always appropriate due to changes to the survey questions and routing.

Gambling Advertising and Sponsorships

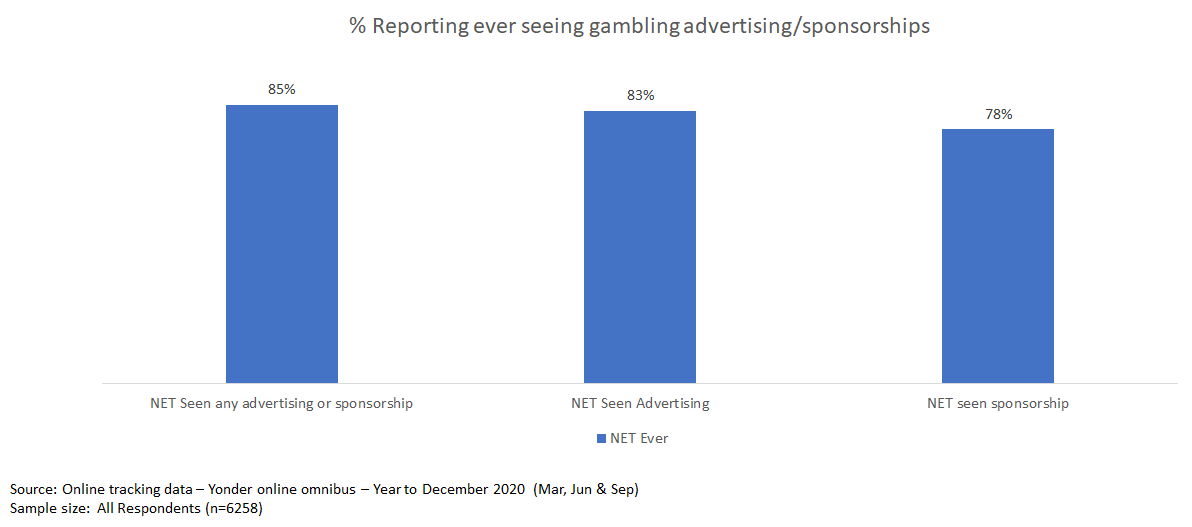

Online survey respondents were asked about advertisements and sponsorships to help us understand awareness of gambling related media. Overall, 85% have ever seen gambling adverts or sponsorships, with 83% seeing adverts and 78% seeing any sponsorships. This compares to 87% who had seen advertisements or sponsorships in 2019 (86% had seen any gambling advertisements and 82% had seen any gambling sponsorships).

Defining gambling advertisements and sponsorships in the survey

By gambling advertisements, we mean the promotion of gambling via a variety of media.

By gambling sponsorships, we mean a commercial agreement between a gambling company and another company.

| NET Seen any advertising or sponsorship | NET Seen Advertising | NET seen sponsorship |

|---|---|---|

| 85% | 83% | 78% |

| Percentage | |

|---|---|

| Gambling advertisements on the TV | 76% |

| Gambling advertisements on the radio | 41% |

| Gambling advertisements in newspapers | 45% |

| Gambling advertisements on posters/ billboards | 56% |

| Gambling advertisements on social media websites | 49% |

| Gambling adverts on live streaming or video sharing platforms | 45% |

| Gambling adverts sent directly to you via email, text message or app push notification | 37% |

