Statistics and research release

Taking a more in-depth look at online gambling

Publication of online survey looking at online gambling behaviour in 2020.

Summary

Key facts

This release contains data on consumer online gambling behaviour in 2020, taken from an online survey of c.8,000 adults in Great Britain.

The results show that:

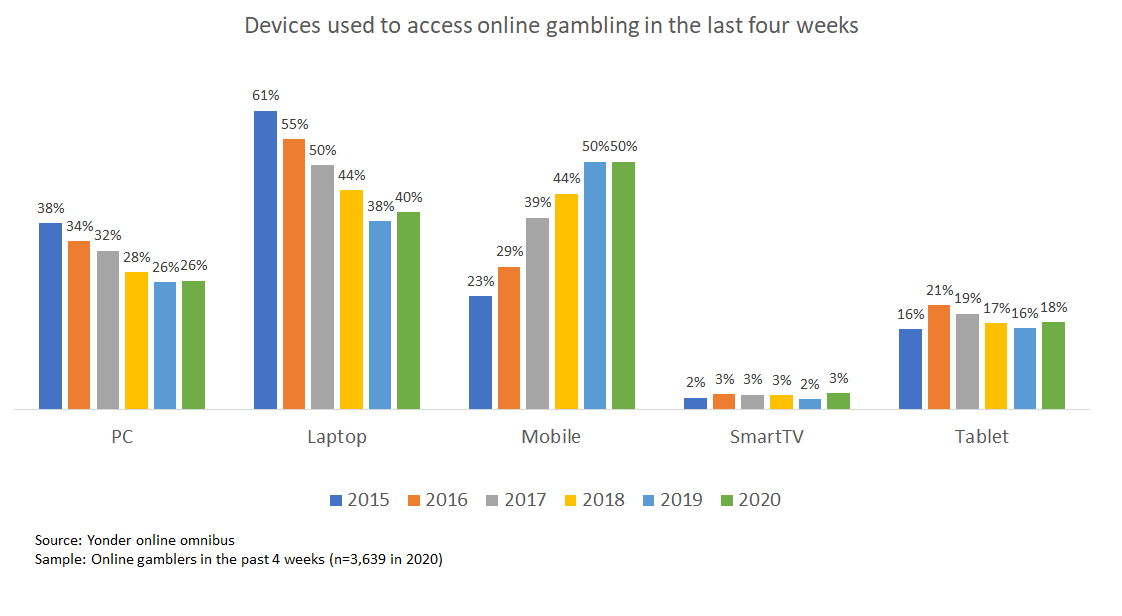

- the most popular way to access online gambling remains via mobile phone, particularly for younger people

- while mobile phones remain the dominant device for online gambling, laptops, PCs and tablets halted recent declines in 2020

