Statistics and research release

Market overview - consumer research March 2021 (published April 2021)

Market overview - consumer research March 2021 (published April 2021).

Summary

Also published recently

Throughout the coronavirus (COVID-19) period, we have published research data to help us better understand potential risks to consumers.

Details

In previous survey data from October to December 2020 we provided contextual indicators of how the pandemic had affected consumers in terms of their wellbeing and explored the reasons why people had increased or decreased their gambling activity during the coronavirus period. In this latest release of consumer data, again taken from the Yonder online omnibus, we have aggregated data from fieldwork conducted in January, February and March 2021 to generate a large, nationally representative sample of 3,323 adults.1.We have compared this latest data from the first quarter of 2021 with corresponding data collected in the last quarter of 2020 to provide insights into the impact of the latest national lockdown2.

The impact of the latest lockdown has been felt by consumers, with significant increases in the proportions of GB adults reporting having more spare time, feeling more bored and feeling more stressed in the first quarter of 2021 compared to the last quarter of 2020. In the latest period, 50% report an increase in the amount of spare time they have, compared with 44% in quarter 4 2020, while the proportion saying the amount of boredom they have felt has increased has risen from 47% to 54%, and those stating the amount of stress they have felt has increased has risen from 47% to 50%.

The latest three-month survey period also shows 62% of adults reporting spending more time online, 42% saying they have felt lonelier, and 27% saying their household income has declined in the coronavirus period. One in five also say they have noticed an increase in the amount of marketing by gambling companies in the coronavirus period, compared to only 7% who think that this has decreased.

While our official participation statistics show that fewer people are gambling in the population overall, the Yonder online tracker data enables us to see whether gambling activity is increasing or decreasing among those who gamble.

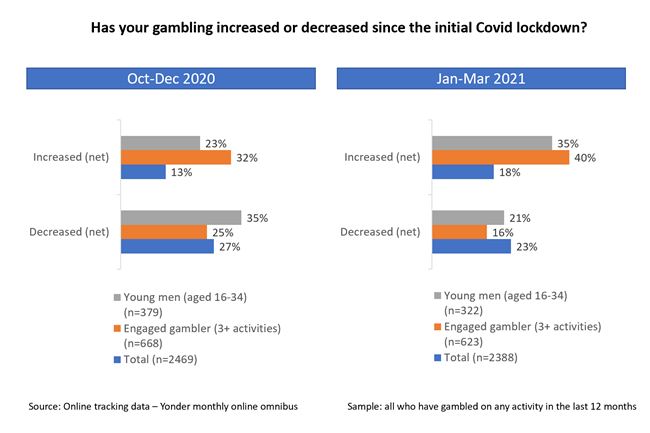

Among adults who have gambled in the last 12 months, claimed levels of activity have increased since the start of the pandemic, but also show a further increase in Quarter 1 2021 compared to Quarter 4 2020 which can be attributed, at least in part, to the latest lockdown. In the combined January-March data, 18% of past 12 month gamblers state their gambling has increased since the pandemic began, compared to 13% in the previous combined three-month period. At the same time, the proportion of gamblers saying their activity has decreased fell from 27% in October-December 2020 to 23% in January-March 2021. The increased gambling activity reported in our January-March surveys is particularly evident among males aged under 35 and engaged gamblers (who take part in 3+ activities).

The latest research data continues to suggest that young women (aged under 35) are more likely than average to have started gambling since March 2020, where they hadn’t gambled before. Some 9% of young women who had ever gambled, started doing so during the coronavirus period, compared to 4% of all gamblers. As would be expected, online activities have the highest proportion of new players since the pandemic began.

In similar results to the previous three-month period, most gamblers anticipate their gambling spend remaining the same (72%) or decreasing (22%) over the next three months, and relatively few (4%) anticipate an increase. Nonetheless, when considering the results of this research against the environmental factors brought by the latest lockdown, our view is that risk did increase for consumers.

Notes

1 Yonder interviewed a total of 3,323 respondents aged 16 and above, with fieldwork conducted from 15-17 January, 19-21 February and 19-21 March 2021. This survey is separate from the Commission’s quarterly online survey, which is also run by Yonder. Please see the attached data tables for the sample sizes for individual statistics, noting that caution should be applied for lower sample sizes.

2 It should be noted that the consumer data reported here is based on questions asked in the coronavirus period only. We do not have corresponding data to benchmark the results shown against pre-coronavirus levels.