Statistics and research release

How the consumer engages with safer gambling opportunities

Research on the steps taken to ensure consumer protection throughout their gambling journey.

Summary

Also published recently

Research on the steps taken to ensure consumer protection throughout their gambling journey.

Key facts

This release contains data on metrics captured in 2020, taken from an online survey of c.8,000 adults in Great Britain. The results show that:

- in terms of gambling management tools, gamblers are most aware of and have most commonly used the financial limits tool

- those in the younger age groups, online gamblers and engaged gamblers are the groups most likely to have used safer gambling tools to control their gambling, albeit engagement is still low

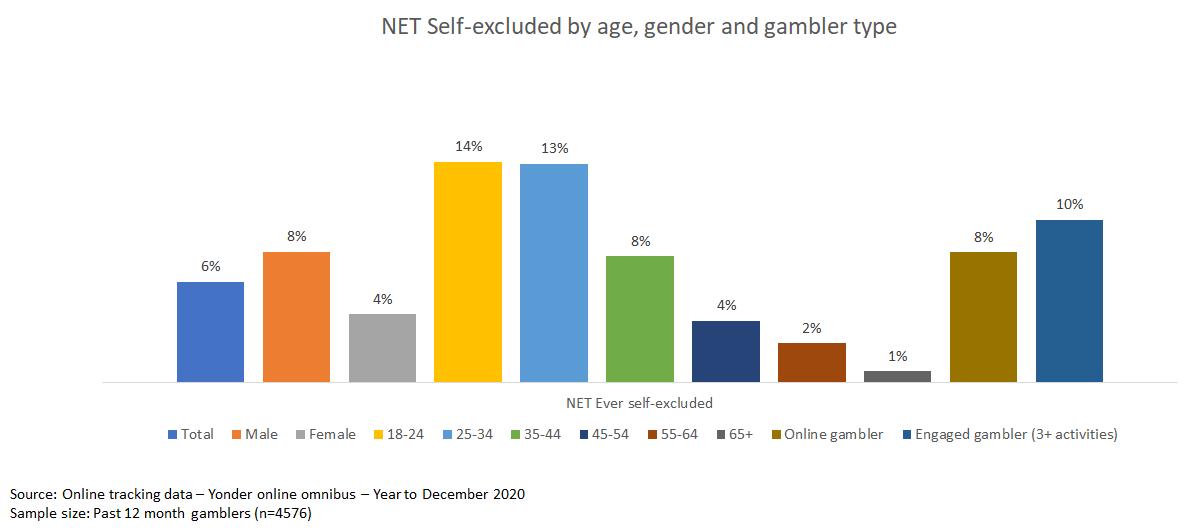

- those in the 18-34 age group are most likely to have ever self-excluded. Online gamblers and engaged gamblers were also more likely to have ever self-excluded

- most consumers are aware of operator terms and conditions, but readership of these is low.

Details

Previous releases in this series

What we think

We recognise that there will always be differences in the awareness and use of safer gambling tools. it was particularly interesting to see that the awareness of payment card blocking with your bank, which was first brought in during 2018, had higher levels of awareness than some of the more established gambling management tools.

Whilst only a minority of gamblers make use of these gambling management tools, it is encouraging to see that the tools are reaching those groups most at risk of harm, according to the PGSI scores for these demographics.

We understand from our other research work that many gamblers do not always see themselves as gamblers, even when they have participated in a gambling activity. This is also the case with problem gambling, with many of those experiencing harm not recognizing it. Those customers are unlikely to seek out or recognise the need to engage with these tools.

Operators are required to offer these tools, and they should provide them and promote them in a way that maximises take up from those that would benefit from them, but there will always be customers that are experiencing harm that would not opt to take up any of these gambling management tools. This is why it is important for operators to have effective customer interaction approaches so that harm is identified at an early point with the operator acting to reduce harm.

We would like to see an increased awareness of the gambling management tools, and for operators to continue to improve promotion so that customers make the best use of the right tool, at the right time for them.

Introduction

As part of our work to understand consumers better, we run a series of questions on our online tracker to understand if and how consumers make use of the safer gambling protection tools available to them. This information also helps inform related policy decisions.

In this release we explore the terms and conditions, gambling management tools and the self-exclusion facility.

