Strategy

National Strategic Assessment 2020

This report sets out our latest assessment of the issues we face and the risks that gambling poses to consumers and the public

What do we know

The British gambling market is diverse in terms of size and business models ranging from small-scale owner operated businesses through to the largest multi-national gambling companies in the world.

In total, we license 2,759 individual operators. 2,053 operators are licensed to provide facilities for gambling in premises or on- course, and 706 to provide online facilities42. We also license 16,508 individuals: 5,145 personal management licence holders; and 11,363 personal functional licence holders.

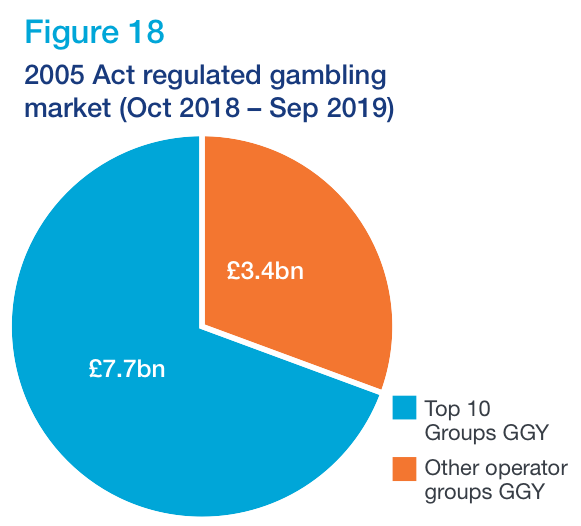

The gambling market in Great Britain has consolidated in recent years. A number of very large gambling groups who hold multiple licences and operate a number of brands dominate industry GGY. The 10 largest Gambling Groups generate 69% of total GGY (excluding the National Lottery).

We continue to collect information to help inform our regulatory assessment of licensed providers. In 2019/20 our contact centre handled 35,856 enquiries and we received 301 calls to our confidential hotline.

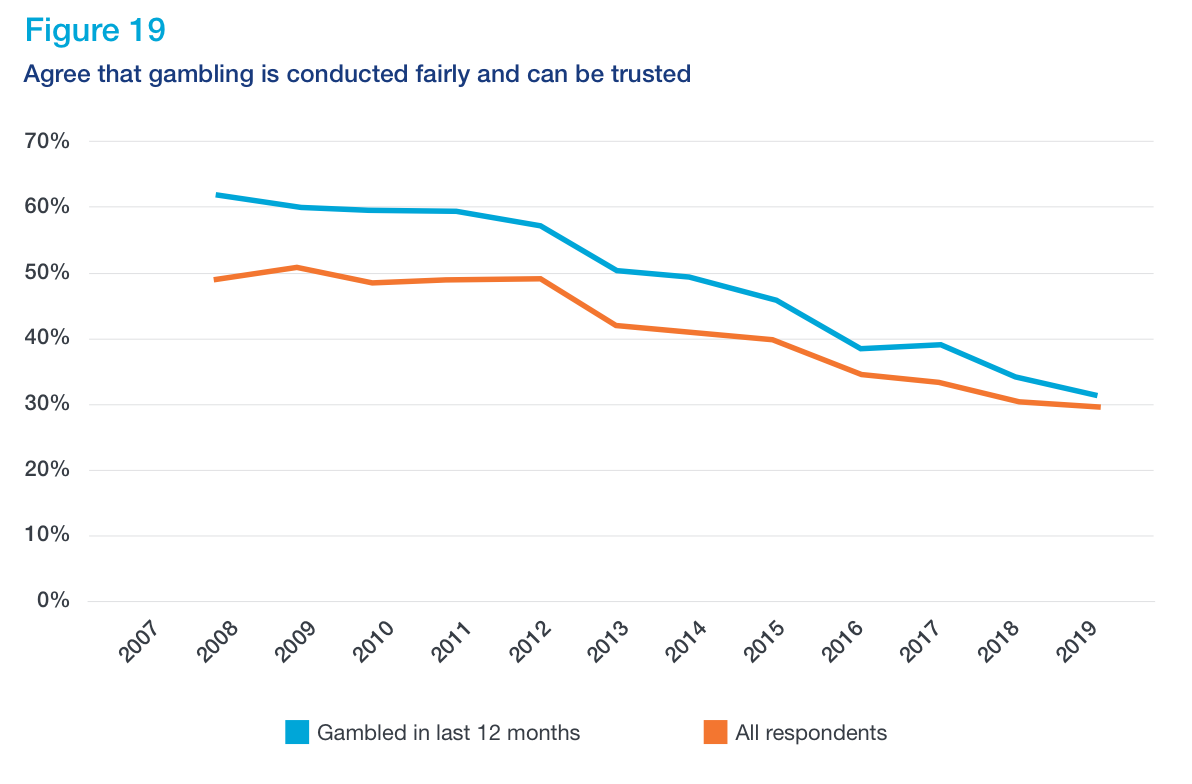

Public trust that gambling is fair

Public trust in gambling has fallen from 49% in 2008 to 29% in 201943. Despite this concerning public perception, nearly half of British adults (47%) report having gambled in the last 4 weeks.

Further research and consumer insight are required to understand the factors behind the public’s perception of gambling and the drop in trust that gambling is provided fairly. For example, we need to understand how this drop compares with changes in trust in other sectors and institutions over the same period.

Licensees should be actively supporting this by sharing data they hold based on consumer surveys on their products and services.

Complaints

Complaints from consumers are an important tool for any industry and provide an indicator of how fair and open their products and services are from a consumer perspective.

Complaints data helps licensees understand how well they are meeting the needs of their customers and whether there are areas that can be improved to both satisfy and retain existing customers, and to increase their appeal to new ones.

Complaints data can also help us identify emerging problems in the sector. It is vital that consumers can raise complaints and have licensees address them. An effective complaints process can help to improve consumer confidence in an industry.

Our regulatory return data tells us that around 165,000 consumer complaints were recorded by licensees in 2019-2044. Licensees have eight weeks to resolve complaints. After that time has elapsed, if the consumer is not satisfied with the outcome, they can refer the dispute to an alternative dispute resolution (ADR) provider.

An ADR provider is an independent third party that will take another look at the dispute. We are responsible for approving ADR providers in the gambling sector. There are eight approved providers and licensees must choose one of these. Around 5% of the complaints initially made to licensees will end up being referred to an ADR provider.

Consumers have access to comprehensive and free to use avenues redress for contractual disputes. Where consumers think they have been treated unfairly on issues relating to social responsibility – for instance when consumers think an operator should have stopped them gambling when they were exhibiting signs of harm - they don’t have the same support arrangements.

In 2018-19, our Contact Centre received around 2,300 complaints of this nature from consumers (26% of the total number of consumer complaints we received).

In 2019-20, this increased to around 2,700 complaints (27% of the total). ADR providers also report seeing increased numbers of these kinds of disputes.

ADR providers cannot deal with these kinds of complaints. We are not currently resourced or equipped to adjudicate individual complaints and, where appropriate, direct licensees to provide redress.

GC action

We will improve our data systems and capacity to ensure consumer issues are identified and acted upon quickly.

References

42 Some operators hold licences for both premises based and online gambling.

43 Gambling participation in 2019: behaviour, awareness and attitudes Annual report (PDF) from Telephone survey – similar chart on p35

44 These are complaints that entered a licensee’s complaints process and not those resolved quickly via online chat, for example

Key issues and risks Next section

What are the issues - Ownership and governance

Last updated: 7 June 2021

Show updates to this content

No changes to show.