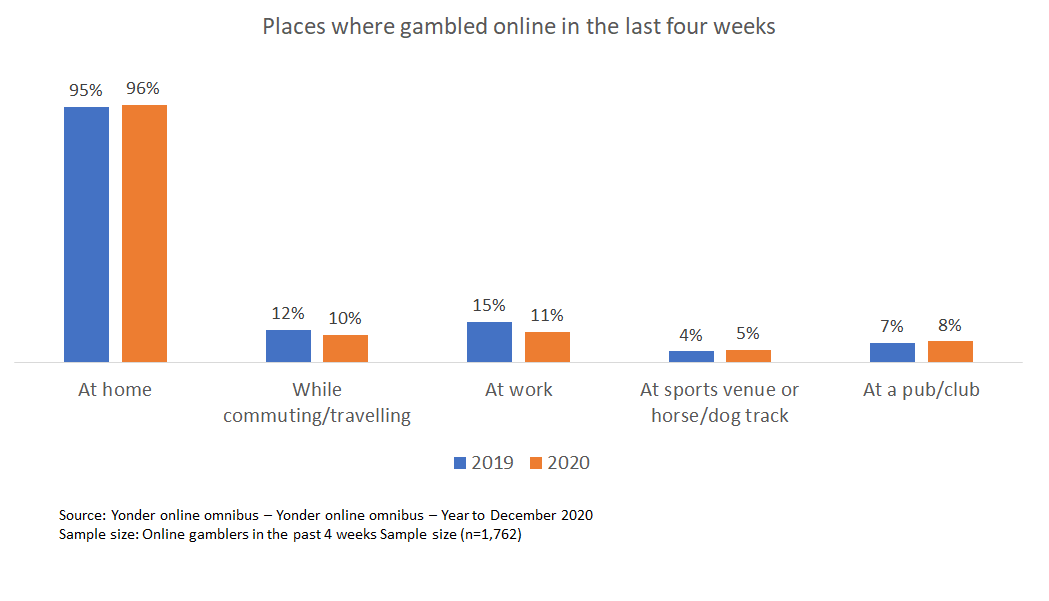

- most online gambling is still done within the home, but one in five online gamblers have done so outside the home

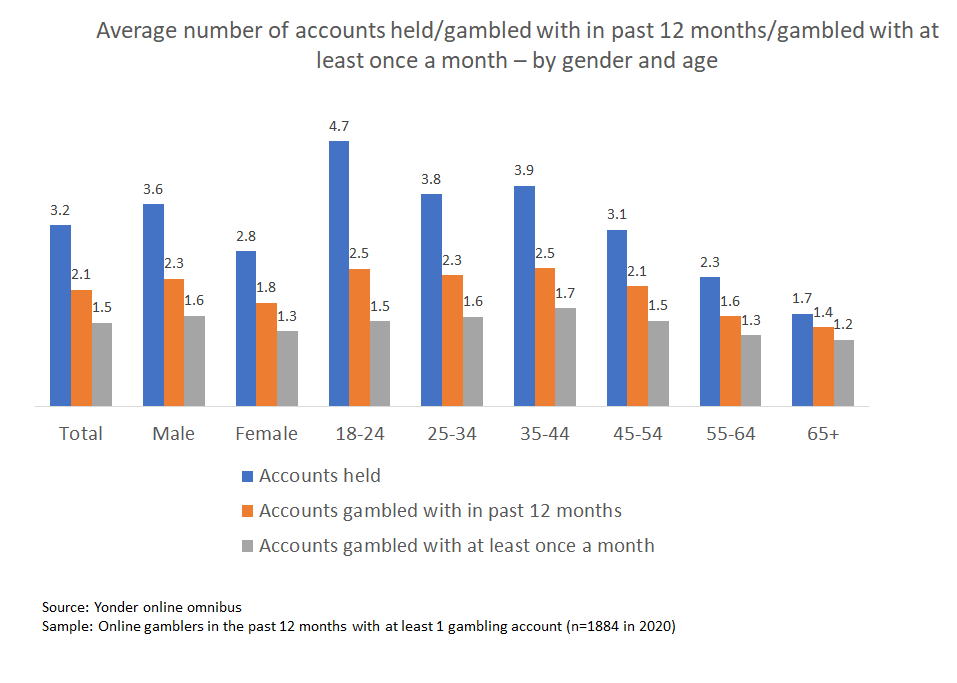

- online gamblers hold an average of three accounts, but a significant proportion of younger gamblers hold more

