Statistics and research release

Coronavirus (COVID-19) and its impact on gambling – June 2020

Coronavirus (COVID-19) and its impact on gambling – June 2020.

Summary

Details

Overview

The coronavirus (COVID-19) crisis continues to affect everyone across Great Britain. The lockdown has also brought significant consumer behavioural change and major impacts on the gambling industry.

Our responsibility during the crisis is to protect consumers and we are focused on understanding how the risks posed to them are changing. To help understand these risks and trends, and to inform public knowledge, we are collecting additional data from operators1 and consumer research2 – allowing us to build a clearer picture week by week.

General consumer trends

When assessing the gambling market, we should look to wider consumer trends for important context, in terms of how they feel, the money in their pocket and how they are spending our time.

Research by Savanta reports that 23% of the population feel their mental health in general has been negatively affected. There has also been a significant financial impact, with the same research noting that 39% of people have seen their disposable income decrease.

Naturally, while spending most of our time in the home, we have also seen changes in the way people engage with news and entertainment. This is particularly so among people who gamble. According to YouGov data up to 7 May, those who had gambled in the past four weeks were more likely than the national average to have:

- Spent more money online on entertainment (17% of gamblers compared to 12% of all adults)

- Watched TV more (56% of gamblers compared to 43% of all adults)

- Consumed more on-demand entertainment (50% of gamblers compared to 39% of all adults)

Gambling Market Impacts

On 20 March all retail gambling venues closed – meaning that, at a stroke, activities that normally generate 50%3 of the overall market (excluding lotteries) stopped.

Operator data collected by the Commission comparing March 2020 with March 2019 provided an initial insight into the changing shape and size of the market. April data now provides a clearer picture.4

Overall, fewer consumers are gambling

The lockdown period does not appear to have attracted many new consumers to gambling. According to YouGov research from 16-17 April5, only 0.2% of all adults surveyed stated that they had started gambling for the first time during the last four weeks. This compares with 2% of adults who had stopped gambling altogether during this period.

Operator data on overall active player accounts6indicates a 5% decrease between March and April 2020, driven substantially by real event betting (active players down 55%), and reflecting the lack of top-quality sport during April. Although fewer consumers are taking part in sports betting, the data indicates that the participation has not fallen as drastically as anticipated at the beginning of the crisis.

This is reflected in the four waves of the YouGov survey conducted from 16 April to 7 May. Past-four-week gambling participation remained relatively stable, with the exception of significant decreases in participation in National Lottery draws and sports betting, and a significant increase in those playing National Lottery online instant win games.7

National Lottery sales have held up reasonably. Despite an initial fall, sales have recovered to a level slightly below normal8.

Some people, who are gambling already, are trying new products

Our analysis of year on year data for the number of activities undertaken by online gambling consumers indicates that, over the last year, there has been a shift towards a larger number of online activities. During April 2019, 26% of consumers appeared to engage in more than one online activity, a figure which rose to 42% during April 2020. We know from previous studies that engagement across a larger number of activities can correlate to higher levels of moderate-risk and problem gambling recognising that the data does not include offline activities which have not been available during the lockdown period.

The lockdown period has also shown an increase in range of activities for some; the YouGov research shows that around a third of past four-week gamblers say they have tried one or more gambling activities for the first time during lockdown9. This figure rises to over half (54%) of engaged gamblers10 – meaning those who have participated in three or more gambling activities in the last four weeks – with 18% of this group having tried betting on virtual races or sports and a similar proportion trying out online bingo for the first time during the last four weeks. The main new activity is National Lottery draw-based games, with one in five recent gamblers claiming to have played National Lottery draws for the first time in the last four weeks.

Online operator data shows that certain products are seeing active player increases compared to March 2020 (some from low comparative bases of players) or are broadly level following growth seen year on year in March. These are generally those with a faster play cycle.

Total number of active players per vertical during March 2019, March 2020 and April 2020

| % y-o-y change March | % change from March 2020 to April 2020 | |

|---|---|---|

| Slots | 25% | -2% |

| Other gaming (including casino) | 13% | 5% |

| Betting (Real event) | -11% | -55% |

| Betting (Virtual) | 88% | 44% |

| Poker | 53% | 53% |

This shift is against the backdrop of relatively stable advertising awareness, where the YouGov research11 hows that 34% of adults recalled seeing marketing for online bingo, casino or slots games in the last four weeks. This is comparable with 39% in our pre-lockdown research12.

Overall gamblers claim to be playing products at the same rate or less

A majority of those who have participated in 3 or more gambling activities in the last four weeks claim to be spending more time or money on one or more activities.

This is reflected in growth in the average number of bets per customer on some products

The volume of activity on certain products appears to be still be growing. We have seen a slight shift compared to our last report, for both slots and casino products, which are the largest constituent parts of online gaming.

