- Print the full document

- Save the page as a HTML document to your device

- Save the page as a PDF file

- Bookmark it - it will always be the latest version of this document

This box is not visible in the printed version.

Understanding Consumer Journeys: Introducing the Path to Play

An introduction to the Path to Play

Published: 31 May 2022

Last updated: 31 May 2022

This version was printed or saved on: 7 February 2026

Online version: https://www.gamblingcommission.gov.uk/about-us/guide/understanding-consumer-journeys-introducing-the-path-to-play

Overview: This research focuses on building our understanding of what the typical consumer journey looks like, from the beginning of a gambling interaction to the end. It builds on our earlier work to understand why people gamble, and our wider Consumer Voice research.

The intention is to explore this journey specifically from the gambler’s perspective, which may be different to an operator or regulator’s perspective. This will allow us to better understand how consumers experience gambling, what factors influence them, where there may be greater risks for some gamblers, and identify opportunities for intervention.

The aim was to create a framework of the ‘path to play’ indicating the key milestones and stages gamblers go through when they gamble. This is not a ‘one size fits all’ model, as gamblers are not homogenous, and everyone’s experience will be slightly different. It is a framework that encompasses the moments typically experienced by consumers, but that also shows how gambling experiences can differ for different people, or in different contexts.

About our consumer voice research

We use a mix of quantitative and qualitative methods to gather views, opinions and insights from gambling consumers. This work complements our nationally representative statistics on gambling participation and the prevalence of problem gambling but goes into more depth on key issues and emerging areas of interest.

Our Consumer Voice research is currently conducted by 2CV, who use a combination of online surveys and online community panels to tap into the voice of gambling consumers and those affected by gambling in Great Britain.

Path to Play methodology

A multi-stage approach was taken for this research spanning three phases that continually built on one another. The three stages were:

Scoping phase

Desk research to conduct an audit of existing knowledge, maximising the value of previous Consumer Voice projects and external research and identifying gaps in our understanding of different journey types and consumer groups.

Qualitative exploration of consumer journeys

- depth interviews to build a rich picture of how behaviours and attitudes may start and become embedded, and how that impacts ongoing behaviour. This involved eighteen 1.5hr interviews with gamblers who engage in a variety of different gambling types

- digital diaries spanning two weeks, with 27 participants, to capture detail on the consideration and play experience in-the-moment, and with reflective activities to bolster our understanding of the path to play stages – with particular focus on understanding the risks to players at the different stages of the play journey

- for both qualitative stages, participants were a range of ages, GB regions, socio-economic Groups, life stage, ethnicity and PGSI ratings, and all to have gambled in the last 6 months (excluding those who have only taken part in lotteries)

Quantitative validation and sizing

A 20 minute online quantitative survey asking about the influences they may experience at each path to play stage. Questions were anchored within one recent gambling moment so that data could be interpreted by activity type (with the exception of passive influences which applies across activities). We spoke to 937 gamblers who had all gambled within the last 12 months. Gamblers who had only taken part in lotteries were excluded. Demographic quotas were in place to ensure the sample was representative of GB gamblers as a whole.

A core part of the analysis of this stage was formed by looking at the ‘prevalence’ of influences (the percentage of gamblers who experienced it), and the ‘encouragement’ of each influence (the percentage who say it influenced them to gamble, among those who experienced it). By combining these two elements, we arrive at an ‘impact’ score – the percentage of all gamblers who recognise that this influence has an impact on their behaviour.

By looking at influences in this way, we have one overall ‘impact’ score for every influence which allows us to compare their impact at an overall level. It also gives us a more nuanced view, allowing us to identify the influences that work more as ‘background noise’ (high prevalence but low encouragement) as well as niche but powerful influences (low prevalence but high encouragement)

Throughout this research, it is worth noting that we are relying on the claimed impact of each influence – i.e. the factors that gamblers are able to recognise as having an impact on their behaviour. There may well be influences that work at a more subconscious level where the full impact is not recognised. We have gone some way to mitigate this by capturing the prevalence of influences in the quantitative stage to identify how many people notice the influences, even if the impact isn’t recognised, but this doesn’t tell us which are more influential when they do occur.