| Gambling adverts shown within app games (or similar) | 48% |

| Gambling advertisements online other platforms (websites) | 56% |

| Gambling sponsorships on the TV, radio or podcast | 67% |

| Gambling sponsorships on sports merchandise | 60% |

| Gambling sponsorships in sports venues | 59% |

| Associations with sporting competitions | 56% |

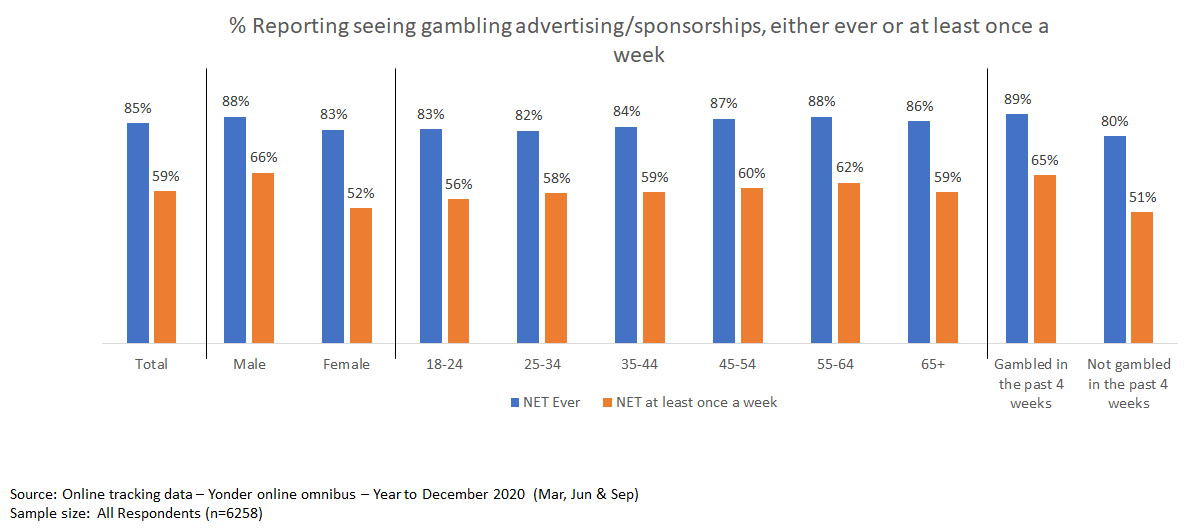

Gambling advertising and sponsorships are widespread, with most consumers reporting having ever seen them, regardless of their age, gender or gambling status

Advertising has been seen by more than 8 in 10 people across all demographic groups. Male gamblers aged 25 to 34 and 45+ are most likely to have ever seen gambling advertising, with 90% and 91% reporting doing so, respectively.

However, when we look at respondents who’ve seen advertising more recently (i.e. at least once a week), differences are more pronounced with males, those in older age groups, and gamblers being more likely to be seeing advertising.

| Total | Male | Female | 18 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65+ | Gambled in the past 4 weeks | Not gambled in the past 4 weeks | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NET Ever | 85% | 88% | 83% | 83% | 82% | 84% | 87% | 88% | 86% | 89% | 80% |

| NET at least once a week | 59% | 66% | 52% | 56% | 58% | 59% | 60% | 62% | 59% | 65% | 51% |