While active player numbers are growing, the number of bets placed is now growing at a faster rate. This indicates both an overall growth in the product, and an increase in the average number of bets per customer.

Total number of bets placed per vertical during March 2019, March 2020 and April 2020

| % y-o-y change March | % change from March 2020 to April 2020 | |

|---|---|---|

| Slots | 16% | 15% |

| Other gaming (including casino) | 3% | 25% |

| Betting (Real event) | -31% | - |

| Betting (Virtual) | 40% | 37% |

| Poker | 38% | 70% |

Note: some verticals are starting from small base sizes, impacting percentage sizes where absolute growth is small in comparison with other verticals – see data tables for more detail.

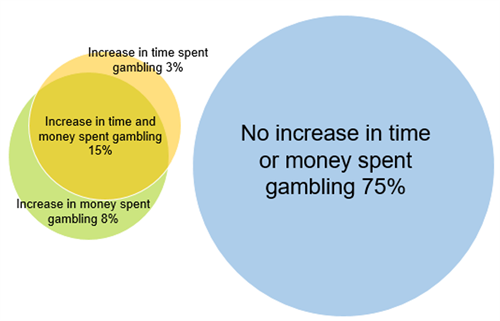

These changes need to be viewed in the context that the YouGov research shows the majority (three quarters) of recent gamblers indicate that they have not increased the time or money they have spent on any gambling activities.

Percentage of recent gamblers who have increased the time and/or money they have spent on one or more gambling activities, including the National Lottery.13

The profile is different for engaged14 gamblers. More than six in ten (62%) have increased either the amount of time or money they have spent on at least one gambling activity, including National Lottery products, noting that this does not necessarily mean that the time or money they have spent overall on all gambling has increased.

Increase in numbers of sessions over an hour

Between March and April 2020, the average session length reported by operators has not changed. Within that, the number of sessions which lasted more than one hour increased to 2,274,521. This means that the proportion of sessions lasting more than one hour remains at around one in eight.

Notes

1 From the biggest operators, covering approximately 80% of the online gambling market, noting that it may include some duplication of customer numbers where it is not possible to identify unique customers

2 As part of our regular research programme, we publish a range of official statistics on consumer gambling participation and the prevalence of problem gambling. Official statistics are published on a quarterly basis from our telephone survey via an annual gambling behaviour report (opens in new tab) and via Health Surveys (opens in new tab) approximately every 2 years. These official statistics remain our most robust and trusted sources of gambling participation and problem gambling data.

However, the pre-defined timings of the surveys that contribute to our official statistics do not allow us to provide regular reports on the impact of coronavirus at this time.

Therefore, in response to the coronavirus outbreak, The Gambling Commission has commissioned questions on YouGov’s COVID-19 tracker, a weekly online survey of around 2,000 adults in Great Britain, which enables us to monitor key metrics including:

- Changes in gambling participation

- How many people are taking up gambling activities for the first time

- How many people are increasing the time or money they spend on gambling

The YouGov data is not being published as official statistics, but provides the Commission with a flexible way to add to our consumer evidence base via a weekly nationally representative survey. For more information on the methodology of the YouGov survey please see the data tables.

3 Gambling Commission Industry statistics

4 It should be noted that:

- the first half of March (pre-lockdown) featured Cheltenham, a major event in the horse racing calendar, as well other sporting events, which have a major impact on the results of the data. This data therefore does not provide a full picture of the impact coronavirus has had on the market.

- It is also worth considering that while we expect products to experience some organic growth year on year (y-o-y), the increases we have seen from the data in certain products goes above and beyond what can be considered as organic year on year growth

5 YouGov COVID-19 Tracker

6 Players who have placed one or more bet / spin during the month

7 National Lottery online instant win growth was from a low base and against a backdrop of decreasing scratchcard sales

8 The National Lottery operator Camelot will release April sales figures in line with publication timescales in the week commencing 15 June, find at Camelot's website (opens in new tab)

9 In the first wave (16-17 April) the last 4 weeks could include a short period pre-lockdown, but we do not think this point impacts the finding significantly. For clarity this also includes National Lottery products.

10 138 respondents has participated in three or more gambling activities in the last four weeks, which represents 5% of all those who had gambled in that period.

11 YouGov COVID-19 Tracker

12 From Populus online tracker March 2020

13 Source: YouGov COVID-19 Tracker Wave 6-9. Sample: 1,948 respondents aged 18+ who had gambled in the last four weeks but not for the first time

14 By ‘the engaged’ we mean those who have participated in three or more gambling activities in the last four weeks, but not for the first time. The sample size for this group is relatively low (n=138), however, compared to all who have gambled in the last four weeks (not for the first time), the difference in the proportion who have increased the time or money they have spent is statistically significant.