The Path to Play framework

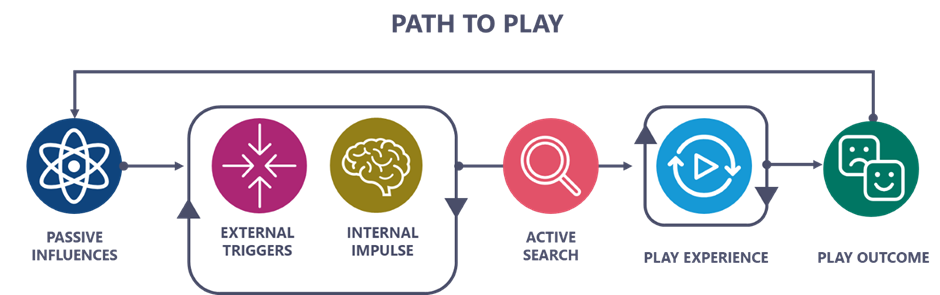

There are six stages of the path to play journey - they are:

- passive influences

- external triggers

- internal impulses

- active search

- play experience

- play outcome.

The stages of the journey are experienced one after the other, except for ‘external triggers’ and ‘internal impulses’ which are likely to occur at the same time. The following paragraphs explain each of the stages in more detail.

Overview of each stage

Passive Influences – Underlying attitudes and perceptions of gambling

The journey begins with how we think and feel about gambling in general – which evolves gradually over time. Our upbringing, social circle, day to day encounters with gambling, and past experiences all affect our underlying perceptions and attitudes towards gambling. Passive influences have an overarching impact on both our consideration and the experience of play.

External Triggers - Nudges that prompt consideration of play

This stage encompasses the impact of operator communications, prevalence in media and consumer conversations related to gambling – feeding into the top-of-mind consideration of play and shortlisting of brands or products. External triggers don’t necessarily prompt direct action in the moment and are not always obvious or directly linked to play but build our awareness cumulatively and provide incentives to play.

Internal Impulses - Underlying motivation / reason to gamble

Internal impulses provide us with reasons to gamble (informed and nudged by external triggers). Motivations to gamble are comprised of a mix of habitual and social behaviour, perceived knowledge, skill or luck advantage and monetary desire or need – individual gambling occasions can straddle multiple underlying motivations. Internal impulses and external triggers are likely to occur at the same time.

Active Search - Gambling product selection process

Once we have the motivation to play – we go through a process of deciding where and what to play. Whether it be deciding what gambling app or website to use, which gambling venue to visit, what odds to take, which game to play or what stake to place. This stage varies in complexity and speed – some journeys will involve a default app/venue to play and others may involve registering with a new gambling brand. This stage may also involve setting limits to manage our gambling.

Play Experience – The experience of play itself

This stage covers the experience of play itself – whether it be a single bet or a ‘session’ of play (where multiple bets are made or games are played). It encompasses enjoyment of the activity in-the-moment and the overall customer / user experience with the gambling brand / product. During the process of play, adverts and offers from gambling brands can influence extended play sessions or cross-sell to other products.

Play Outcome - The impact of winning or losing

The outcome of play (whether it results in a win or a loss) has both a short-term and cumulative long-term impact on gambling attitudes and behaviour – shaping future consideration of play and the behaviour itself. Some journeys may result in us returning to the beginning of the journey to gamble again at a later point, whilst others may lead to other outcomes such as breaks from gambling (for example via a time-out or self-exclusion), seeking or receiving gambling support or treatment, or seeking redress from gambling brands.

The journey can be visualised as follows:

Key influences at each stage of the journey

Different factors will have greater or lesser influence at each stage of the journey. While most stages have numerous influencing factors, there are usually a few in particular that have greater impact.

Biggest influences encouraging (more) gambling at each stage

Passive influences

Winning experiences (either winning themselves or hearing about others winning) has the biggest influence. Operator advertising and sponsorship are factors that are very widely noticed, but not thought to have much impact on behaviour or attitudes – they’re considered ‘background noise’.

Impact Scores (calculated by Prevalence x Encouragement) of Passive Influence factors

Data from chart

| Influencing factor | Impact (percentage) |

|---|---|

| Win a significant amount of money gambling | 28% |

| Hear about someone who’s had a big win through gambling | 27% |

| Take part in any type of gambling activities | 20% |

| See or hear adverts from gambling companies | 19% |

| Receive emails, texts or app notifications from operators | 19% |

| Gamble with friends | 18% |

| Regret how much you’ve spent in one go whilst gambling | 16% |

| Talk about gambling with friends or family | 16% |

| See sponsorship or logos from gambling companies | 15% |

| See something about gambling on social media | 15% |

| Lose a significant amount of money gambling | 14% |

| See bookies, casinos etc when you’re out and about | 14% |

| Hear about someone whose gambling is having a negative impact | 14% |

| Watch videos about, or read blogs/articles about gambling activities | 11% |

Question details: P11a: How often do you… P11b: And to what extent do you think each of these have influenced whether / how much you gamble?