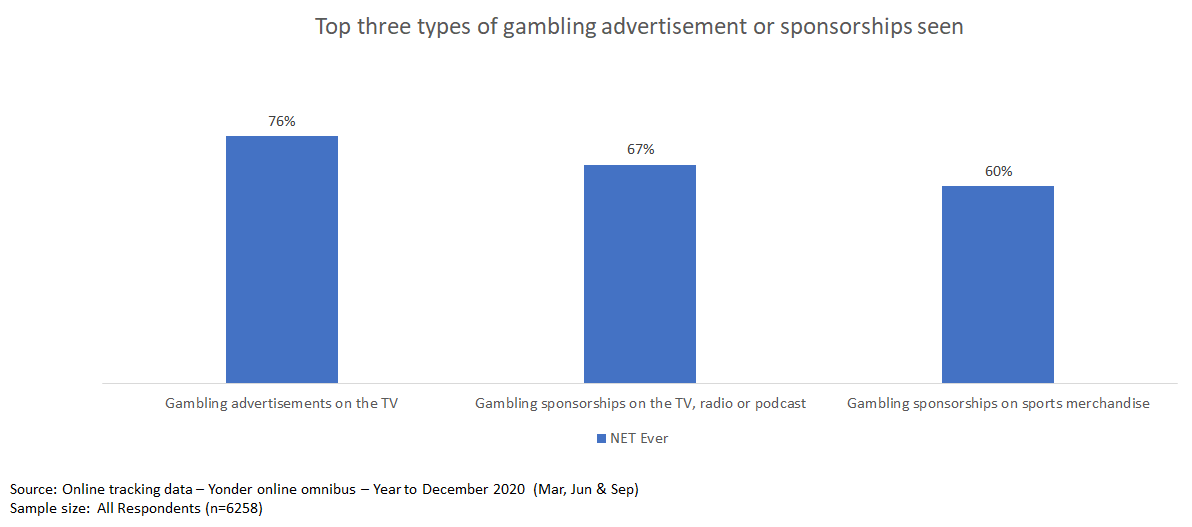

Gambling ads are most commonly seen on TV, with 76% of respondents having ever seen them. This may not, however, come as a surprise given findings from Havas Media which suggest that almost two-thirds (64%) are watching more live TV than they did prior to the coronavirus outbreak8. This is closely followed by gambling sponsorships on the TV, radio or podcasts (67%). The third most common type of advertising seen is gambling sponsorships on sports merchandise (60%).

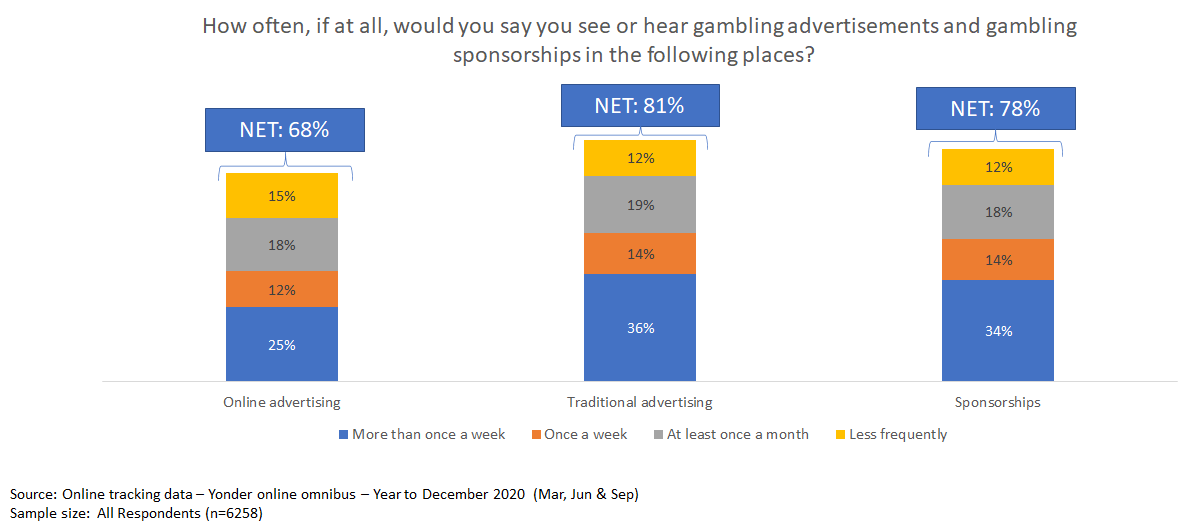

Once all types of advertising have been combined into online, traditional and sponsorship categories it becomes more evident that respondents are generally more likely to report seeing traditional advertising, followed by sponsorships and online advertising (though all categories of advertising have high visibility). Read definitions for each advertising category.

| NET Ever | More than once a week | Once a week | At least once a month | Less frequently | |

|---|---|---|---|---|---|

| Online advertising | 66% | 25% | 12% | 18% | 15% |

| Traditional advertising | 81% | 36% | 14% | 19% | 12% |

| Sponsorships | 78% | 34% | 14% | 18% | 12% |

Males are more likely to report seeing each of these three main types of gambling advertising than their female counterparts. The discrepancy is greatest for online advertising, with almost three-quarters (74%) of males reporting ever seeing gambling ads online compared to 63% among females.