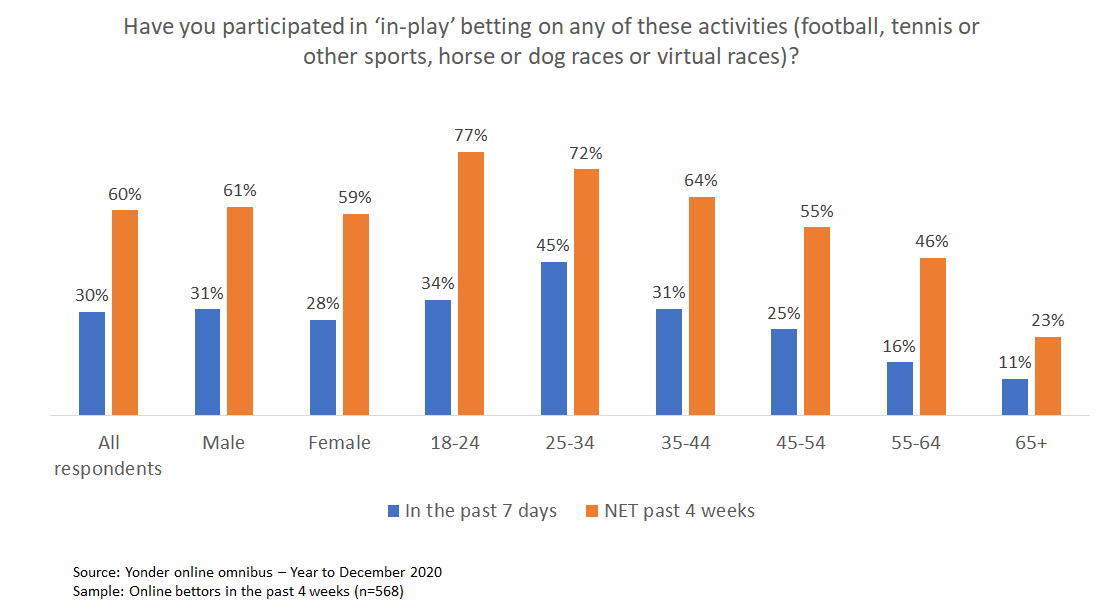

- the majority of online bettors have bet in-play, with rates highest for the younger demographic

- eSports betting is also growing, fuelled particularly by younger males.

Details

Introduction

The last few years have seen a dramatic shift in the ways in which people gamble. Our Industry Statistics for April 2019 - March 2020 show that remote (or online) gambling is now the largest industry sector, generating a Gross Gambling Yield of £5.7bn and comprising c.40% of the overall market. This trend is further emphasised by official statistics from our quarterly telephone survey that show consecutive year-on-year increases in online gambling participation. In 2020, almost one in four adults (24%) had gambled online in the last four weeks, compared to around one in six (17%) five years ago.

Of course, the gambling industry, like our lives in general, has been given a massive jolt over the last 12 months or so due to the arrival of Covid-19. Wave upon wave of restrictions have been imposed on our daily lives and land-based gambling opportunities have been significantly reduced. To understand the impact of Covid-19 on the gambling market and consumers, we have been publishing regular updates based on operator and research data which provide more frequent insights into market impacts.

In addition to these sources, another important piece of the evidence jigsaw is provided by our quarterly online survey. Like our telephone survey, this is run on a quarterly basis, but rather than deliver official statistics on participation and prevalence, it offers an opportunity to investigate online gambling behaviour (plus a range of other topics including marketing and advertising and safer gambling issues) in much more detail.

While we can’t know for certain what the trends in online gambling behaviour would have been if Covid-19 hadn’t arrived, we think it’s possible to detect the influence of the pandemic in our online survey data for 2020. In this release we delve into the online survey data for the year to 2020 to flesh out our understanding of the headline trends illustrated in our official stats, and to further illuminate the impact of Covid-19 on how people gamble. We intend to publish further releases in the coming weeks, looking at data on gambling advertising and safer gambling.

The data is based on the Gambling Commission’s quarterly online survey conducted by Yonder Consulting. A nationally representative sample of approximately 8,000 adults aged 18 and over in Great Britain was interviewed during March, June, September and December 2020. All the data was collected during either national or some element of local restrictions. Approximately 4,000 respondents had taken part in at least one form of online gambling in the last four weeks, and were asked more detailed questions about their behaviour, including the devices they use to gamble, the locations where they play and the number of online gambling accounts they hold. Further details on the quarterly online survey methodology can be found in the notes section as follows.