About the online survey

The data is based on the Gambling Commission’s quarterly online survey conducted by Yonder Consulting. A nationally representative sample of approximately 8,000 adults aged 18 and over in Great Britain were interviewed during March, June, September and December 2020. All the data was collected during either national or some element of local restrictions.

Base sizes for individual sections of the survey can be found in the respective charts.

Further details on the quarterly online survey methodology can be found in the notes section.

Comparisons to previous years’ data are not always appropriate due to changes to the survey questions and routing.

Engaging in gambling - Terms and Conditions

Each gambling operator has its own individual set of terms and conditions which set out the agreement between them and the customer at the beginning of their gambling activity, and, amongst other things, sets out how to play safely with the operator. Gambling operators (and other industries) must ensure that any terms and conditions are fair and made available in plain and simple language. Operators must also inform consumers in advance if they make any significant changes to their terms and conditions.

In the Commission’s survey, respondents who have gambled (on any activity) in the past 12 months are asked whether they have ever read terms and conditions and, if they have, whether they found them to be helpful.

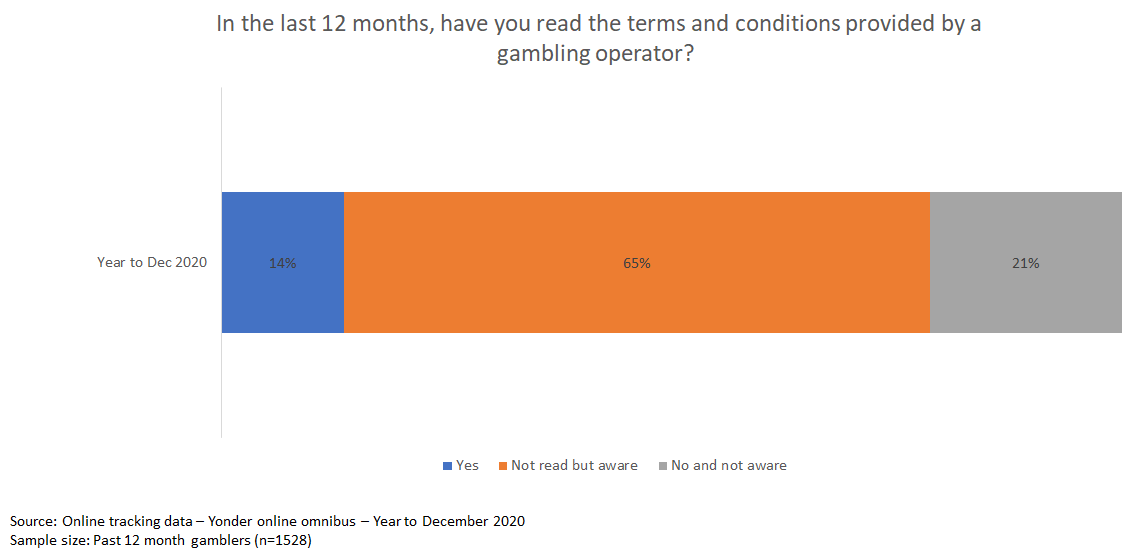

Most gamblers are aware of operator terms and conditions, but readership of these is low.

Overall, 14% of past 12 month gamblers had read the terms and conditions provided by a gambling operator in the past 12 months. The majority (65%) are aware of terms and conditions but have not read them. Around a fifth (21%) did not know that terms and conditions were available.

In the last 12 months, have you read the terms and conditions provided by a gambling operator? (n=1,528 past 12 month gamblers)

| Yes | No - but I was aware that they were available | No - and I wasn't aware that they were available |

|---|---|---|

| 14% | 65% | 21% |

Of those who had read terms and conditions provided by a gambling operator

- 70% found them easy to understand (either fairly or very).

- 31% had been in a situation where they felt that an operator’s terms and conditions were unfair.

The data also shows that of those who had read the terms and conditions, seven out of ten found them easy to understand. Around three in ten had been in a situation where they felt that an operator’s terms and conditions were unfair. Of those who had read terms and conditions, males and younger age groups were most likely to have been in a situation where they felt they were unfair.

