Strategy

National Strategic Assessment 2020

This report sets out our latest assessment of the issues we face and the risks that gambling poses to consumers and the public

What are the issues - Higher risk products

The speed and frequency of the gambling opportunity within a game impacts the risk. Activities that permit high frequency participation are more likely to be associated with harm and more readily facilitate problematic behaviour, such as loss chasing.

This type of game may mean that some players experience greater feelings of 'punishment' (as opposed to reward), which can cause persistent play as the player tries to get away from that uncomfortable feeling. In practice, though, there is likely to be a limit to how slow a gaming opportunity can be made before a customer seeks alternative forms of stimulation.

Higher risk products typically provide players with the opportunity for fast-paced, repetitive and chance-based games which are available 24 hours a day.

Problem gamblers tend to be more motivated to gamble because of the need to relax or escape or modify their mood, and evidence suggests that faster, more continuous or repetitive games best accommodate that need.

Activities with high event frequency are likely to be the most attractive. As a result, online slots, casino and bingo are higher risk. We are focusing on products that behave like this, and the measures that can be put in place to make these products safer.

Case study

A Commission investigation found that 6 licensees were offering products providing ‘feature buy-in’ facilities on slots style games. This facility gave consumers the option of staking significant amounts of money to access the bonus feature without playing the initial stages of the game. One game was charging more than £3,000 to enter the bonus feature.

The option of purchasing a feature in a slot game raised huge concerns linked to social responsibility.

After considering Remote Technical Standards section 3A and 14A, the 6 Licensees were instructed to remove these products. This included withdrawing the identified games in their current form and any games with similar game features and functionality. Further licensees were contacted and instructed to remove games with the option to buy a feature.

The Commission’s remote gambling and software technical standards contain the following requirements:

- RTS requirement 3A: An explanation of the applicable rules must be easily available to the customer before they commit to gamble

- the content including artwork and text must be accurate, and sufficient to explain all of the applicable rules and how to participate. All reasonable steps must be taken to ensure that the content is understandable

- RTS requirement 14A: Gambling products must not actively encourage customers to chase their losses, increase their stake or increase the amount they have decided to gamble, or continue to gamble after they have indicated that they wish to stop.

The focus when discussing higher risk products is often on gaming products. However, product characteristics which traditionally acted as a natural brake on the intensity of sports betting have been eroded with the growth in in-play betting.

In-play betting allows for rapid, repeat activities, which are risk factors for problem gambling, and blur the distinction between online gaming and online betting38.