The most popular way to access online gambling in 2020 remained via mobile phone, particularly for younger people

While half of all online gamblers have done so on their smartphone, there is a clear age skew, with three-quarters of 18–34-year-old online gamblers using their smartphones to gamble compared to only 14% of those aged 65 and over. The data also shows that online gamblers aged 18-34 tend to use a wider range of different devices for gambling – 1.7 – than the average of 1.4.

While mobile phones remain the dominant device for online gambling, laptops, PCs and tablets halted recent declines in 2020 Laptops are the second most common way of accessing online gambling, used by four in ten online gamblers. Their use for online gambling has been declining in recent years but stabilised in 2020, and they are the preferred route to online gambling for those aged 55 and over. The third most popular way to gamble online is via PC, used by one in four online gamblers, while tablets are used by just under one in five. Like laptops, PC and tablet usage stabilised in 2020 after years of decline. These findings are in keeping with a reported growth of 11% in PC shipments in 2020 vs 20191 as more consumers have turned to technology durables while confined to their homes.

Smart TVs remain a ‘niche’ way to access online gambling – for now at least Used to access gambling by just 3% of online gamblers, smart TV usage did show significant growth among younger people, with usage doubling between 2019 and 2020 among those aged 18-24 (from 5% to 10%) and 25-34 (from 4% to 8%). With Ofcom data indicating that more than half (57%) of UK homes have a smart TV (up from 42% in 2018), smart TVs appear to have untapped potential for gambling companies to offer online gambling opportunities.

| PC | Laptop | Mobile | SmartTV | Tablet | |

|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| 38% | 34% | 32% | 28% | 26% | 26% |

| 61% | 55% | 50% | 44% | 38% | 40% |

| 23% | 29% | 39% | 44% | 50% | 50% |

| 2% | 3% | 3% | 3% | 2% | 3% |

| 16% | 21% | 19% | 17% | 16% | 18% |

Most online gambling is still done within the home, but one in five online gamblers have done so outside the home Unsurprisingly, given the extra time most of us have been forced to spend at home in recent months, ‘at home’ remains the main location where people have gambled online, although the incidence hasn’t shifted notably from the level seen in the previous 12 months.

Despite the dominance of ‘the home’, one in five (20%) of respondents had gambled online in other places, particularly those online gamblers aged 18-24 (44%) while less than 2% of those aged 65 and over had done so.

As home and work life blur into one for many people, and others have been furloughed, it is also unsurprising to note that fewer online gamblers say they have gambled at work (down 4 percentage points in 2020) and while commuting (down 2 percentage points). Despite lockdowns, 8% still say they have gambled online at a pub or club, which reflects the fact that there were periods of lighter restrictions that coincided with some of the data collection.

| At home | While commuting/travelling | At work | At sports venue or horse/dog track | At a pub/club | |

|---|---|---|---|---|---|

| 2019 | 95% | 12% | 15% | 4% | 7% |

| 2020 | 96% | 10% | 11% | 5% | 8% |

Online gamblers hold an average of three accounts, but a significant proportion of younger gamblers hold more As well as how and where people gamble online, it is also important to monitor the number of online gambling accounts that customers hold. One of the weaknesses of operators’ current approach to customer data is that it is limited to observing a customer’s gambling on their own products. The survey data we collect shows that most gamblers have more than one online account – in fact, the average is around three – meaning that the current data gives a narrow view. This is why we have issued a challenge to industry to work together to develop ways data could be used to create a ‘single customer view’.