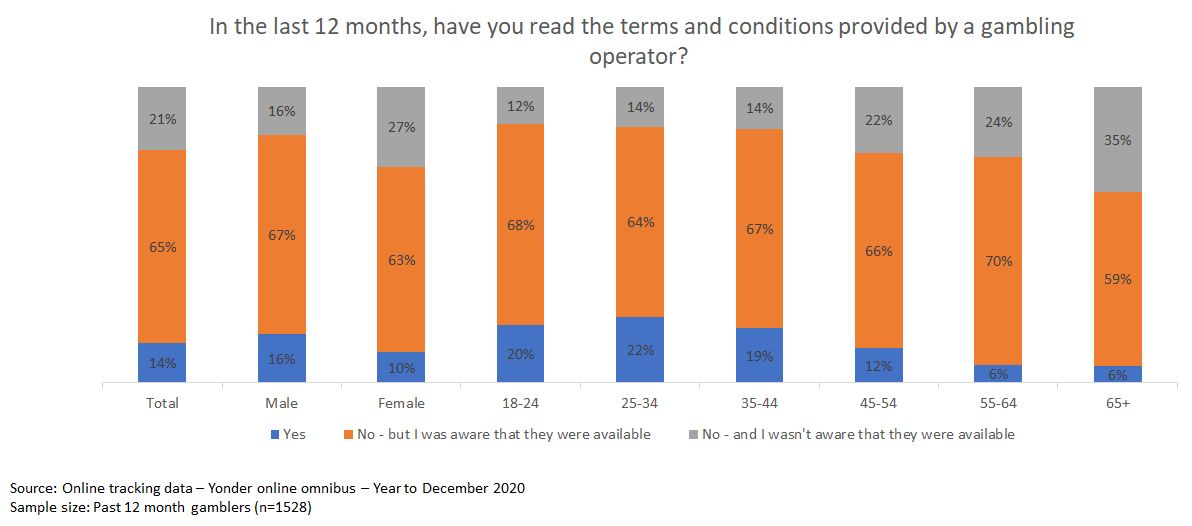

In the last 12 months, have you read the terms and conditions provided by a gambling operator? (n=1,528 past 12 month gamblers)

| Total | Male | Female | 18 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65 and over | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 14% | 16% | 10% | 20% | 22% | 19% | 12% | 6% | 6% |

| No - but I was aware that they were available | 65% | 67% | 63% | 68% | 64% | 67% | 66% | 70% | 59% |

| No - and I wasn't aware that they were available | 21% | 16% | 27% | 12% | 14% | 14% | 22% | 24% | 35% |

Males and those in younger age groups generally have higher awareness of terms and conditions, with 8 in 10 male gamblers having either read these in the past 12 months or are aware of them. The majority of those aged 18-24 report having either read or being aware of terms and conditions, with this percentage declining gradually with age. Around a third of gamblers aged 65+ appear to be unaware that terms and conditions are provided by gambling operators.

Controlling gambling behaviour - Gambling management tools

During gambling play, there are a number of tools available to consumers which can help a player to control their gambling. These tools, principally online, consist of self-exclusion by product, setting time or money limits, reality checks1, using time-outs to suspend play for a short period of time, gambling blocking software and payment card blocking with a bank. Within the survey, respondents are asked whether they are aware of each tool and whether they’ve ever used it.