Base: All respondents (937), all who ever experienced each influence. Base varies, minimum 526.

External triggers

Catching the eye, special offers and direct communications (emails/text/app notifications) were most commonly cited. Unusually good odds or prizes are also particularly influential when they occur, but these are less common.

Gambler quote: “I saw an ad on social media for a Valentines day draw and I couldn’t help but get involved, I feel like I’m missing out if not a part of it and it will play on my mind“

Gambler quote: “I’m a sucker for a promotion or ad, it does draw me in to play. I’m also a fan of the ‘spend a certain amount get a certain amount free’ deals- who doesn’t like free money!”

Internal impulses

The desire to win a small amount of money and having fun were the two factors that were the greatest motivators on respondents’ most recent activity.

Internal impulses: why they took part in most recent activity

Data from chart

| Impulse factor | Percentage |

|---|---|

| To win some money, even a small amount | 43% |

| To have fun | 38% |

| It was a spontaneous decision | 21% |

| To give myself a treat | 21% |

| To pass the time | 20% |

| I was feeling lucky | 19% |

| To add excitement to a game or experience | 19% |

| To win large amounts of money | 17% |

| Because I enjoy the game(s) | 14% |

| It’s just part of my routine | 13% |

| To be social | 12% |

| To be part of something | 10% |

Question details: INT1: Which of these describe why you…? Base: All respondents (937).

Active search

The respondents’ familiarity and previous experience with the operator and/or type of game or bet were the most common reasons given for why they chose to gamble in that particular way at that time.

Gambler quote: “I tried out an instant win game that reminded me of Candy Crush - I'm definitely going to play this game again as I liked the game, but also as I have positive sentiment towards it now I’ve won on it once!”

Play experience

Influences on the duration and activities involved in a play experience were most commonly reported as having fun, winning, and seeing special offers.

Play experience Impact (Prevalence x Encouragement) Factors

Data from chart

| Factor | Percentage |

|---|---|

| Winning a game or bet | 14% |

| I was having loads of fun | 10% |

| I was having an ok time, but not loads of fun | 8% |

| I received a special offer or free bet specifically for me | 7% |

| I saw or heard about a special offer / free bet open to everyone | 6% |

| I came really close to winning | 5% |

| I had a winning streak | 4% |

| Losing a game or bet | 4% |

| I saw or heard an advert for a gambling company | 3% |

| Someone gave me a good tip | 3% |

| I received an email, text or app notification from a gambling company | 3% |

| I looked at my account and to check how much time and money I had spent | 2% |

| I saw a gambling company post something on social media (not an advert) | 2% |

| I saw some gambling sponsorship or logos | 2% |

| Someone suggested I play a different game or place a different bet | 2% |

Question details: PS3a. And still thinking about the last time you 'gambling on this activity', which of these, if any, did you see or experience at any point while you were playing/betting? PS6. And to what extent do you think each of these influenced whether you continued to play/bet? Base: all respondents (937).

Play outcome

Play outcome is more about reflection and next steps rather than influencing further behaviour. Winning or losing may inform behaviour as it will form part of their passive influences before the next journey.

Gambler quote: “I last won 2 weeks ago online playing bingo, I won £50, I felt overjoyed and happy. I used the money to get my hair done as a lovely, rare treat. It made me want to gamble more”.

The impact of different types of gambling activities

Within this framework, the journey will look and feel different for individuals based on their specific situation. In particular, the type of gambling activity they are taking part in will have a significant impact on their journey. Below, we outline the influences that are more prevalent at each stage for different methods of gambling.

It’s worth bearing in mind that there is a higher level of crossover between betting and online, and games and land-based activities, which may be driving some of the influences outlined below. For example, people taking part in online activities are more likely to be influenced by unusually good prizes/odds because they’re more likely to be placing a bet, not because of anything inherent to online gambling itself.

Influences that are more prominent for particular types of gambling

| External triggers | Internal impulses | Active search | Play experience | |

|---|---|---|---|---|

| Online | Special offers, direct comms, tips, unusually good prizes/odds | To pass the time (primarily games), to add excitement to a game / event (primarily betting) | Familiarity, trust, past experience of playing/winning | Winning, having fun, special offers |

| Land based | Someone else suggested it, it caught my eye | Spontaneous decision, feeling lucky (both primarily scratchcards), to be social (bingo & casinos) | Caught my eye, feels like fun, felt like a good idea | n/a - it reflects the overall gambling journey |

| Betting | Tips, unusually good prizes/odds, special offers | To add excitement to a game/ event, to feel part of something | Having an existing account, money in the account, ease of withdrawing money, trust the operator, previous experience of winning | Direct comms, receiving a tip |

| Gaming | It caught my eye (primarily scratchcards) | Spontaneous decision, feeling lucky (both primarily scratchcards), to pass the time (primarily online games) | Caught my eye (driven by scratchcards), feels like fun, felt like a good idea | n/a - it reflects the overall gambling journey |

Key differences:

Special offers, unusually good odds and direct communications play a greater role for betting and online activities, as does past experience – either of playing, winning, or simply already having an account set up with funds.