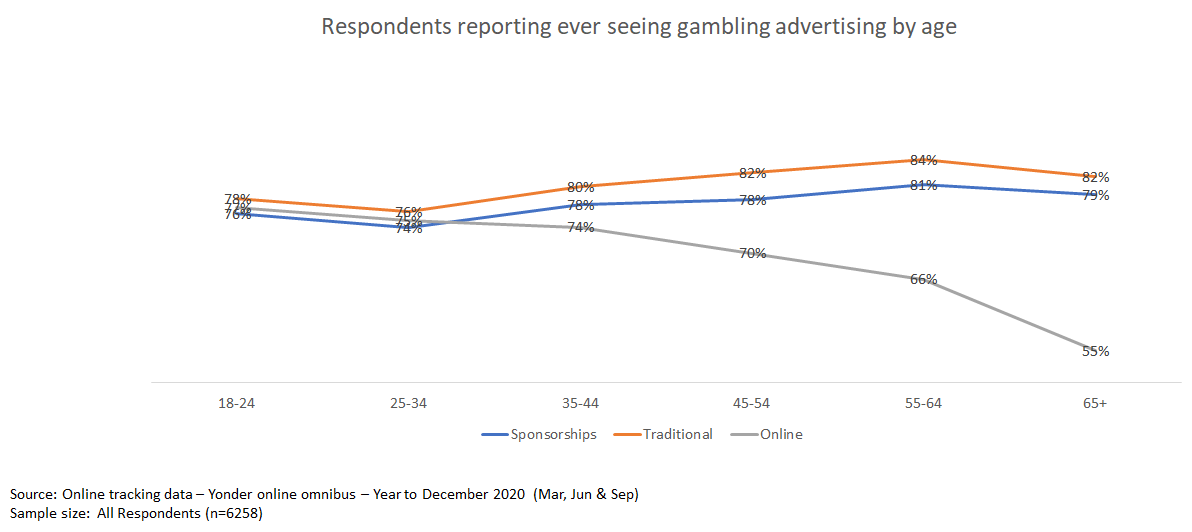

Whilst sponsorships and traditional advertising are consistently seen among all age groups, online advertising is more likely to be seen amongst younger age groups

Whilst both men and women and all age groups are widely aware of traditional gambling advertising and sponsorships, online ad awareness skews noticeably to younger age groups. We can see that for traditional advertising and sponsorships, the proportion of respondents seeing advertising increases slightly with age. However, the opposite is true for online advertising, with those aged 18 to 24 being most likely to see gambling advertising online. This decreases as respondents age, with just over half (55%) of those aged 65+ seeing it. This is consistent with findings from Ofcom’s Technology Tracker, which shows that those aged 55+ are less likely than average to have access to the internet9.

| 18 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65 and over | |

|---|---|---|---|---|---|---|

| Online advertising | 77% | 75% | 74% | 70% | 66% | 55% |

| Traditional advertising | 78% | 76% | 80% | 82% | 84% | 82% |

| Sponsorships | 76% | 74% | 78% | 78% | 81% | 79% |

Social media and video sharing platforms

| NET Follow/watch gambling company | Use social media but don’t follow gambling operators | Don’t use social media or streaming platforms |