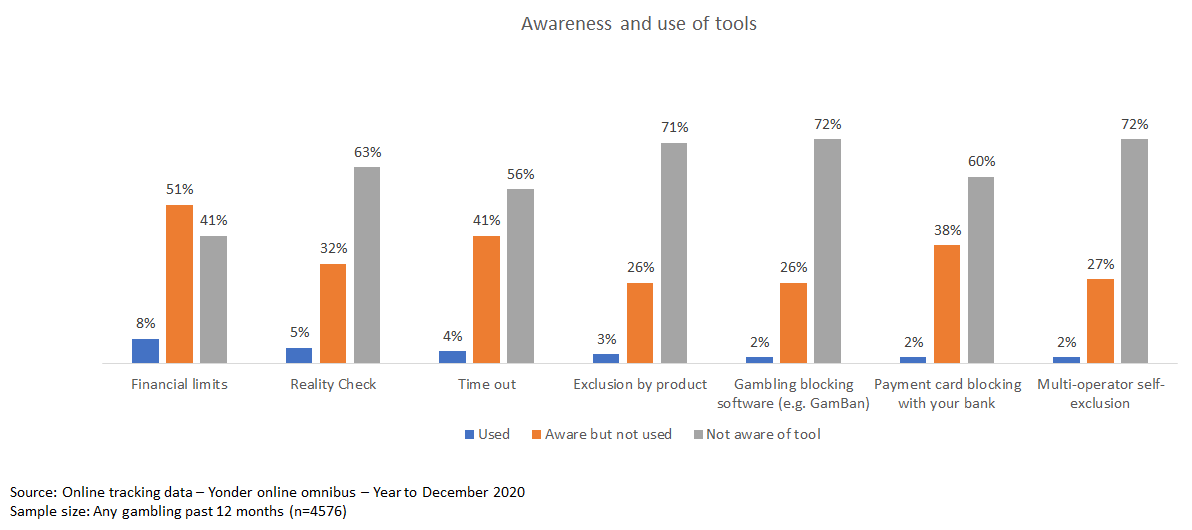

Financial limit-setting tools have the highest awareness and use

The most used tool is setting financial limits, with 8% of gamblers having done this, followed by a reality check, which 5% of gamblers have used. Those tools with the lowest levels of awareness were gambling blocking software, multi-operator self-exclusion and exclusion by product, with over seven in ten past 12 month gamblers unaware of these tools.

In 2018, Starling Bank and Monzo became the first banks to offer the payment card blocking feature2. It was, therefore, interesting to see that the awareness of this management tool sat at 38%, much higher than some of the other more established gambling management tools.

Further research on the use of bank transactional data, including the gambling block function is available on the BeGambleAware website (opens in new tab).

Use and awareness of safer gambling tools (n=4,576 past 12 month gamblers)

| Financial limits | Reality Check | Time out | Exclusion by product | Gambling blocking software (e.g. GamBan) | Payment card blocking with your bank | Multi-operator self-exclusion | |

|---|---|---|---|---|---|---|---|

| Used | 8% | 5% | 4% | 3% | 2% | 2% | 2% |

| Aware but not used | 51% | 32% | 41% | 26% | 26% | 38% | 27% |

| Not aware of tool | 41% | 63% | 56% | 71% | 72% | 60% | 72% |

Younger players, online players and engaged gamblers are more likely to use gambling management tools

Younger age groups are most likely to engage with safer gambling tools to control their gambling, albeit engagement is still low. It can also be seen that the likelihood of using these tools reduces with age. Gambling management tools are also more likely to be utilised by online and engaged gamblers (defined here as those who have taken part in 3 or more different gambling activities in the past 12 months).

Use of safer gambling tools by age, gender and gambling status (n=4,576 past 12 month gamblers)

| Total | Male | Female | 18 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65 and over | Online gamblers | Engaged gamblers (3+ activities) | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NET Used any | 13% | 16% | 11% | 26% | 21% | 17% | 12% | 8% | 4% | 16% | 20% |

| Financial Limits | 8% | 10% | 7% | 13% | 11% | 12% | 8% | 6% | 3% | 11% | 12% |

| Reality check | 5% | 5% | 4% | 7% | 7% | 7% | 5% | 3% | 1% | 6% | 7% |

| Time out | 4% | 4% | 3% | 9% | 6% | 5% | 2% | 2% | 1% | 5% | 6% |

| Exclusion by product | 3% | 3% | 2% | 6% | 6% | 3% | 1% | 1% | 0% | 3% | 4% |

| Gambling blocking software | 2% | 3% | 1% | 6% | 5% | 3% | 1% | 0% | 0% | 3% | 4% |

| Payment card blocking | 2% | 3% | 2% | 6% | 6% | 3% | 1% | 0% | 0% | 3% | 4% |

| Multi-operator self-exclusion | 2% | 2% | 1% | 5% | 4% | 2% | 1% | 0% | 0% | 2% | 3% |

| Unweighted base | 4,576 | 2,389 | 2,187 | 414 | 734 | 779 | 888 | 731 | 1,030 | 3,490 | 2,628 |

Controlling gambling behaviour - Self exclusion

If a consumer thinks that they are spending too much time or money gambling, whether online or in gambling premises, and wishes to be supported in their decision to stop, they can ask to be self-excluded from a gambling operator or to self-exclude from multiple operators. This is when the consumer enters a voluntary agreement that commits them to abstain from gambling and the operator to take all reasonable steps to prevent them from gambling with them for a period of time. The minimum self-exclusion period is six months.