The average number of gambling accounts held2 (among those with at least one account) has remained at around three over the last few years, although there are signs that this figure is on the rise, reaching a mean of 3.2 accounts per person in 2020 compared to 2.7 in 2018.

| Mean number of accounts held | Mean number of accounts gambled with in past 12 months | Mean number of accounts gambled with monthly | |

|---|---|---|---|

| 2016 | 3.0 | 2.2 | 1.5 |

| 2017 | 2.8 | 2.0 | 1.4 |

| 2018 | 2.7 | 1.9 | 1.3 |

| 2019 | 3.0 | 2.1 | 1.4 |

| 2020 | 3.2 | 2.1 | 1.5 |

The mean only tells part of the story, however. On average, males tend to have both more online accounts than females and to use these accounts more frequently. Younger gamblers (aged 18-44) tend to hold more online accounts on average and use these more often than those aged 55 and over. While just under a fifth of 18–34-year-old online gamblers hold five or more accounts, only 5% of those aged 65 and over hold this many.

| All respondents | Male | Female | 18 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65 and over | |

|---|---|---|---|---|---|---|---|---|---|

| Accounts held | 3.2 | 3.6 | 2.8 | 4.7 | 3.8 | 3.9 | 3.1 | 2.3 | 1.7 |

| Accounts gambled with in past 12 months | 2.1 | 2.3 | 1.8 | 2.5 | 2.3 | 2.5 | 2.1 | 1.6 | 1.4 |

| Accounts gambled with at least once a month | 1.5 | 1.6 | 1.3 | 1.5 | 1.6 | 1.7 | 1.5 | 1.3 | 1.2 |

Operators need to consider the needs of all their customers – from those customers who only play with them, through to those who are active across a larger number of accounts – to ensure they have a fuller understanding of their behaviour and where they may be susceptible to potential harm.

The majority of online bettors have bet in-play3 , with rates highest for the younger demographic We know that live or in-play betting (which occurs while an event is actually taking place) has been a rapidly growing way to bet in recent years, and our online survey reveals that three in ten online bettors have bet in-play in the last seven days, with a further 30% doing so in the last four weeks.

While there was little difference in in-play participation rates among males and females, there were again clear differences by age: net past four-week in-play participation was highest among those aged 18-24 (77%) and lowest for those aged 65 and over (23%).

| All respondents | Male | Female | 18 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65 and over | |

|---|---|---|---|---|---|---|---|---|---|

| In the past 7 days | 30% | 31% | 28% | 34% | 45% | 31% | 25% | 16% | 11% |

| NET past 4 weeks | 60% | 61% | 59% | 77% | 72% | 64% | 55% | 46% | 23% |

The survey also confirms a skew towards using mobile devices for in-play betting. Three quarters (74%) of in-play bettors had used a mobile phone to gamble, compared to 50% of online gamblers overall.