|---|---|---|

| 16% | 68% | 17% |

| YouTube | Snapchat | TikTok | Twitch | |||

|---|---|---|---|---|---|---|

| 11% | 6% | 6% | 6% | 3% | 1% | 1% |

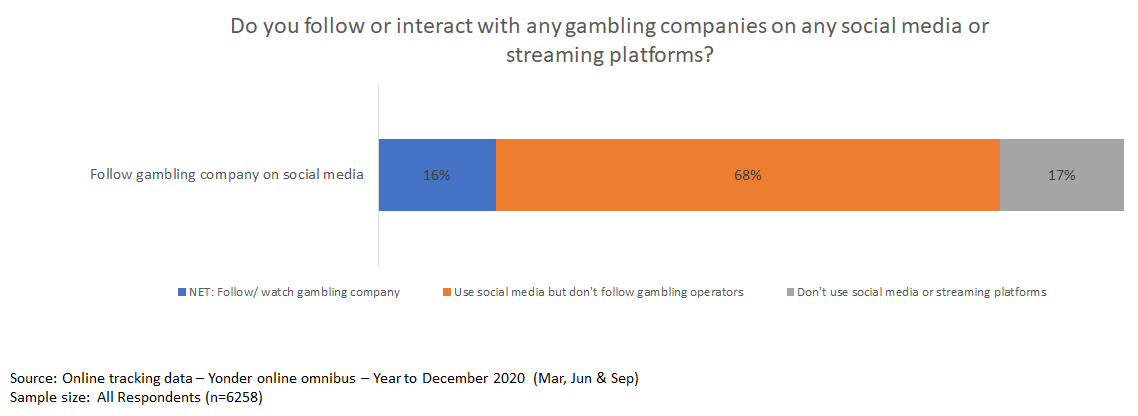

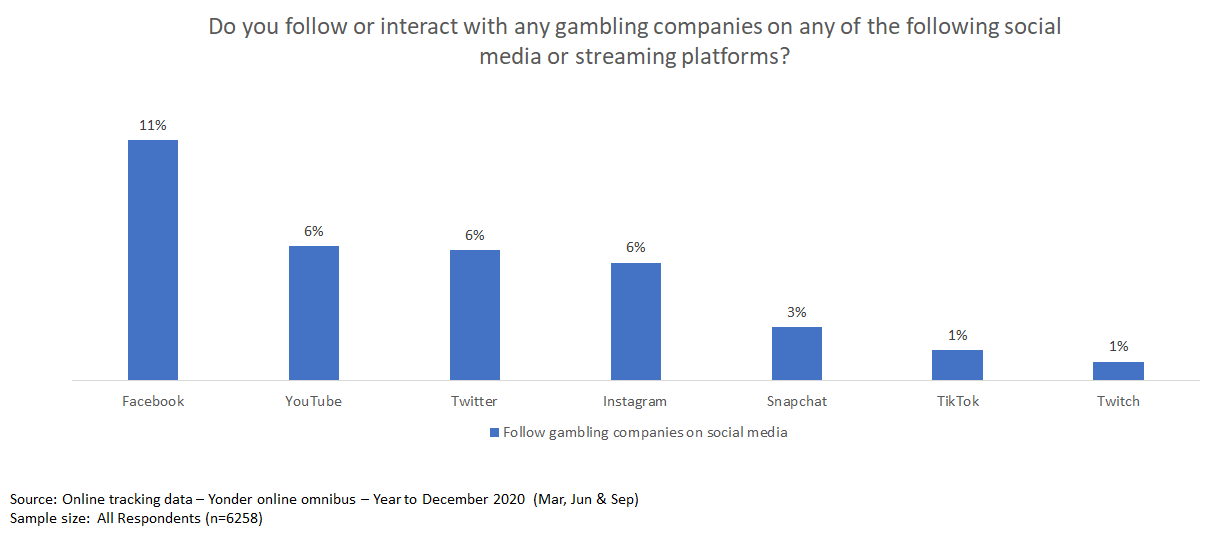

Among those active on social media, 19% report following or watching gambling companies

In total, 16% of adults say they follow or interact with gambling companies on any social media or video sharing platform. The most popular platform to do this is Facebook (11%), followed by YouTube, Twitter and Instagram (all 6%). These figures remain consistent with findings from the latest Adult’s Media Use and Attitudes Report (Ofcom, 202110) which identifies Facebook as having the highest overall use of any social media site or app.