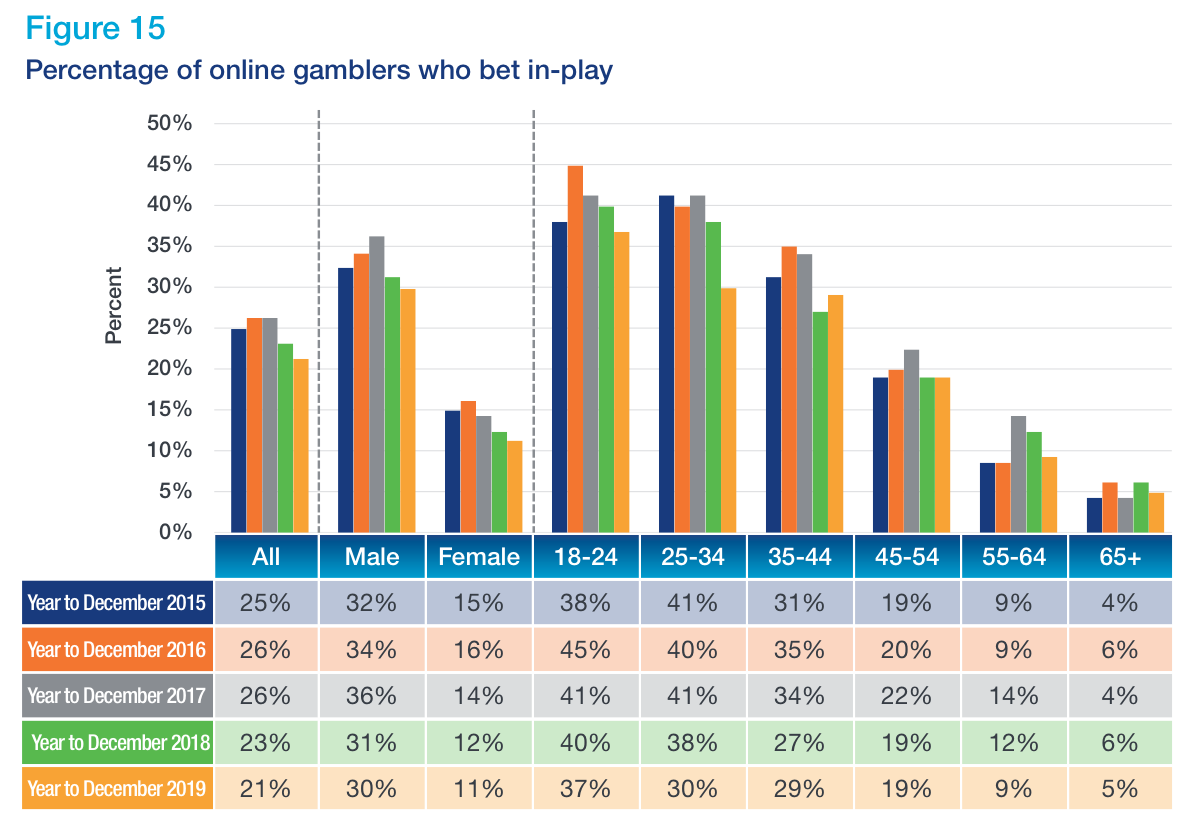

Figure 15 shows the proportion of online gamblers who bet in play. Since 2015 the proportion who do so appears to have declined from one-quarter to just over one-fifth, with the main decreases being seen in the 25-34 age groups and in females39.

Percentage of online gamblers who bet in-play

| Year | All | Male | Female | 18-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ |

|---|---|---|---|---|---|---|---|---|---|

| Year to December 2015 | 25% | 32% | 15% | 38% | 41% | 31% | 19% | 9% | 4% |

| Year to December 2016 | 26% | 34% | 16% | 45% | 40% | 35% | 20% | 9% | 6% |

| Year to December 2017 | 26% | 36% | 14% | 41% | 41% | 34% | 22% | 14% | 4% |

| Year to December 2018 | 23% | 31% | 12% | 40% | 38% | 27% | 19% | 12% | 6% |

| Year to December 2019 | 21% | 30% | 11% | 37% | 30% | 29% | 19% | 9% | 5% |

Our data shows the importance of in-play GGY to licensees, with in-play betting generating over one-half of GGY for sports where consumers can bet in play.

In-play has successfully utilised the increase in use of mobile for online gambling particularly in terms of removing friction and the constraints of pre-event betting only.

Figure 16 compares the proportion of online gamblers who bet in-play (shown on the left hand side of the infographic), currently at 21% and contrasts this figure with the proportion of relevant sports betting GGY which is derived through in-play (54%) – shown on the right hand infographic.

This illustrates the commercial importance of in-play betting to operators where a relatively small portion of online gamblers accounts for a large portion of betting GGY.

Given the risk factors associated with in-play betting, it is important that licensees ensure appropriate consumer protections are put in place. That includes controls to prevent excessive gambling, and to ensure responsible advertising and promotion of these products.

It is also important that clear player information is available on how in-play markets operate including ‘cash-out’ features and accompanying risks associated with delayed video streams or data provided to the player.

References

38 Killick, E. A., & Griffiths, M. D. (2018). In-play sports betting: A scoping study https://www.researchgate.net/publication/324550767_In-Play_Sports_Betting_a_Scoping_Study (opens in new tab)

39 Gambling participation in 2019: behaviour, awareness and attitudes Annual report (PDF) via online tracker

What are the issues - Online game and platform design Next section

Product innovation - Betting Exchanges, Pool betting and Crossover products

Last updated: 7 June 2021

Show updates to this content

No changes to show.