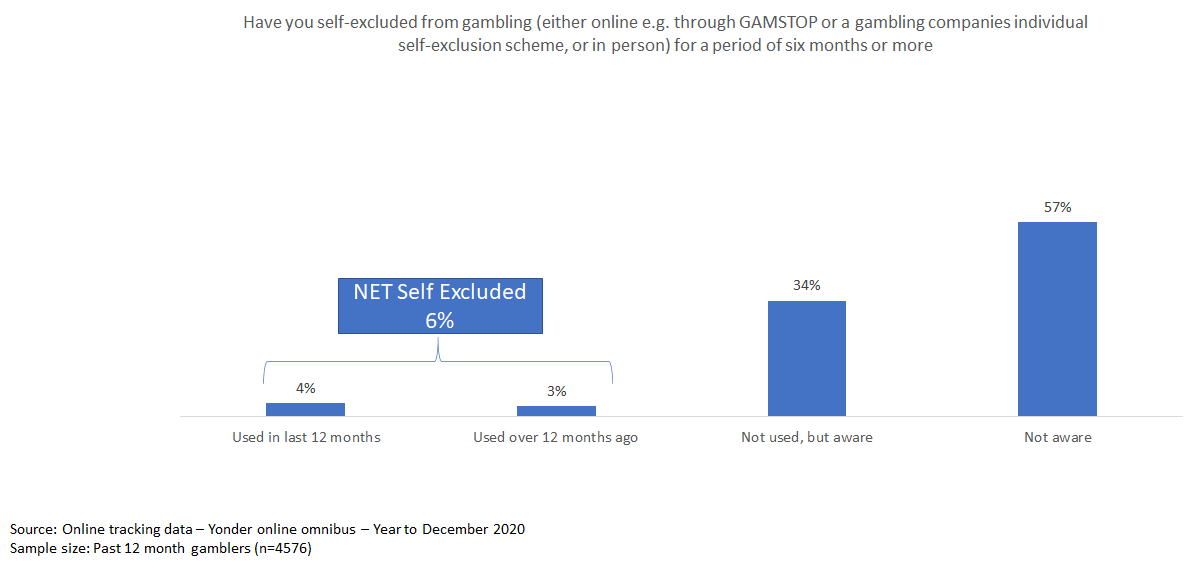

Rates of self-exclusion are low but are used by one in seven young people

Overall, 6% of gamblers have ever self-excluded. 34% of gamblers are aware of self-exclusion but have not self-excluded. Over half of gamblers are not aware of self-exclusion.

Use and awareness of self-exclusion (n=4,576 past 12 month gamblers)

| NET Ever self-excluded | Used in the last 12 months | Used over 12 months ago | Not used, but aware | Not aware |

|---|---|---|---|---|

| 6% | 4% | 3% | 34% | 57% |

Figures show that higher proportions of male gamblers have self-excluded compared to females. Those in the 18-24 age group are most likely to have self-excluded (14%), closely followed by those aged 25-34 at 13%.

Use of self-exclusion by age, gender and gambling status (n=4,576 past 12 month gamblers)

| Total | Male | Female | 18 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65 and over | Online gambler | Engaged gambler (3+ activities) |