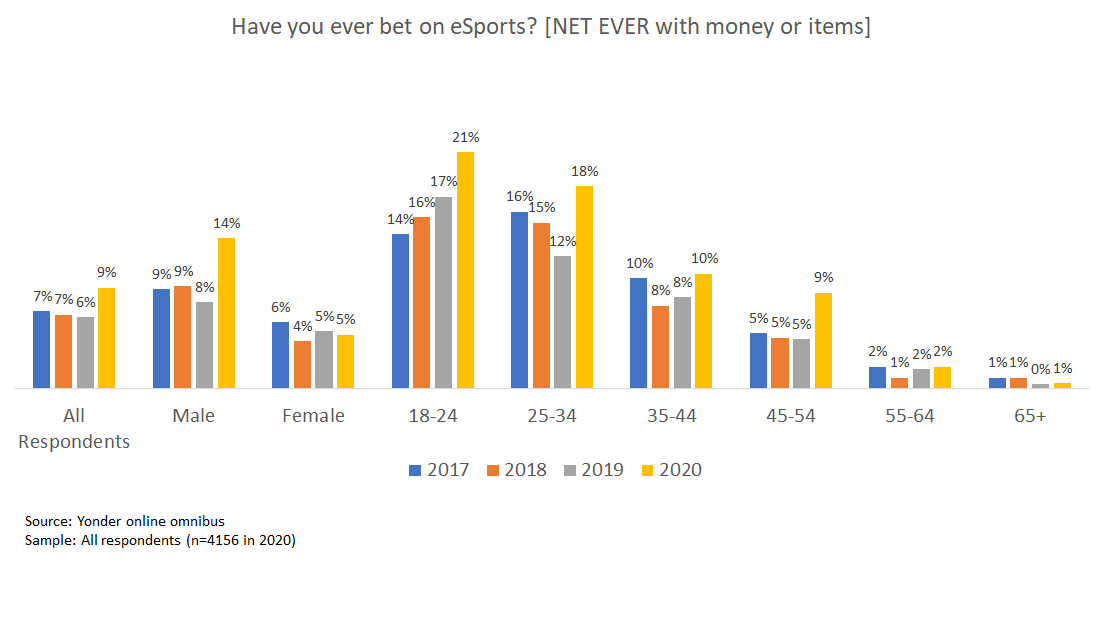

eSports betting is also growing, fuelled particularly by younger males Another activity which continues to grow in popularity is eSports, with the market estimated to have grown at an average annual rate of 8.5% between 2016 and 2019.4 The online survey data suggests that just under one in ten GB adults (9%) has ever bet on eSports, up from 6% in 2019. Once again, it is predominantly younger players who have driven this growth, with around a fifth of those aged 18-34 claiming to have ever placed a bet on eSports. The figure rises even further among young men, to over a third (36%) of males aged 18-24.

| All respondents | Male | Female | 18 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65 and over | |

|---|---|---|---|---|---|---|---|---|---|

| 2017 | 7% | 9% | 6% | 14% | 16% | 10% | 5% | 2% | 1% |

| 2018 | 7% | 9% | 4% | 16% | 15% | 8% | 5% | 1% | 1% |

| 2019 | 6% | 8% | 5% | 17% | 12% | 8% | 5% | 2% | 0% |

| 2020 | 9% | 14% | 5% | 21% | 18% | 10% | 9% | 2% | 1% |

Conclusion

The data paints a picture of online gambling in which smartphones are the preferred devices, but laptops, PCs and tablets remain important routes of access. It shows that despite the opportunities to gamble online ‘on the go’, most online gambling continues to be done at home. The extent to which in-play betting has taken hold, and the growth of esports, is also clear to see. While online gambling does skew more towards younger people, and especially younger males, these activities are by no means confined to the younger generations.

Further releases from the online survey, which will look at gambling advertising and safer gambling, will follow in the next few weeks. This will help to build up a fuller picture of consumer gambling behaviour. And as the country hopefully emerges from the worst impacts of Covid-19 and returns to something approaching normality in the months ahead, we look forward to releasing more research and statistics that help us understand how consumer gambling behaviour is affected.

Notes about the online tracker survey

The Commission collects in depth data from online gamblers about their online gambling behaviour via a quarterly online tracker, conducted by Yonder Consulting as part of their online omnibus.

The 2020 data is based on a sample of c.8,000 adults aged 18+ in Great Britain. Fieldwork took place in March, June, September and December with approximately 2,000 interviews per quarter. All waves were completed after the emergence of Covid-19 and the start of the national restrictions on 23rd March 2020.

The online survey sample is sourced through Yonder’s panel and the sample is subject to quotas in-line with those used for the Commission’s quarterly telephone survey. In addition, data are weighted which are derived from The Publishers Audience Measurement Company (PAMCO) data based on a face-to-face random probability sample. The variables used for weighting are age, gender, region, social grade, tenure and working status.

Notes

1 The PC market just had its first big growth in 10 years (opens in new tab)

2 Among those with more than one account. Covers all online gambling activities including betting, bingo and lotteries.

3 In-play or live betting occurs while an event is actually taking place, for example, placing a bet on a horse race while the race is being run, or on a football match whilst it is being played. This form of betting takes place mainly, but not exclusively, on sporting events. It is predominantly an online activity with bets being made via the internet using either a betting exchange or a traditional bookmaker’s website, but it can also take place in betting shops or over the phone.

Data and downloads

Files

Feedback

We are always keen to hear how these statistics are used and would welcome your views on this publication.