| Total | Male | Female | 18 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65+ | Gambled in the past 4 weeks | Not gambled in the past 4 weeks | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NET Any Social Media Platform | 16% | 19% | 12% | 26% | 29% | 26% | 13% | 7% | 3% | 22% | 8% |

| 11% | 13% | 10% | 17% | 20% | 20% | 10% | 6% | 2% | 16% | 6% | |

| YouTube | 6% | 8% | 5% | 10% | 12% | 10% | 5% | 3% | 1% | 8% | 4% |

| 6% | 9% | 4 | 12% | 11% | 10% | 4% | 3% | 1% | 9% | 2% | |

| 6% | 7% | 5% | 13% | 11% | 9% | 3% | 1% | 0% | 8% | 3% | |

| Snapchat | 3% | 2% | 2% | 8% | 4% | 3% | 1% | 1% | 0% | 4% | 1% |

| TikTok | 1% | 2% | 1% | 4% | 3% | 2% | 1% | 0% | 0% | 2% | 1% |

| Twitch | 1% | 1% | 0% | 1% | 3% | 1% | 1% | 0% | 0% | 1% | 0% |

Those who do follow gambling companies on social media are more likely to be male, aged 18 to 44 and to have gambled at least once in the past 4 weeks

It is interesting to note that males, and those in the younger age groups (18 to 44), and past 4 week gamblers are all more likely than average to follow gambling companies on any social media platform. This remains consistent when looking at each individual platform in isolation.

The impact of gambling advertising

| Category | Percentage |

|---|---|

| NET Any posts or media | 34% |

| NET Advertising on social media | 15% |

| Free bets or money to spend with a gambling company | 22% |

| Advertising for a gambling company on TV | 15% |

| Advertising for a gambling company online | 13% |

| Advert or post by a gambling company on Facebook | 10% |

| Adverts sent directly to you via email, text message or app push notification by a gambling company | 9% |