Catching the eye plays a key role for games and land-based activities (predominantly scratchcards) both as an external trigger and in the active search phase. It’s often accompanied by a spontaneous decision, feeling lucky (both internal impulses) and the activity feeling fun and like a good idea (both at active search).

Betting and gaming tend to have opposing internal impulses – with bets driven by a desire to add excitement to another event (e.g. sports game), while games (particularly online games) are more likely to be motivated by wanting to simply pass the time.

Implications for higher risk gamblers

Those who qualify as moderate risk or problem gamblers on the PGSI tend to be more heavily influenced throughout the journey both in terms of the number of factors influencing them, and the extent of the impact they have.

Passive influences

Higher risk gamblers have greater exposure to passive influences and find them influential on their behaviour. Safer gambling messages are also more likely to be seen by higher risk gamblers at this stage.

External triggers

Higher risk gamblers experience a greater number of triggers, particularly around special offers, direct communications, sponsorship, and receiving tips from friends.

Internal impulses

Higher risk gamblers are more likely to be motivated by the desire to win large amounts of money, pass the time, or simply feel lucky.

Active search

For most of this phase there is little difference in what influences choices for all gambling consumers, regardless of PGSI score. When it comes to setting limits, higher risk gamblers are actually more likely to put limits in place but aren’t as successful at keeping to them.

Play experience

Higher risk gamblers experience far more touchpoints than other gamblers – information from operators, from other people, and special offers. Meanwhile they are less likely to see safer gambling information while gambling. All of which contributes to the session being more likely to end because they’ve over-spent.

Play outcome

Higher risk gamblers are more likely to feel bad about the amount they’ve spent, and take action following their play session (e.g. take a break, set limits, seek help for problem gambling).

Greatest differences in influences for moderate risk – problem gamblers vs non problem – low risk gamblers

Percentage of people who are influenced to gamble (more) because of each factor.

Passive influences

| Influencing factor | Non problem – low risk gamblers (percentage) | Moderate risk or Problem gambler (percentage) | Difference (percentage) |

|---|---|---|---|

| Receive emails, texts or app notifications from gambling companies | 10% | 41% | plus 30% |

| Regret how much you’ve spent in one go whilst gambling | 8% | 37% | plus 29% |

| Take part in any type of gambling activities | 12% | 40% | plus 28% |

| Win a significant amount of money gambling | 20% | 48% | plus 28% |

External triggers

| Influencing factor | Non problem – low risk gamblers (percentage) | Moderate risk or Problem gambler (percentage) | Difference (percentage) |

|---|---|---|---|

| I saw/heard an advert for a gambling company | 3% | 9% | plus 6% |

| I saw/heard about a special offer/free bet open to everyone (e.g. through an advert) | 4% | 8% | plus 4% |

| I saw a reminder about a special offer that was about to end | 3% | 7% | plus 4% |

Internal impulses

| Influencing factor | Non problem – low risk gamblers (percentage) | Moderate risk or Problem gambler (percentage) | Difference (percentage) |

|---|---|---|---|

| To win large amounts of money | 13% | 27% | plus 14% |

| To pass the time | 17% | 27% | plus 10% |

Active search

| Influencing factor | Non problem – low risk gamblers (percentage) | Moderate risk or Problem gambler (percentage) | Difference (percentage) |

|---|---|---|---|

| The operator offers a good chance of winning | 3% | 9% | plus 6% |

| I feel like I'm more likely to win with this operator | 3% | 7% | plus 4% |

Play experience

| Influencing factor | Non problem – low risk gamblers (percentage) | Moderate risk or Problem gambler (percentage) | Difference (percentage) |

|---|---|---|---|

| Winning a game/bet | 10% | 24% | plus 14% |

| I was having loads of fun | 8% | 15% | plus 8% |

The role and impact of operator marketing and communications

Operator marketing and communications are varied, taking many forms (e.g. advertising, sponsorship, direct comms), and with different purposes (e.g. brand building vs. call-to-action focused). Different types of marketing activity feature at different stages of the gambling journey and can be more-or-less influential at different stages. For example, a TV advert with the intention of raising brand awareness for the operator would be a factor at the Passive Influences stage, whereas an email with a special offer or free bet would be considered as part of the External Triggers or Play Experience stages (depending on the timing and whether the recipient was already taking part).

