Background to our evidence gaps and priorities

The Gambling Commission uses a range of data, research and insights to inform the decisions that we make and provide advice to the Government about gambling behaviour and the gambling market. We are responsible for the production of official statistics on the size and shape of the gambling industry, rates of participation in gambling, and the prevalence of problem gambling, in both adults and children. In addition, we track wider trends in consumer behaviour, listen to the full breadth of consumer voices, and deep dive quantitatively and qualitatively on key issues, impacts and emerging areas of interest.

We are a people focussed and evidence-led regulator. To be the most effective regulator possible, however, we require a robust evidence base - and the current evidence base still has many gaps. A lack of conclusive evidence does not necessarily mean that action shouldn’t be taken (for example, we sometimes apply the precautionary principle where we are satisfied that there is sufficient risk of harm), but we should aim to have as much reliable evidence as possible on which to base our decision.

Here, we present our ambitions and vision for developing the evidence base over the next three years and outline the gaps that we believe can and should be filled. We have gone through an extensive process to identify these gaps and priorities for improving the evidence base, all of which relate to our regulatory duty under the Gambling Act 2005 (opens in new tab) to:

- prevent gambling from being a source of crime or disorder, being associated with crime or disorder, or being used to support crime

- ensure that gambling is conducted in a fair and open way

- protect children and other vulnerable people from being harmed or exploited by gambling.

And under the National Lottery etc Act 1993 (opens in new tab) to:

- ensure that the interests of all players are protected

- ensure the Lottery is run with due propriety

and subject to those two requirements:

- that returns to good causes are maximised.

This forward look demonstrates where we intend to focus our efforts in the next three years, within the parameters of our existing resources and remit, in line with the contents of DCMS’s White Paper following the review of the Gambling Act. It also identifies where we feel there is a wider evidence need, but where the Commission is not the right organisation to lead on delivery.

We have identified six overarching themes which cover the full range of gaps and research questions that we need to be able to fill and answer within our regulatory scope. Whilst we have a set a direction of travel, we will continually revisit and refresh these priorities as we react to progress and emerging findings from across the gambling research ecosystem.

Our approach to evidence-based regulation and evidence assurance

The approach that we have taken to identify evidence gaps and priorities is underpinned by the principles of Evidence Assurance. Evidence Assurance is a process we use that ensures that decisions we make are underpinned by the best available data and evidence and is based on recognised principles.

We use a rigorous, consistent, and transparent process to collate, interpret and weigh up the overall strength of the evidence base for a given issue or topic. Where there are gaps in the evidence base, we are transparent about that and identify what ideal evidence would look like, and how those gaps could be filled.

Our evidence assurance process is underpinned by a five-phase approach:

- What is the question, issue or problem?

- What would the ideal evidence base look like?

- What do we have in reality, and what are the evidence gaps?

- What is our assessment (quality and quantity) and interpretation of the evidence base?

- How does this inform our advice, position and or next steps?

Our role in the evidence ecosystem

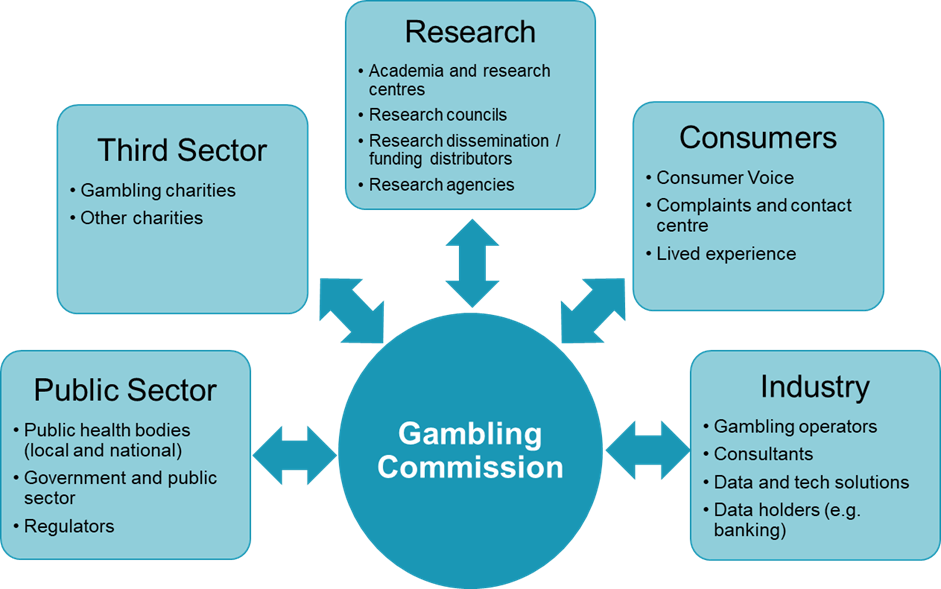

We work with a variety of stakeholders and interested parties to gain insight and perspective about gambling behaviour in Great Britain. This helps to support our own commissioned research, statistics, regulatory casework and operator data analysis, to build a large volume and diverse range of evidence. We also have ready access to the widest range of experience and perspectives through our expert panels.1

Our forward plans also include developing our capacity to be a proactive, data led regulator, using the power of data and advanced analytics to make us more efficient and effective in carrying out our regulation.

The Commission contributes to the wider ecosystem by:

- collecting and publishing official statistics

- conducting wider research and data analysis

- providing and publishing evidence-based advice to government and other stakeholders

- using our data and research from the wider ecosystem to monitor changes that may have an impact on the regulatory framework.

There are five key groups of stakeholders that make up the wider evidence ecosystem:

- public sector – including local and national government, wider public sector, public health bodies (both local and national), and other regulators (national and international)

- third sector – including gambling charities and other charities

- research - including academia and research centres, research councils, research dissemination organisations and funding distributors, and research agencies

- consumers – via our consumer research, complaints and contact centre engagement, as well as engagement with people with lived experience of gambling harms and affected others

- industry – including gambling and lottery operators, consultants, data and technology solutions companies, and other data holders (for example banking).

Notes

1 The Advisory Board for Safer Gambling (ABSG), Digital Advisory Panel (DAP) and Lived Experience Advisory Panel (LEAP).

Previous pageGlossary of terms used in our evidence gaps and priorities Next page

The gambling landscape – what we already know

Last updated: 23 May 2023

Show updates to this content

No changes to show.