| Sponsorship of a sports event tournament or team by a gambling company | 8% |

| Advertising for a gambling company in a newspaper | 7% |

| Advertising for a gambling company on billboards or posters | 7% |

| Advertising by a gambling company on the radio | 6% |

| Advert or post by a gambling company on YouTube | 6% |

| Advert or post by a gambling company on another social media site | 6% |

| Advert or post by a gambling company on Twitter | 6% |

| Advert or post by a gambling company on Instagram | 5% |

| Advert or post by a gambling company on Snapchat | 4% |

| Advert or post by a gambling company on Twitch | 4% |

| Gambling adverts shown within app games (or similar) | 3% |

| Advert or post by a gambling company on TikTok | 3% |

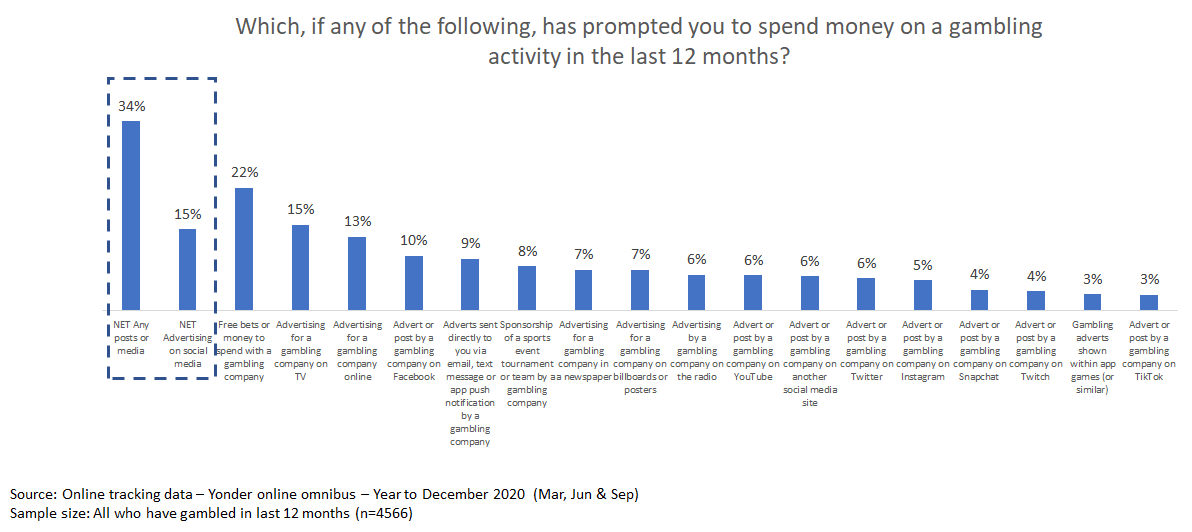

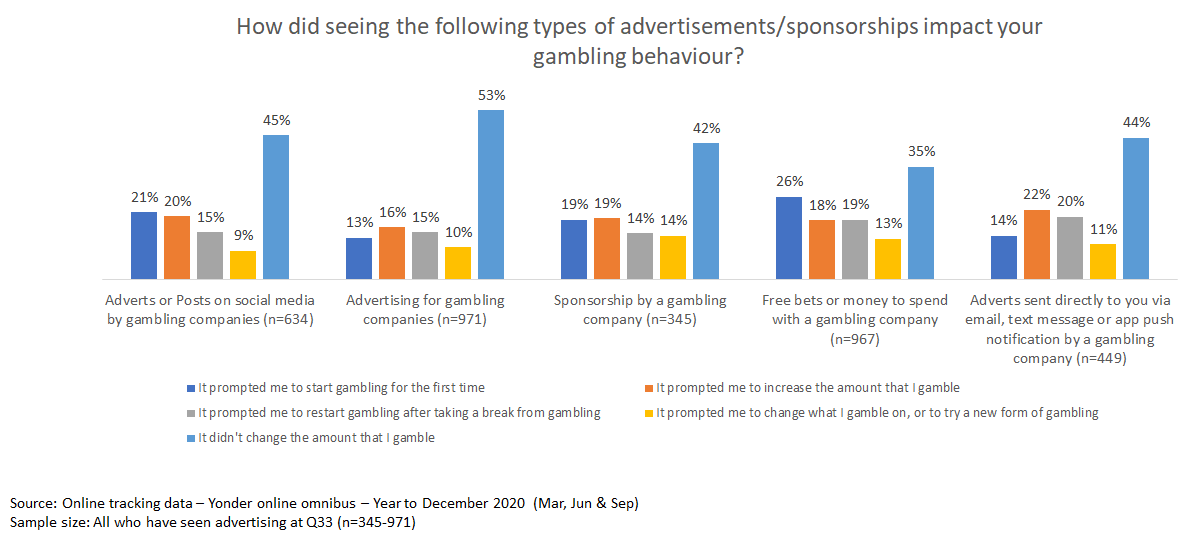

Just over a third of past 12-month gamblers have been prompted to spend on gambling activity by a type of advertising in the past 12 months

The type of advertising most likely to prompt gamblers to spend is advertising for a gambling company on TV; unsurprising given that it is the most frequently seen type of advertising. Free bets or money to spend with a gambling company (which can be received through all different types of adverts), are overall more likely to prompt consumers to spend.

In total, 15% of respondents report being prompted to spend on gambling by advertising on social media. This appears to be driven largely by those who follow gambling companies on social media (54%) compared to only 6% among respondents who use social media but do not follow gambling companies.

Approximately a quarter (26%) of those who’ve been prompted to spend by free bets or money to spend with a gambling company have been prompted to start gambling for the first time. Those who have received advertising directly from a gambling company (for example, by email, text message or push notification) are more likely to be prompted to increase their gambling, than start gambling for the first time.