The three phases where marketing and comms tend to influence the gambling journey are in Passive Influences, External Triggers, and Play Experience.

Passive influences

It is typically advertising and sponsorship (not direct communications) that are a factor at this stage. Generally considered to be ‘background noise’, advertising and sponsorship is widely noticed but considered to have minimal impact on behaviour. However, it is worth considering to what extent this continued exposure contributes to a sense of familiarity with operators and/or activities – which becomes the biggest influencing factor at Active Search.

External triggers

It is special offers that are most influential at this stage – both in terms of prevalence and level of impact when they are received. They come second only to it catching the eye (which is predominantly driven by scratchcards) and are particularly influential for online bingo and online casino games. Other marketing can play a role at this stage, but they tend to be more influential when there is a special offer element included (e.g. if they see a TV advert that includes a special offer, it is the special offer that is motivating, not the fact that it is a TV advert).

External Trigger (Prevalence x Encouragement) Factors

| Factor | Percentage |

|---|---|

| It caught my eye | 12% |

| I received a special offer or free bet specifically for me | 6% |

| I saw or heard about a special offer or free bet open to everyone | 5% |

| The prize or odds were much better than you usually get | 5% |

| I saw or heard an advert for a gambling company | 5% |

| Someone gave me a good tip | 4% |

| I saw a reminder about a special offer that was about to end | 4% |

| I received an email from the company | 4% |

| Someone else suggested it | 4% |

| I was talking to somebody and the topic came up | 3% |

| I saw some gambling sponsorship or logos | 3% |

| Someone else arranged it all | 3% |

| I saw it when I was playing or betting on something else | 3% |

| I received a notification from a gambling app | 3% |

| I received a text from the company | 2% |

| I saw someone I know on social media talking about playing or betting | 2% |

| I saw a gambling company post something on social media | 2% |

| I saw a sign, pop-up or advert for another game or bet | 2% |

| I saw a celebrity or influencer talking on social media about it | 1% |

| Something changed that made a bet more appealing | 1% |

| Something changed that changed the odds or prize | 0% |

Question details: EXT1. Thinking about the time when you (ACTIVITY), which of these, if any, did you see or experience? Even if it didn't influence your decision, please tell us if it happened. EXT2. And to what extent do you think each of these influenced whether you gambled?

Base: Prevalence: all respondents (937) Encouragement: all who experienced each trigger, base varies by trigger, triggers with a base under 50 aren’t shown.

Play experience

Again, it is special offers that are most influential at this stage. 1 in 5 see or receive a special offer during a play session, and with the strong encouragement to continue playing they create, offers are the third most influential factor (after winning and having fun) in terms of impacting continued play. In addition to this, 10% see information relating to cross-play – typically encouraging multiple games/bets within the same operator (rather than switching operators).

Key stats on the role of marketing in path to play

The following statistics are based on claimed recall from survey participants:

- 45% see or hear advertising from gambling companies often or all the time (passive influence)

- 22% of all gamblers received an offer before taking part (external trigger)

- 20% saw or received a special offer while playing (play experience)

- moderate risk - problem gamblers are more likely to report that they have seen or heard about a special offer (15%) or receive an operator email (14%) than lower risk gamblers (7% and 6% respectively).

The role and impact of safer gambling messages and interventions

Safer gambling messages and interventions can appear in numerous ways through the path to play, but there are certain elements that are more prominent at key moments from the gamblers’ perspective.

Gamblers’ interaction with safer gambling messages and interventions

Passive influences

Safer gambling messages are seen frequently, but gamblers consider them to have minimal impact on reducing gambling.

Active search

Having spending limits already in place, and the ability to track spend have very little impact on operator choice. Setting limits in particular is currently under-utilised (only 7% of gamblers claimed to use a limit on their account) despite many going into the session with a budget in mind, suggesting more could be done to prompt and encourage people to set digital limits.

Play experience

Very few see information on safer gambling from operators – primarily because most don’t notice any information rather than safer gambling being under-represented.

Path to play: next steps

This work will allow us to better understand how consumers experience gambling, what factors influence them, where there may be greater risks for some gamblers, and identify opportunities for intervention. We will use the Path to Play as a framework when considering policy development, further research and communications.

We will be continuing to explore the data and findings generated as part of this project and will share further in depth findings and insights over the coming months.