Statistics and research release

Insights on the Path to Play framework

Insights on the Path To Play framework conducted in association with Yonder.

Summary

Also published recently

For the last 2 and a half years the Gambling Commission has been working in partnership with Yonder Consulting to deliver its Consumer Voice programme, which gathers views, opinions, and insights directly from gambling consumers. In this blog, Roland Stout, Research Director at Yonder, reflects on how the programme has enhanced our understanding of consumer journeys, as depicted through the Path to Play framework.

Details

Since late 2022, Yonder, in collaboration with the Commission, has conducted research to explore key gambling-related issues. This has included identifying drivers of consumer trust and developing trust metrics for the Gambling Survey for Great Britain (GSGB), examining consumer use of promotional offers, investigating financial vulnerability and financial risk checks, and tracking the impact of the cost of living on gambling through a longitudinal survey. Yonder has also studied the influence of major sporting events like the 2022 World Cup and 2024 Euros. More recently, we have begun to scope the unlicensed gambling market, focusing on gambler motivations and methods to detect unlicensed activity.

While the programme has addressed specific briefs, it has been highly iterative, consistently connecting insight streams to identify broader evidence gaps and deepen understanding of key audiences. It has also helped clarify the questions regulators should be prioritizing.

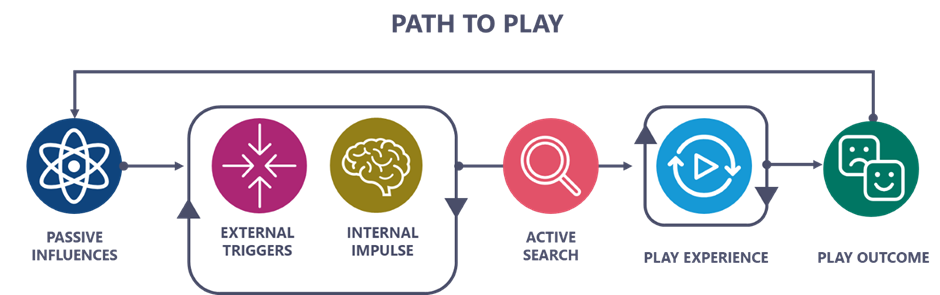

Throughout the programme findings have consistently been linked back to the Path to Play framework which seeks to qualify the gambler journey. Further details on the Path to Play can be found in the Path To Play Framework.

Some of the main overarching implications from the programme to date are in the following paragraphs.

Viewing the Path to Play as a linear process may be limiting, as it focuses on short-term fixes rather than underlying causes.

The concept of the ‘Path to Play’ has evolved. With the rise of ‘always on’ online gambling and increasingly sophisticated marketing strategies, the journey into gambling is becoming more integrated, dynamic, and seamless than ever before.

Digital platforms now ensure that gambling is constantly available. Marketing and promotional offers are omnipresent - regular gamblers are exposed to them almost continuously. Our research into promotional activity reveals just how abundant and pervasive these incentives have become. Gamblers encounter them through influencers, online forums, word of mouth, paid advertisements, direct marketing, WhatsApp groups, and niche gambling communities. This saturation, combined with the speed at which offers are acted upon, creates a fast-paced and overlapping decision-making environment, where choices are made quickly and often impulsively. The complexity and fluidity of the customer journey and Path to Play requires reappraisal such that it can better reflect the dynamic interplay of influences, triggers, and experiences across the gambler journey.

A more nuanced appreciation of this shifting landscape is essential for designing interventions that reflect real-world influences and motivations.

There is evidence that once individuals become deeply engaged in gambling, they may continue regardless of the consequences, especially when exposed to real-time prompts like in-play messaging. Here, our study on consumer trust uncovered a key paradox: while many gamblers express distrust toward gambling operators, this sentiment rarely translates into changes in behaviour once they are actively involved. Interestingly, quantitative research into customer journeys and operator-led tools shows that when responsible gambling tools are promoted, gamblers may view operators more favourably. However, this shift in perception doesn’t appear to meaningfully alter behaviour in the moment.

Recognising that interventions may more likely be more effective when they reach individuals before gambling becomes deeply embedded feels critical to acknowledge. The cost of living research strongly supports this by emphasising how the relationship with gambling is often deeply ingrained and begins at a young age, particularly for individuals who view gambling as a key part of British culture. A better understanding of the range and variability of gambling experiences is essential to move beyond a one-size-fits-all approach.

Research into promotional offers reveals distinct differences between novice and experienced gamblers. Novices tend to be more exploratory in their behaviour, often influenced by marketing, bonuses, and peer recommendations. They appear more open to trying various forms of gambling. In contrast, experienced gamblers typically adopt a more sceptical view of promotional offers, maintain established betting routines, and often engage in niche gambling communities or specialist forums.

Anecdotal evidence also points to a rise in female gambling, or at least greater openness about it. Women may approach gambling more strategically and discreetly, often treating it as a form of personal downtime. Their betting patterns can fluctuate around specific events - such as Euro 2024 - where there was a marked increase in female participation, outpacing the rise among male respondents.

Importantly, research also suggests that those who are financially vulnerable often work the hardest to sustain their gambling behaviour, which may shape how they engage with the Path to Play.

These insights underline the importance of mapping consumer journeys more precisely across different groups, particularly women, younger individuals, and those identified within higher PGSI (Problem Gambling Severity Index) categories. Embedding this understanding into a revised view of the Path to Play framework could help to quantitatively identify the key drivers shaping behaviour among diverse audiences, supporting more targeted and effective interventions.

Accordingly, the goals of the Consumer Voice Programme should be to adopt a more rounded outside-in approach

The focus should move towards a deeper understanding of audiences in their entirety, rather than simply focusing on a specific topic. This means looking across the full consumer journey or experience, acknowledging its variability, and recognising the broader context of people’s lives, needs, and behaviours.

To do this effectively, we should look to enhance the use of digital tools. By leveraging sophisticated social intelligence techniques, we can access insight-rich data that allows us to understand people’s lived experiences in real time.

Now is perhaps also the right moment to consider collaboration with other adjacent organisations and sectors to deepen audience understanding. For example, what can we learn from how consumer-facing businesses map customer journeys or how other sectors design regulation with end-users in mind? This kind of cross-sector insight can help us move beyond working solely from the inside out and instead adopt a truly outside-in perspective that places the human being, rather than the gambler, at the centre.

At Yonder, we pride ourselves on using customer-centric insight to unlock commercial growth. However, in our work with the Gambling Commission, shifting towards a deeper, more joined up, understanding of what motivates behaviour at the heart of our approach will, we believe, ultimately enable us to better support the goal of reducing harm.

Data and downloads

There are no files for this release.