| Adverts or Posts on social media by gambling companies (n=634) | Advertising for gambling companies (n=971) | Sponsorship by a gambling company (n=345) | Free bets or money to spend with a gambling company (n=967) | Adverts sent directly to you via email, text message or app push notification by a gambling company (n=449) | |

|---|---|---|---|---|---|

| It prompted me to start gambling for the first time | 21% | 13% | 19% | 26% | 14% |

| It prompted me to increase the amount that I gamble | 20% | 16% | 19% | 18% | 22% |

| It prompted me to restart gambling after taking a break from gambling | 15% | 15% | 14% | 19% | 20% |

| It prompted me to change what I gamble on, or to try a new form of gambling | 9% | 10% | 14% | 13% | 11% |

| It didn't change the amount that I gamble | 45% | 53% | 42% | 35% | 44% |

What we learnt

This research reinforces what we already knew – that gambling advertising and marketing activity has a wide reach, encompassing existing gamblers but also lapsed/non-gamblers who may be encouraged to start or restart gambling.

With gambling operators’ marketing across a range of media, from TV ads, to sports team sponsorships, to social media, there is a question about appreciating better the cumulative impact of all this activity on consumers. The effects of gambling advertising may have been potentially exacerbated by the pandemic, where many people have been at home more, watching more live TV, spending more time online and on social media, and have seen their financial circumstances change.

We should be clear – our official statistics on gambling participation don’t indicate an increase in gambling through the pandemic period, in fact the opposite. Similarly, we aren’t seeing an increase in problem gambling rates at a population level. Nonetheless, all who are interested in gambling related trends should be alert to the potential risks of ad exposure to different population groups.

We have recently released data on taking a more in-depth look at online gambling, and intend to publish a further release looking at safer gambling within the coming weeks. This will help to build up a fuller picture of consumer gambling behaviour throughout the pandemic period. And as the country hopefully emerges from the worst impacts of coronavirus and returns to something approaching normality in the months ahead, we look forward to releasing more research and statistics that help us understand how consumer gambling behaviour has been affected.

Advertising category definitions

Online

- Gambling advertisements online on other platforms (websites)

- Gambling advertisements shown within app games (or similar)

- Gambling adverts sent directly to you via email, text message or app push notification

- Gambling adverts on live streaming or video sharing platforms

- Gambling adverts on social media websites.

Traditional

Gambling advertisements:

- on posters and billboards

- in newspapers

- on the radio

- on the TV.

Sponsorships

- associations with sporting competitions

- gambling sponsorships in sports venues

- gambling sponsorships on sports merchandise

- gambling sponsorships on the TV, radio or podcasts.

About the online tracker

The Commission collects in depth data from online gamblers about their online gambling behaviour via a quarterly online tracker, conducted by Yonder Consulting as part of their online omnibus.

The 2020 data is based on a sample of circa 8,000 adults aged 18+ in Great Britain. Fieldwork took place in March, June, September and December with approximately 2,000 interviews per quarter. All waves were completed after the emergence of coronavirus and the start of the national restrictions on 23 March 2020.

The online survey sample is sourced through Yonder’s panel and the sample is subject to quotas in-line with those used for the Commission’s quarterly telephone survey. In addition, data are weighted which are derived from The Publishers Audience Measurement Company (PAMCO) data, based on a face-to-face random probability sample.

The variables used for weighting are:

- age

- gender

- region

- social grade

- tenure

- working status.

Notes

1 Advertising spending in the UK 2024 | Statista (opens in new tab)

2 Charted: UK advertising spend by sector 2020 - Press Gazette (opens in new tab)

3 A nation’s online migration: Ofcom reveals a year lived online - Ofcom (opens in new tab)

4 Gambling advertising in all forms is permitted by the Gambling Act 2005 but is subject to a wide range of controls which reflect the Licensing Objectives. Gambling advertisements cover a variety of gambling activities.

6 New rules to stop under-18s seeing betting ads - Betting & Gaming Council (opens in new tab)

8 COVID-19: Media Behaviours Reports - Havas Media (opens in new tab)

9 Ofcom technology tracker 2020 UK data tables (opens in new tab)

10 Adult's Media Use and Attitudes report 2020 to 2021 - OFCOM (opens in new tab).

Data and downloads

Files

Feedback

We are always keen to hear how these statistics are used and would welcome your views on this publication.