|---|---|---|---|---|---|---|---|---|---|---|

| 6% | 8% | 4% | 14% | 13% | 8% | 4% | 2% | 1% | 8% | 10% |

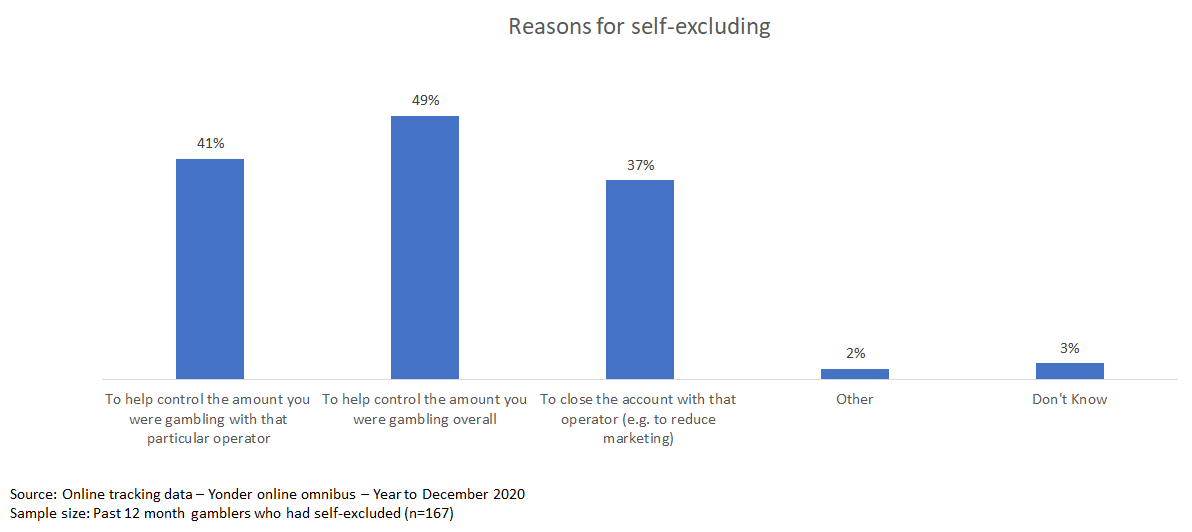

Whilst self-exclusion is a facility to manage potentially problematic gambling, not everyone will use it only for this reason, such as 37% looking to use it to close the account with that operator. If gamblers within the survey have ever self-excluded, they are asked why they chose to self-exclude. The most common reason given for self-exclusion is to help control the amount being gambled overall (49%), followed by, to help control the amount being spent with a particular operator (41%).

Reasons for self-excluding (n=167 past 12 month gamblers who had self-excluded)

| To help control the amount you were gambling with that particular operator | To help control the amount you were gambling overall | To close the account with that operator (e.g. to reduce marketing) | Other | Don’t Know |

|---|---|---|---|---|

| 41% | 49% | 37% | 2% | 3% |

Conclusion

In terms of the safer gambling tools available within the industry, our data showed us that male and younger gamblers were the groups most likely to engage with these tools. We also see that the use of these tools generally declines with age. In terms of the gambling management tools and the self-exclusion tool, it was also the case that online gamblers and engaged gamblers made more use of the tools than the average gambler.

We recognise that there will always be differences in the awareness and use of safer gambling tools and it was particularly interesting to see that the awareness of payment card blocking with your bank, which was first brought in during 2018, had higher levels of awareness than some of the more established gambling management tools.

Whilst only a minority of gamblers make use of these gambling management tools, it is encouraging to see that the tools are reaching those groups most at risk of harm, according to the PGSI scores for these demographics.

We understand from our other research work that many gamblers do not always see themselves as gamblers, even when they have participated in a gambling activity. This is also the case with problem gambling, with many of those experiencing harm not recognizing it . Those customers are unlikely to seek out or recognise the need to engage with these tools.

Operators are required to offer these tools, and they should provide them and promote them in a way that maximises take up from those that would benefit from them, but there will always be customers that are experiencing harm that would not opt to take up any of these gambling management tools. This is why it is important for operators to have effective customer interaction approaches so that harm is identified at an early point with the operator acting to reduce harm.

We would like to see an increased awareness of the gambling management tools, and for operators to continue to improve promotion so that customers make the best use of the right tool, at the right time for them.

Previous releases from the online survey are available on our website and explore the areas of gambling advertising and online behaviour. Together these releases help to build up a fuller picture of consumer gambling behaviour. And as the country hopefully emerges from the worst impacts of Covid-19 and returns to something approaching normality in the months ahead, we look forward to releasing more research and statistics that help us understand how consumer gambling behaviour is affected.

Notes about the online tracker survey

The Commission collects in depth data from online gamblers about their online gambling behaviour via a quarterly online tracker, conducted by Yonder Consulting as part of their online omnibus.

The 2020 data is based on a sample of c.8,000 adults aged 18+ in Great Britain. Fieldwork took place in March, June, September and December with approximately 2,000 interviews per quarter. All data was collected after the emergence of Covid-19 and the start of the national restrictions on 23rd March 2020.

The online survey sample is sourced through Yonder’s panel, and the sample is subject to quotas in-line with those used for the Commission’s quarterly telephone survey. In addition, data are weighted which are derived from The Publishers Audience Measurement Company (PAMCO) data based on a face-to-face random probability sample. The variables used for weighting are age, gender, region, social grade, tenure and working status.

Notes

1 By using a reality check, consumers can set alerts that will pop up on screen to help them monitor the time spent on gambling.

Data and downloads

Files

Feedback

We are always keen to hear how these statistics are used and would welcome your views on this publication.